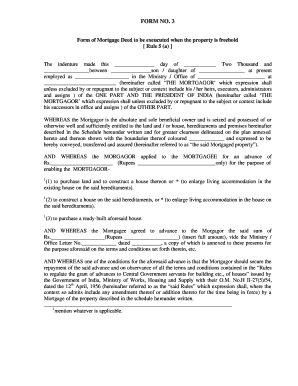

Sbi Indenture of Mortgage Form

What is the SBI Indenture of Mortgage

The SBI Indenture of Mortgage is a legal document that establishes a mortgage agreement between a borrower and the State Bank of India (SBI). This document outlines the terms and conditions under which the borrower secures a loan against a property. It serves as a formal record of the loan, detailing the obligations of both parties, including repayment terms, interest rates, and the consequences of default. The document is essential for protecting the lender's interests while providing the borrower with access to necessary funds for purchasing or refinancing property.

How to Use the SBI Indenture of Mortgage

Using the SBI Indenture of Mortgage involves several key steps. First, the borrower must complete the application process with SBI, providing necessary documentation such as proof of income, property details, and identification. Once the loan is approved, the borrower will receive the indenture form to fill out. It is crucial to ensure that all information is accurate and complete. After filling out the form, both parties must sign it to make it legally binding. This document can then be stored electronically or in paper form, depending on the preferences of the parties involved.

Steps to Complete the SBI Indenture of Mortgage

Completing the SBI Indenture of Mortgage requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, including identification, proof of income, and property details.

- Fill out the SBI Indenture of Mortgage form accurately, ensuring all required fields are completed.

- Review the terms and conditions outlined in the document, paying close attention to interest rates and repayment schedules.

- Both the borrower and a representative from SBI must sign the document to validate it.

- Keep a copy of the signed document for personal records and future reference.

Legal Use of the SBI Indenture of Mortgage

The SBI Indenture of Mortgage is legally binding once it has been signed by both parties. It must comply with state and federal laws governing mortgage agreements. This includes adherence to regulations regarding disclosures, interest rates, and borrower rights. In the event of a dispute, the document serves as evidence in court, outlining the obligations of each party. Therefore, it is essential to ensure that the form is completed correctly and that all legal requirements are met to protect both the lender and the borrower.

Key Elements of the SBI Indenture of Mortgage

Key elements of the SBI Indenture of Mortgage include:

- Borrower and Lender Information: Names and addresses of both parties.

- Property Description: Detailed information about the property being mortgaged.

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Schedule and method of repayment, including any penalties for late payments.

- Default Clauses: Conditions under which the lender may take action if the borrower defaults.

State-Specific Rules for the SBI Indenture of Mortgage

State-specific rules may affect the SBI Indenture of Mortgage, as each state has its own regulations governing mortgage agreements. These regulations can include requirements for disclosures, interest rate limits, and foreclosure processes. It is important for borrowers to familiarize themselves with their state's laws to ensure compliance and protect their rights. Consulting with a legal professional or a mortgage advisor can provide valuable insights into these state-specific rules.

Quick guide on how to complete sbi indenture of mortgage

Complete Sbi Indenture Of Mortgage effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Sbi Indenture Of Mortgage on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Sbi Indenture Of Mortgage with ease

- Obtain Sbi Indenture Of Mortgage and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sbi Indenture Of Mortgage and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi indenture of mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SBI indenture of mortgage?

An SBI indenture of mortgage is a legal document that outlines the terms of a loan secured by real estate through State Bank of India. This document provides details on the obligations of the borrower and the lender, ensuring clarity and protection for both parties. Understanding the intricacies of the SBI indenture of mortgage is essential for borrowers seeking loans.

-

How can airSlate SignNow help with the SBI indenture of mortgage?

airSlate SignNow simplifies the process of preparing and signing an SBI indenture of mortgage by providing an intuitive electronic signature platform. Users can easily create, send, and manage mortgage documents online, reducing the need for paper and in-person meetings. This streamlined process accelerates the completion of mortgage transactions.

-

What features does airSlate SignNow offer for managing SBI indentures of mortgage?

airSlate SignNow offers features like document templates, in-person signing, and secure cloud storage specifically for SBI indentures of mortgage. Users can automate workflows to track document progress and get instant notifications when documents are signed. These features enhance efficiency and ensure compliance with legal requirements.

-

Is there a cost to use airSlate SignNow for SBI indenture of mortgage documents?

Yes, airSlate SignNow offers several pricing plans tailored to suit different business needs for managing SBI indenture of mortgage documents. Plans are designed to be cost-effective, with options for individual users as well as larger businesses. You can choose a plan that fits your budget while still benefiting from all features.

-

What are the benefits of using airSlate SignNow for SBI indenture of mortgage?

Using airSlate SignNow for SBI indenture of mortgage offers benefits such as increased efficiency, secure electronic storage, and enhanced collaboration. The platform eliminates delays associated with traditional paper-based processes, allowing for quick turnaround times on essential documents. Additionally, it provides a better user experience for all parties involved.

-

How secure is airSlate SignNow when handling SBI indenture of mortgage documents?

airSlate SignNow prioritizes security by employing advanced encryption and authentication protocols for all SBI indenture of mortgage documents. This ensures that sensitive information remains protected throughout the document lifecycle. The platform is compliant with various regulatory standards, giving users peace of mind regarding data safety.

-

Can airSlate SignNow integrate with other tools for managing SBI indenture of mortgage?

Yes, airSlate SignNow offers integrations with various tools and applications that enhance the management of SBI indenture of mortgage documents. Users can connect with popular CRM systems, cloud storage services, and other business software, leading to streamlined workflows. These integrations help consolidate processes in one unified platform.

Get more for Sbi Indenture Of Mortgage

- Bylaws of mitchell hutchins securities trust form

- Insurance trust form

- Agreement between company 497336560 form

- Sample employment agreement contract form

- Wellcraft master dealer agreement form

- Dealer agreement form

- Sample common shares purchase agreement between visible genetics inc and investors form

- Registration company form

Find out other Sbi Indenture Of Mortgage

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy