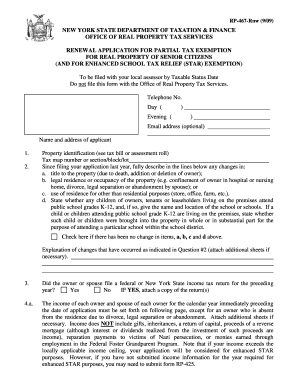

Rp 467 Rnw Form

What is the Rp 467 Rnw

The Rp 467 Rnw form is a specific document used primarily for reporting certain financial transactions to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with tax regulations. The form typically includes details such as income, deductions, and other pertinent financial information that must be reported for tax purposes.

How to use the Rp 467 Rnw

Using the Rp 467 Rnw form involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to complete the Rp 467 Rnw

Completing the Rp 467 Rnw form requires a systematic approach:

- Gather required documents, such as W-2s, 1099s, and any relevant receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring to include all sources of income.

- Detail any deductions or credits you are eligible for, which can reduce your taxable income.

- Review the form for accuracy, making sure all calculations are correct.

- Submit the form electronically or by mail as per IRS guidelines.

Legal use of the Rp 467 Rnw

The Rp 467 Rnw form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and accurately reporting all required information. Failure to comply with these regulations can result in penalties or legal consequences. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Rp 467 Rnw form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to ensure timely submission.

Who Issues the Form

The Rp 467 Rnw form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers have the resources needed to comply with federal tax regulations.

Quick guide on how to complete rp 467 rnw

Finalize Rp 467 Rnw effortlessly on any device

Digital document management has become increasingly popular with companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents promptly without interruptions. Manage Rp 467 Rnw on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Rp 467 Rnw without hassle

- Obtain Rp 467 Rnw and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for such tasks.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you want to submit your form, via email, text message (SMS), invite link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Rp 467 Rnw to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rp 467 rnw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rp 467 rnw solution offered by airSlate SignNow?

The rp 467 rnw is a comprehensive eSigning solution that allows businesses to easily send and sign documents online. With its intuitive interface, users can streamline their document workflows and enhance their operational efficiency. This solution is tailored to meet the needs of various industries looking for a reliable electronic signature service.

-

How does the pricing for rp 467 rnw compare to other eSigning solutions?

The rp 467 rnw pricing structure is designed to be competitive and affordable, providing great value for businesses of all sizes. Customers can choose from different subscription plans that fit their specific needs, ensuring you only pay for what you use. This cost-effective approach helps organizations save on traditional signing methods.

-

What features are included in the rp 467 rnw package?

The rp 467 rnw package includes key features such as unlimited document signing, customizable templates, and advanced security options to protect sensitive information. Users benefit from real-time tracking and notifications, making it easy to manage document statuses. These features enhance the signing experience for both senders and recipients.

-

What are the benefits of using rp 467 rnw for my business?

Utilizing the rp 467 rnw solution offers numerous benefits, including increased efficiency through faster document turnaround times. Businesses can reduce operational costs and improve customer satisfaction by providing a seamless signing experience. Additionally, it enables teams to collaborate more effectively from anywhere at any time.

-

Can rp 467 rnw integrate with my existing software?

Yes, the rp 467 rnw solution is designed to integrate easily with various existing software and tools, such as CRM systems and document management platforms. This integration ensures a smooth workflow, allowing teams to send, sign, and store documents without disrupting their current processes. It enhances productivity by minimizing the need for manual data entry.

-

Is rp 467 rnw compliant with legal standards for electronic signatures?

Absolutely, the rp 467 rnw solution complies with essential legal standards and regulations, ensuring that all electronic signatures are valid and enforceable. This includes adhering to the ESIGN Act and UETA in the United States, providing businesses with the peace of mind that their signed documents hold up in court. Compliance is a top priority for airSlate SignNow.

-

How can I get started with rp 467 rnw?

Getting started with rp 467 rnw is simple and straightforward. Prospective users can sign up for a free trial on the airSlate SignNow website, allowing them to explore the features and benefits of the solution. After the trial, users can choose the appropriate plan that suits their business needs.

Get more for Rp 467 Rnw

Find out other Rp 467 Rnw

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template