Michigan 1040es Form

What is the Michigan 1040es?

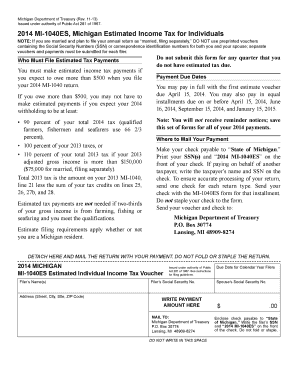

The Michigan 1040es is a state-specific estimated tax payment form used by individuals and businesses in Michigan to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual tax return. The Michigan 1040es allows taxpayers to make quarterly payments throughout the year, ensuring they meet their tax obligations and avoid penalties for underpayment. It is important to understand the purpose and requirements of this form to maintain compliance with state tax laws.

Steps to complete the Michigan 1040es

Completing the Michigan 1040es involves several key steps. First, gather your financial information, including income sources and deductions. Next, calculate your estimated tax liability for the year based on your expected income. You will then determine the amount to pay each quarter by dividing your estimated tax liability by four. After calculating your payments, fill out the Michigan 1040es form with the required information, including your name, address, and Social Security number. Finally, submit the completed form along with your payment by the due date to ensure compliance with state tax regulations.

How to obtain the Michigan 1040es

The Michigan 1040es form can be obtained through multiple channels. Taxpayers can download the form directly from the Michigan Department of Treasury's website or request a paper copy by contacting the department. Additionally, many tax preparation software programs include the Michigan 1040es, making it easier to complete the form electronically. Ensure you have the most current version of the form to avoid any issues with your estimated tax payments.

Filing Deadlines / Important Dates

Timely filing of the Michigan 1040es is crucial to avoid penalties. Estimated tax payments are typically due on specific dates throughout the year: April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar and ensure that payments are made by the deadlines to maintain compliance with state tax laws. Failing to meet these deadlines may result in penalties and interest on unpaid taxes.

Legal use of the Michigan 1040es

The Michigan 1040es is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the state's eSignature laws. It is essential to retain copies of submitted forms and payment confirmations for your records, as these documents may be required for future reference or in case of an audit.

Key elements of the Michigan 1040es

Several key elements make up the Michigan 1040es form. These include personal information such as the taxpayer's name, address, and Social Security number. The form also requires the taxpayer to estimate their total income, deductions, and tax credits for the year. Additionally, it outlines the payment amounts due for each quarter. Understanding these elements is crucial for accurately completing the form and ensuring proper tax payment.

Quick guide on how to complete michigan 1040es

Effortlessly Prepare Michigan 1040es on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Handle Michigan 1040es on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Michigan 1040es with Ease

- Find Michigan 1040es and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious browsing for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Michigan 1040es and guarantee effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan 1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi 1040 es 2020 form?

The mi 1040 es 2020 form is a state-level estimated tax payment voucher used for filing taxes in Michigan. It allows taxpayers to make quarterly payments towards their state income tax obligations. Completing this form accurately is important to avoid penalties and ensure compliance with state tax laws.

-

How can airSlate SignNow help me with mi 1040 es 2020 submissions?

airSlate SignNow simplifies the process of electronically signing and submitting your mi 1040 es 2020 form. Our platform allows you to upload, sign, and securely send documents in just a few clicks, saving you time and paper. With airSlate SignNow, you can ensure your submissions are timely and compliant.

-

What are the pricing options for using airSlate SignNow to manage mi 1040 es 2020 forms?

airSlate SignNow offers a variety of pricing plans to fit different business needs, including options suitable for managing mi 1040 es 2020 forms. From free trials to affordable monthly subscriptions, our pricing is designed to be cost-effective while providing the features you need. Explore our plans to find the best fit for your tax submission process.

-

Is airSlate SignNow secure for signing mi 1040 es 2020 documents?

Yes, airSlate SignNow is dedicated to the security of your documents, including the mi 1040 es 2020 forms. We utilize bank-level encryption and multiple security measures to ensure your documents are safe during signing and storage. You can trust our platform to protect your sensitive tax information.

-

What features does airSlate SignNow offer for managing mi 1040 es 2020 forms?

airSlate SignNow provides robust features for managing your mi 1040 es 2020 forms, including customizable templates, in-app signing, and document tracking. These features enhance workflow efficiency and ensure you never miss a deadline. Our user-friendly interface makes it easy to navigate throughout the signing process.

-

Can I integrate airSlate SignNow with other software for mi 1040 es 2020 handling?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions like CRM systems and cloud storage services. This allows for streamlined management of your documents, including the mi 1040 es 2020 forms, by enabling easy access and sharing across platforms.

-

What are the benefits of using airSlate SignNow for my mi 1040 es 2020 submissions?

Using airSlate SignNow for your mi 1040 es 2020 submissions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick signing and issuing of documents, helping you stay organized and compliant with tax regulations. Additionally, it reduces the hassle associated with traditional signing processes.

Get more for Michigan 1040es

Find out other Michigan 1040es

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter