Senior Ze Maricopa County Form

What is the Senior Ze Maricopa County

The Senior Ze Maricopa County refers to a property tax exemption program designed for eligible seniors in Maricopa County, Arizona. This program aims to provide financial relief by reducing the property tax burden on qualifying individuals. Seniors who meet specific criteria can benefit from this exemption, which helps them maintain their homes and manage their finances more effectively.

Eligibility Criteria

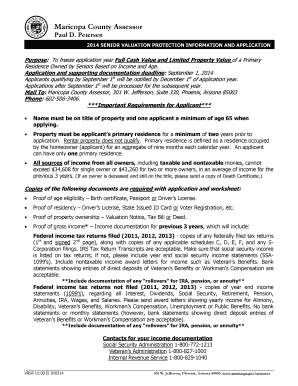

To qualify for the Senior Ze Maricopa County, applicants must meet several criteria:

- Age: Applicants must be at least sixty-five years old.

- Residency: The property must be the primary residence of the applicant.

- Income Limits: Applicants must have a gross income below a certain threshold, which is adjusted annually.

- Ownership: The applicant must own the property for which they are seeking the exemption.

It is essential for applicants to verify their eligibility before proceeding with the application process.

Steps to Complete the Senior Ze Maricopa County

Completing the application for the Senior Ze Maricopa County involves several steps:

- Gather Required Documents: Collect documents that verify age, residency, income, and property ownership.

- Fill Out the Application: Complete the application form accurately, ensuring all information is correct.

- Submit the Application: Submit the completed application along with the required documents to the Maricopa County Assessor's Office.

- Await Confirmation: After submission, wait for confirmation from the assessor's office regarding the approval status.

Following these steps can help ensure a smooth application process.

Required Documents

When applying for the Senior Ze Maricopa County, certain documents are necessary to support the application:

- Proof of Age: A copy of a government-issued ID or birth certificate.

- Proof of Residency: Documents such as utility bills or lease agreements showing the applicant's name and address.

- Income Verification: Recent tax returns, pay stubs, or Social Security statements to demonstrate income levels.

- Property Ownership: Deeds or mortgage statements confirming ownership of the property.

Ensuring all required documents are included can help expedite the review process.

Form Submission Methods

Applicants have several options for submitting their Senior Ze Maricopa County application:

- Online: Applications can be submitted electronically through the Maricopa County Assessor's website.

- Mail: Completed applications can be sent via postal mail to the Assessor's Office.

- In-Person: Applicants may also choose to submit their applications in person at the Assessor's Office.

Selecting the most convenient submission method can help ensure timely processing of the application.

Legal Use of the Senior Ze Maricopa County

The Senior Ze Maricopa County exemption is legally binding once approved. It provides seniors with a legitimate means to reduce their property tax obligations. It is crucial for applicants to understand that any misrepresentation or failure to comply with the program's requirements may result in penalties or the revocation of the exemption. Therefore, maintaining accurate records and adhering to the guidelines is essential for continued eligibility.

Quick guide on how to complete senior ze maricopa county

Easily prepare Senior Ze Maricopa County on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Senior Ze Maricopa County on any device with airSlate SignNow's Android or iOS apps and streamline any document-related process today.

The easiest way to modify and eSign Senior Ze Maricopa County effortlessly

- Locate Senior Ze Maricopa County and select Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Senior Ze Maricopa County and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the senior ze maricopa county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Maricopa County Assessor?

The Maricopa County Assessor is responsible for determining the value of properties in the county for tax purposes. They ensure that property assessments are accurate and fair, which directly impacts local funding for schools and other community services. Understanding their processes can help you navigate property value assessments more effectively.

-

How can airSlate SignNow assist with documents related to the Maricopa County Assessor?

airSlate SignNow streamlines the signing process for documents required by the Maricopa County Assessor. With easy electronic signatures, you can quickly complete and submit necessary paperwork, saving time and ensuring compliance with local regulations. This solution is particularly useful for real estate transactions managed by the assessor's office.

-

Does airSlate SignNow offer any integrations for handling assessments related to the Maricopa County Assessor?

Yes, airSlate SignNow supports integrations with various real estate and tax management applications, making it easier to manage your documents in compliance with the Maricopa County Assessor's requirements. These integrations help automate workflows and maintain organized records, especially during busy tax seasons.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs, ensuring a budget-friendly solution for users needing to interact with the Maricopa County Assessor. You can choose from individual, business, or enterprise plans, all designed to provide value while simplifying the eSignature process. Check the official website for detailed pricing and plan comparisons.

-

What features does airSlate SignNow provide to enhance user experience?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking to create a user-friendly experience. These tools are particularly beneficial when dealing with documents for the Maricopa County Assessor, as they allow for efficient management and easy collaboration. Users appreciate the intuitive interface that simplifies the eSign process.

-

How does airSlate SignNow ensure the security of documents related to the Maricopa County Assessor?

With advanced encryption and secure cloud storage, airSlate SignNow ensures that all documents, including those for the Maricopa County Assessor, are protected against unauthorized access. Compliance with industry standards and regulations further enhances document security, allowing users to sign with confidence. Regular security audits help maintain the highest levels of data integrity.

-

Can airSlate SignNow help with the appeal process to the Maricopa County Assessor?

Absolutely! airSlate SignNow can facilitate the submission of appeal documents to the Maricopa County Assessor by providing easy eSignature options and secure document management. This can expedite the appeal process, allowing for quicker resolutions and enabling you to focus on your property concerns without unnecessary delays.

Get more for Senior Ze Maricopa County

- Nh agreement 497318554 form

- New hampshire agreement form

- Quitclaim deed from husband and wife to an individual new hampshire form

- Warranty deed from husband and wife to an individual new hampshire form

- Nh 540 form

- Quitclaim deed two individuals to one individual new hampshire form

- New hampshire deed 497318560 form

- New hampshire form

Find out other Senior Ze Maricopa County

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form