Berkheimer W2 Reconciliation Form

What is the Berkheimer W2 Reconciliation Form

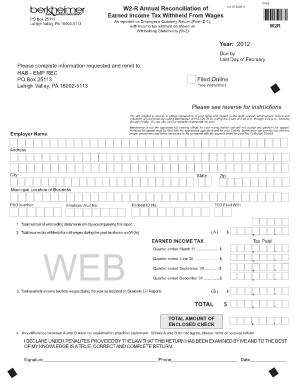

The Berkheimer W2 Reconciliation Form is a critical document used to reconcile W-2 information for employees working in specific jurisdictions. This form ensures that the wages reported by employers match the income tax withheld and submitted to Berkheimer, a tax collection agency in Pennsylvania. The reconciliation process helps maintain accurate tax records and ensures compliance with local tax laws.

How to use the Berkheimer W2 Reconciliation Form

Using the Berkheimer W2 Reconciliation Form involves several steps to ensure accurate completion. First, gather all relevant W-2 forms issued to employees. Next, compare the amounts reported on the W-2s with the amounts submitted to Berkheimer. Any discrepancies should be noted and corrected before submitting the reconciliation form. It is essential to provide accurate information to avoid penalties and ensure compliance with tax regulations.

Steps to complete the Berkheimer W2 Reconciliation Form

Completing the Berkheimer W2 Reconciliation Form requires careful attention to detail. Follow these steps:

- Collect all W-2 forms for the reporting year.

- Verify that the total wages and taxes withheld match the amounts reported.

- Fill out the Berkheimer W2 Reconciliation Form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to Berkheimer by the specified deadline.

Legal use of the Berkheimer W2 Reconciliation Form

The Berkheimer W2 Reconciliation Form is legally binding when completed accurately and submitted on time. It serves as an official record of compliance with local tax laws. To ensure its legal validity, the form must be signed by an authorized representative of the business. Additionally, maintaining copies of submitted forms and supporting documentation is advisable for future reference and compliance checks.

Form Submission Methods

The Berkheimer W2 Reconciliation Form can be submitted through various methods, including:

- Online Submission: Many businesses prefer to submit the form electronically through Berkheimer's online portal.

- Mail: The form can be printed and mailed to the appropriate Berkheimer office.

- In-Person: Businesses may also deliver the form directly to a Berkheimer office.

Filing Deadlines / Important Dates

Filing deadlines for the Berkheimer W2 Reconciliation Form are crucial to avoid penalties. Typically, the form must be submitted by the end of January following the tax year. It is important to check for any specific deadlines that may apply to your jurisdiction, as they can vary. Staying informed about these dates helps ensure timely compliance and reduces the risk of late fees.

Quick guide on how to complete berkheimer w2 reconciliation form

Prepare Berkheimer W2 Reconciliation Form easily on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage Berkheimer W2 Reconciliation Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Berkheimer W2 Reconciliation Form effortlessly

- Obtain Berkheimer W2 Reconciliation Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and eSign Berkheimer W2 Reconciliation Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the berkheimer w2 reconciliation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Berkheimer W 2 reconciliation form?

The Berkheimer W 2 reconciliation form is a document used to verify income tax withholding from wages. It is essential for ensuring accurate reporting and compliance with tax regulations. Using this form can help streamline your tax filing process and prevent discrepancies.

-

How can airSlate SignNow assist with the Berkheimer W 2 reconciliation form?

airSlate SignNow allows you to easily create, customize, and electronically sign the Berkheimer W 2 reconciliation form. With our user-friendly interface, you can automate the entire process, saving you time and ensuring accuracy. Integration with your other business applications further simplifies document management.

-

Is there a cost associated with using the Berkheimer W 2 reconciliation form in airSlate SignNow?

While airSlate SignNow offers a range of pricing plans, the actual cost for using the Berkheimer W 2 reconciliation form will depend on your specific needs and volume of documents. We provide flexible pricing that can accommodate businesses of all sizes. You can try our services for free to see the value before committing.

-

Can I integrate the Berkheimer W 2 reconciliation form with other software?

Yes, airSlate SignNow supports integration with various applications, allowing you to connect your Berkheimer W 2 reconciliation form with payroll and accounting software. This ensures a seamless flow of information and reduces manual entry, enhancing overall efficiency. Check our integration options for more details.

-

What are the benefits of using airSlate SignNow for the Berkheimer W 2 reconciliation form?

Using airSlate SignNow for the Berkheimer W 2 reconciliation form provides numerous benefits, including enhanced security, reduced processing time, and improved accuracy. Our electronic signature feature speeds up the approval process and minimizes paperwork, making it ideal for modern businesses. Plus, you can track document status in real-time.

-

Are there templates available for the Berkheimer W 2 reconciliation form?

Yes, airSlate SignNow offers customizable templates for the Berkheimer W 2 reconciliation form. You can easily modify these templates to suit your specific requirements and save time in the document preparation process. This flexibility ensures you always have the latest version ready for use.

-

How does eSigning the Berkheimer W 2 reconciliation form work with airSlate SignNow?

eSigning the Berkheimer W 2 reconciliation form with airSlate SignNow is simple and intuitive. Recipients receive an email invitation to sign, and they can complete the process electronically on any device. This eliminates the need for printing and scanning, ensuring a faster and more efficient workflow.

Get more for Berkheimer W2 Reconciliation Form

Find out other Berkheimer W2 Reconciliation Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free