Sales Tax Exempt Certificate Form

What is the Sales Tax Exempt Certificate

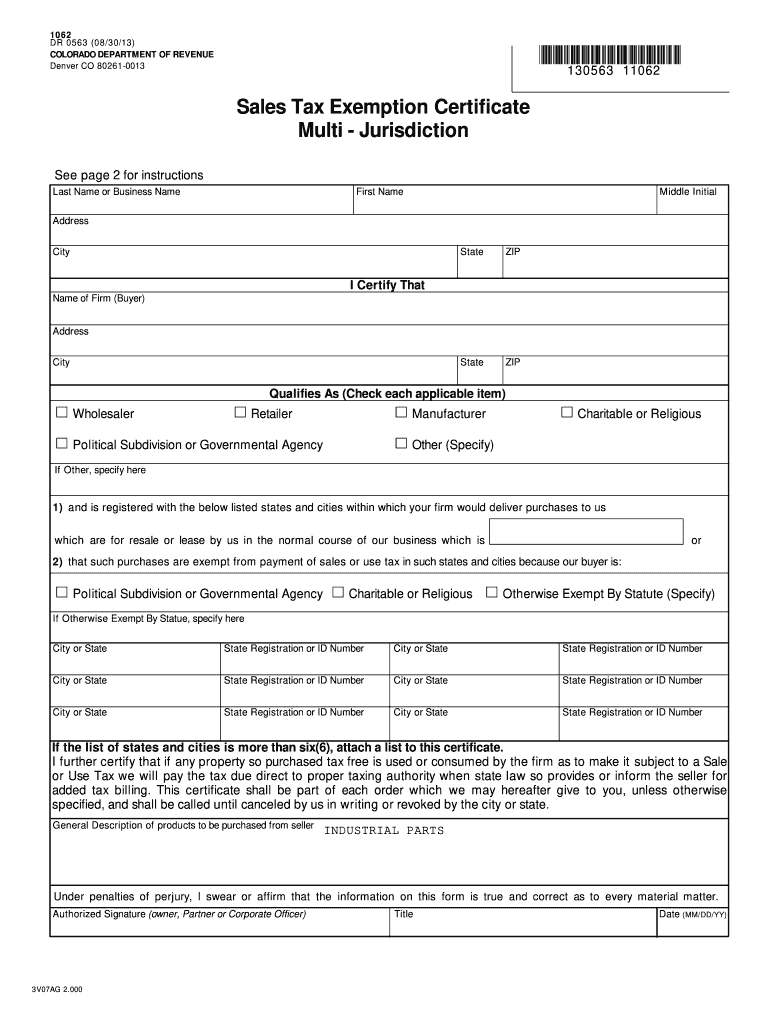

The Sales Tax Exempt Certificate, often referred to as the Colorado DR 0563, is a crucial document that allows eligible entities to make purchases without paying sales tax. This form is primarily used by organizations that qualify for tax-exempt status, such as non-profits, government agencies, and certain educational institutions. By presenting this certificate at the time of purchase, these entities can avoid the additional costs associated with sales tax, thereby maximizing their resources for their respective missions.

How to use the Sales Tax Exempt Certificate

To effectively use the Colorado DR 0563, the purchaser must complete the form accurately and present it to the seller during a transaction. The seller must retain a copy of the certificate for their records to validate the tax-exempt status of the sale. It is essential that the certificate includes all required information, such as the purchaser's name, address, and the nature of their tax-exempt status. Failure to present a properly completed certificate may result in the purchaser being charged sales tax.

Steps to complete the Sales Tax Exempt Certificate

Completing the Colorado DR 0563 involves several straightforward steps:

- Obtain a copy of the form from the appropriate state department or download it from a reliable source.

- Fill in the required fields, including the name and address of the purchaser and the reason for tax exemption.

- Ensure that the form is signed and dated by an authorized representative of the organization.

- Provide the completed certificate to the seller at the time of purchase.

Legal use of the Sales Tax Exempt Certificate

The legal use of the Colorado DR 0563 is governed by state tax laws, which stipulate that only eligible organizations can utilize this certificate to make tax-exempt purchases. Misuse of the certificate, such as using it for personal purchases or by ineligible entities, can result in penalties, including fines and back taxes owed. It is vital for organizations to understand their eligibility and to ensure compliance with all relevant regulations to maintain their tax-exempt status.

Eligibility Criteria

To qualify for the Sales Tax Exempt Certificate in Colorado, an organization must meet specific criteria. Generally, the following entities are eligible:

- Non-profit organizations recognized under IRS Section 501(c)(3).

- Government agencies at the federal, state, or local level.

- Educational institutions that are recognized as tax-exempt.

It is important for applicants to verify their eligibility and ensure they have the necessary documentation to support their tax-exempt status before applying for and using the Colorado DR 0563.

Who Issues the Form

The Colorado DR 0563 is issued by the Colorado Department of Revenue. This state agency is responsible for overseeing tax regulations and ensuring compliance among businesses and organizations. Entities seeking to obtain the Sales Tax Exempt Certificate must follow the application process outlined by the Department of Revenue, which includes providing necessary documentation to prove their tax-exempt status.

Quick guide on how to complete sales tax exempt certificate

Complete Sales Tax Exempt Certificate effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Sales Tax Exempt Certificate on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Sales Tax Exempt Certificate with ease

- Find Sales Tax Exempt Certificate and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Edit and electronically sign Sales Tax Exempt Certificate and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exempt certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado hotel lodging tax exempt form?

The Colorado hotel lodging tax exempt form is a document that allows eligible organizations and individuals to claim an exemption from paying hotel lodging taxes when staying in Colorado accommodations. Businesses, non-profit organizations, and government entities often use this form to avoid unnecessary tax expenses. Properly filling out this form ensures compliance with Colorado tax regulations.

-

How can I obtain a Colorado hotel lodging tax exempt form?

You can obtain a Colorado hotel lodging tax exempt form from various sources including the Colorado Department of Revenue website. Additionally, hotels may offer the form directly on their websites or upon request at their front desk. AirSlate SignNow also provides templates that can assist you in creating tailored tax exempt forms quickly.

-

What are the benefits of using the Colorado hotel lodging tax exempt form?

Using the Colorado hotel lodging tax exempt form can signNowly reduce your travel costs by eliminating the need to pay lodging taxes. This form streamlines the process for eligible parties, ensuring they benefit from potential savings. Additionally, completing this form properly aids in maintaining tax compliance and avoiding penalties.

-

Can airSlate SignNow help with the Colorado hotel lodging tax exempt form process?

Yes, airSlate SignNow offers a platform that simplifies the process of creating, signing, and managing the Colorado hotel lodging tax exempt form. With its user-friendly interface, you can easily customize the form, collect necessary signatures, and store documents securely. This makes managing lodging tax exemptions more efficient for your business.

-

Are there any fees associated with using the Colorado hotel lodging tax exempt form?

There are generally no fees associated with completing the Colorado hotel lodging tax exempt form itself, but individual hotels may have specific policies that could incur charges. It’s important to check each establishment's requirements before submitting the form. Using airSlate SignNow to manage this process may involve a subscription fee, but it offers substantial benefits by simplifying document management.

-

What types of organizations can use the Colorado hotel lodging tax exempt form?

The Colorado hotel lodging tax exempt form can be utilized by a variety of organizations, including government entities, non-profit organizations, and educational institutions. Many businesses that travel for work can also qualify for this exemption. Ensure that your organization meets eligibility criteria outlined by Colorado tax regulations before using the form.

-

Is there a deadline for submitting the Colorado hotel lodging tax exempt form?

While there is no specific deadline for submitting the Colorado hotel lodging tax exempt form, it is essential to provide it at the time of check-in to avoid incurring lodging taxes. Being proactive will ensure smooth processing and compliance with hotel policies. Always check with the respective hotel regarding their specific timelines for acceptance of tax exempt forms.

Get more for Sales Tax Exempt Certificate

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles new jersey form

- Letter from tenant to landlord about landlords failure to make repairs new jersey form

- Nj letter rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession new jersey form

- Letter from tenant to landlord about illegal entry by landlord new jersey form

- Letter from landlord to tenant about time of intent to enter premises new jersey form

- Letter notice rent 497319220 form

- Letter from tenant to landlord about sexual harassment new jersey form

Find out other Sales Tax Exempt Certificate

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer