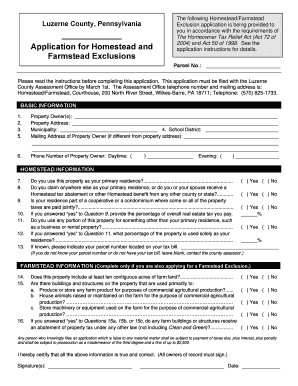

Luzerne County, Pennsylvania Application for Homestead and Farmstead Exclusions the Following HomesteadFarmstead Exclusion Appli Form

Understanding the Luzerne County Homestead Exemption Application

The Luzerne County homestead exemption application is a crucial document for homeowners seeking tax relief under the Homeowner Tax Relief Act, Act 72 of Pennsylvania. This application allows eligible homeowners to receive a reduction in their property taxes, which can significantly ease financial burdens. The exemption applies to a portion of the assessed value of the property, providing a direct benefit to those who qualify.

To be eligible for this exemption, homeowners must meet specific criteria set forth by the state. This includes being the owner and occupant of the property, and the property must be used as the primary residence. Understanding these requirements is essential for a successful application process.

Steps to Complete the Luzerne County Homestead Exemption Application

Completing the Luzerne County homestead exemption application involves several key steps to ensure that all necessary information is provided accurately. First, gather essential documents, including proof of ownership and residency. This may include a deed, utility bills, or other official documents that confirm your residence.

Next, fill out the application form carefully, ensuring that all required fields are completed. Pay special attention to sections that ask for personal information and property details. After completing the form, review it for accuracy before submission. Any errors could delay the processing of your application.

Finally, submit the application through the appropriate channels, whether online, by mail, or in person. Keeping a copy of your submitted application for your records is advisable.

Eligibility Criteria for the Luzerne County Homestead Exemption

To qualify for the Luzerne County homestead exemption, homeowners must meet specific eligibility criteria. Primarily, applicants must own and occupy the property as their primary residence. The property must not be used for commercial purposes, and it should not exceed the assessed value limits set by the county.

Additionally, applicants must not have any outstanding property taxes or liens against the property. It is also important to note that the exemption is typically limited to one property per applicant. Understanding these criteria can help homeowners determine their eligibility before applying.

Required Documents for the Luzerne County Homestead Exemption Application

When applying for the Luzerne County homestead exemption, several documents are necessary to support your application. These typically include:

- Proof of ownership, such as a deed or title

- Identification documents, like a driver's license or state ID

- Utility bills or lease agreements that confirm residency

- Any previous tax documents that may be required by the county

Ensuring that all required documents are prepared and submitted with the application can facilitate a smoother approval process.

Form Submission Methods for the Luzerne County Homestead Exemption Application

The Luzerne County homestead exemption application can be submitted through various methods, catering to the preferences of different applicants. Homeowners can choose to submit the application online through the county's official website, which often provides a streamlined process.

Alternatively, applications can be mailed to the appropriate county office or delivered in person. Each method has its advantages, and applicants should select the one that best suits their needs. Regardless of the submission method, it is important to keep a record of the submission for future reference.

Legal Use of the Luzerne County Homestead Exemption Application

The Luzerne County homestead exemption application is governed by legal frameworks established under Pennsylvania law. This ensures that the application process is standardized and that applicants are treated fairly. The application must be completed accurately and honestly, as any misrepresentation can lead to penalties or denial of the exemption.

Additionally, the application must be submitted within the designated time frames set by the county to be considered for the current tax year. Understanding the legal implications of this application can help homeowners navigate the process more effectively.

Quick guide on how to complete luzerne county pennsylvania application for homestead and farmstead exclusions the following homesteadfarmstead exclusion

Complete Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli effortlessly

- Obtain Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the luzerne county pennsylvania application for homestead and farmstead exclusions the following homesteadfarmstead exclusion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Luzerne County Homestead Exemption?

The Luzerne County Homestead Exemption is a property tax reduction program for homeowners that helps lower their tax bills. By applying for this exemption, homeowners can reduce the assessed value of their primary residence, resulting in signNow savings on property taxes. It's designed to provide financial relief to eligible homeowners in Luzerne County.

-

Who qualifies for the Luzerne County Homestead Exemption?

To qualify for the Luzerne County Homestead Exemption, homeowners must own and occupy their residence as their primary home. Additionally, applicants must meet certain income and eligibility criteria set by Luzerne County. It's important to check with local authorities to ensure you meet all requirements before applying.

-

How can I apply for the Luzerne County Homestead Exemption?

To apply for the Luzerne County Homestead Exemption, homeowners must complete an application form available from the Luzerne County Tax Office. This can often be done online or in person, depending on local procedures. Make sure to gather the necessary documents to support your application for a smooth process.

-

What are the benefits of the Luzerne County Homestead Exemption?

The benefits of the Luzerne County Homestead Exemption include reduced property tax bills, providing financial relief for homeowners. This exemption allows residents to allocate funds towards other important areas such as education and health care. Overall, it enhances home affordability for many residents in Luzerne County.

-

Is there a specific deadline to apply for the Luzerne County Homestead Exemption?

Yes, there is usually a specific deadline to apply for the Luzerne County Homestead Exemption, which is typically set annually by local authorities. Homeowners must submit their application before this deadline to be eligible for the current tax year. It’s essential to stay informed and submit your application on time.

-

Can I apply for the Luzerne County Homestead Exemption online?

Many residents can apply for the Luzerne County Homestead Exemption online through the official Luzerne County government website. This platform provides easy access to application forms and instructions. Always ensure you're using the official site to avoid any issues during the application process.

-

Does the Luzerne County Homestead Exemption affect my eligibility for other programs?

Applying for the Luzerne County Homestead Exemption does not typically affect your eligibility for other assistance programs, but it's best to check specific guidelines. Some programs may have eligibility criteria that consider your tax liabilities. Consulting a local tax advisor can help clarify your individual situation.

Get more for Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli

Find out other Luzerne County, Pennsylvania Application For Homestead And Farmstead Exclusions The Following HomesteadFarmstead Exclusion Appli

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy