Tbor1 Form

What is the Tbor1

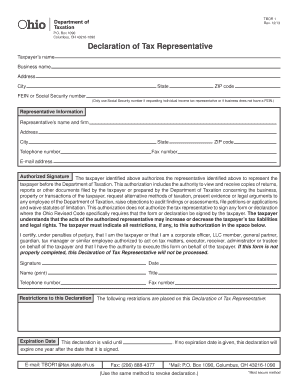

The Tbor1 is a specific form utilized in Ohio for various legal and administrative purposes. It serves as a critical document for individuals and businesses to ensure compliance with state regulations. The form is often required for matters related to taxation, legal filings, or administrative requests. Understanding the Tbor1 is essential for anyone needing to navigate the specific requirements set forth by Ohio law.

How to use the Tbor1

Using the Tbor1 involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation required for the form. This may include personal identification details, financial information, or other relevant data. Next, fill out the form accurately, ensuring that all fields are completed as required. Once filled, review the document for any errors before submitting it to the appropriate authority, whether online, by mail, or in person.

Steps to complete the Tbor1

Completing the Tbor1 can be straightforward if you follow these steps:

- Gather all required documents, such as identification and financial records.

- Access the Tbor1 form, ensuring you have the latest version.

- Fill in the form carefully, paying attention to each section.

- Review your entries for accuracy and completeness.

- Submit the form through the designated method: online, by mail, or in person.

Legal use of the Tbor1

The Tbor1 is legally binding when completed correctly and submitted according to Ohio state laws. To ensure its legal standing, it is crucial to comply with all relevant regulations, including providing accurate information and obtaining necessary signatures. The form may also require notarization or additional verification depending on the context of its use. Utilizing a reputable electronic signature platform can enhance the legal validity of the Tbor1.

Key elements of the Tbor1

Several key elements must be included in the Tbor1 to ensure its validity. These include:

- Personal identification information of the filer.

- The purpose of the form and the specific request being made.

- Accurate financial data, if applicable.

- Signatures from all required parties.

- Date of submission and any relevant case numbers.

Who Issues the Form

The Tbor1 is issued by the Ohio state government, specifically through designated departments that handle legal and administrative matters. These departments are responsible for ensuring that the form meets all regulatory requirements and is accessible to the public. It is advisable to check with the appropriate state agency for the most current version of the form and any specific instructions related to its use.

Quick guide on how to complete tbor1

Complete Tbor1 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without difficulties. Manage Tbor1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Tbor1 without hassle

- Locate Tbor1 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Tbor1 to ensure effective communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tbor1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tbor1 and how does it relate to airSlate SignNow?

tbor1 is a key aspect of airSlate SignNow's services that allows businesses to streamline their document signing process. By using tbor1, users can enhance their workflow efficiency and manage eSignatures with ease, making it a crucial tool for any organization.

-

What pricing plans does airSlate SignNow offer related to tbor1?

airSlate SignNow offers various pricing tiers that incorporate features related to tbor1. These plans are designed to suit different business needs and budgets, ensuring that companies can choose an option that enables them to leverage the full potential of tbor1 for document management.

-

What are the key features of airSlate SignNow associated with tbor1?

The key features associated with tbor1 include customizable templates, bulk sending, and real-time tracking of document signing status. These functionalities give businesses a comprehensive toolset to optimize their eSignature processes efficiently using tbor1.

-

How can tbor1 benefit my business's document management?

Using tbor1 can signNowly improve your business's document management by reducing turnaround times and increasing accuracy in your signing processes. With automation capabilities and user-friendly interfaces, tbor1 allows teams to focus on what truly matters—growing their business.

-

Does airSlate SignNow support integrations with other apps related to tbor1?

Yes, airSlate SignNow supports robust integrations with various applications, enhancing the functionality related to tbor1. This capability ensures that users can connect their existing tools with airSlate SignNow for a seamless document signing experience.

-

Is training available for using tbor1 with airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources aimed at helping users understand how to effectively utilize tbor1. These resources include tutorials, webinars, and customer support, ensuring that your team can maximize their efficiency with tbor1.

-

Can I try out airSlate SignNow's tbor1 features for free?

Yes! airSlate SignNow offers a free trial that allows potential users to explore the tbor1 features without any financial commitment. This is a great opportunity for businesses to evaluate how tbor1 can fit into their document management strategy.

Get more for Tbor1

- Resume cover letter for rn form

- Resume cover letter for professor of a department form

- Resume cover letter for president of a university form

- Resume cover letter for medical position form

- Resume cover letter for database administrator form

- Resume cover letter for land surveyor form

- Resume cover letter for zoologist form

- Resume cover letter for massage therapist form

Find out other Tbor1

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now