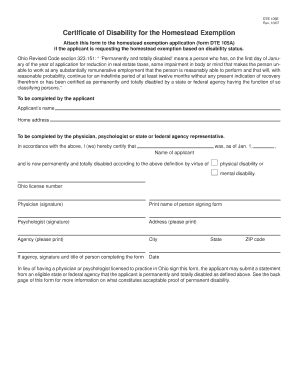

Form Dte 105e

What is the Form DTE 105E?

The Form DTE 105E is a document used in the United States for specific legal and administrative purposes. It is typically required in situations involving property transfers, assessments, or other related transactions. Understanding the form's purpose is crucial for ensuring compliance with local regulations and for facilitating smooth transactions.

How to Use the Form DTE 105E

Using the Form DTE 105E involves several steps to ensure proper completion and submission. First, gather all necessary information related to the transaction, including property details and parties involved. Next, fill out the form accurately, ensuring that all fields are completed as required. Once the form is filled out, it may need to be signed by the relevant parties before submission to the appropriate authority.

Steps to Complete the Form DTE 105E

Completing the Form DTE 105E requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the relevant authority.

- Fill in the property information, including address and parcel number.

- Provide the names and addresses of all parties involved in the transaction.

- Include any additional information required by the form, such as transaction details.

- Review the form for accuracy and completeness.

- Sign the form where indicated, ensuring all required signatures are obtained.

- Submit the completed form to the designated office, either online or by mail.

Legal Use of the Form DTE 105E

The legal use of the Form DTE 105E is governed by state-specific laws and regulations. It is essential to ensure that the form is completed in accordance with these legal requirements to maintain its validity. The form serves as an official record of the transaction, and improper use or completion can lead to legal complications, including disputes over property ownership.

Key Elements of the Form DTE 105E

Key elements of the Form DTE 105E include:

- Property description: Detailed information about the property involved in the transaction.

- Party information: Names and addresses of all parties involved.

- Transaction details: Information regarding the nature of the transaction.

- Signatures: Required signatures from all parties to validate the form.

Form Submission Methods

The Form DTE 105E can typically be submitted through various methods, including:

- Online submission via the relevant government portal.

- Mailing a physical copy to the appropriate office.

- In-person submission at designated government offices.

Quick guide on how to complete form dte 105e

Effortlessly complete Form Dte 105e on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly and efficiently. Handle Form Dte 105e on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form Dte 105e effortlessly

- Obtain Form Dte 105e and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Form Dte 105e and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dte 105e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form dte 105e and how is it used?

The form dte 105e is a document used by businesses to report specific financial information to tax authorities. It simplifies the reporting process, making it easier for users to submit accurate data. Using airSlate SignNow, you can easily complete and eSign the form dte 105e, ensuring compliance and saving time.

-

How can airSlate SignNow help with the form dte 105e?

airSlate SignNow provides a streamlined process for completing and signing the form dte 105e. Our platform allows users to fill out the form digitally, gather necessary signatures, and submit it securely. This reduces the chances of errors and enhances the overall efficiency of your documentation process.

-

Is there a cost associated with using airSlate SignNow for the form dte 105e?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your requirements, you can choose a plan that includes features for managing the form dte 105e efficiently. We provide cost-effective solutions to ensure that managing your documents is both affordable and effective.

-

What features does airSlate SignNow offer for the form dte 105e?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for the form dte 105e. These features are designed to simplify the process of document management and enhance collaboration among team members. With our platform, you can manage your documents seamlessly.

-

Can I integrate other tools with airSlate SignNow for managing the form dte 105e?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing you to connect your existing systems for managing the form dte 105e. This ensures a smooth workflow and improves productivity by eliminating the need to switch between multiple platforms.

-

What are the benefits of using airSlate SignNow for the form dte 105e?

Using airSlate SignNow for the form dte 105e allows businesses to enhance efficiency, reduce paperwork, and promote a more organized approach to document management. The platform ensures compliance and security while making the signing process convenient for all parties involved. Experience faster turnaround times and improved accuracy.

-

Is airSlate SignNow secure for signing the form dte 105e?

Yes, airSlate SignNow employs advanced security measures to ensure that your documents, including the form dte 105e, are protected throughout the signing process. We utilize encryption and secure storage to maintain the confidentiality and integrity of your sensitive information. Trust our platform to safeguard your documents.

Get more for Form Dte 105e

- Sample letter promotional 497332696 form

- Letter guardianship template form

- Sample questions in a behavioral interview form

- Sample letter cancellation 497332699 form

- Guardianship benefits form

- Sample letter services form

- Arrearage form

- Second mortgage with mortgagors recertification of representations warranties and covenants in first mortgage 497332703 form

Find out other Form Dte 105e

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT