Form 8453 Ol

What is the Form 8453 Ol

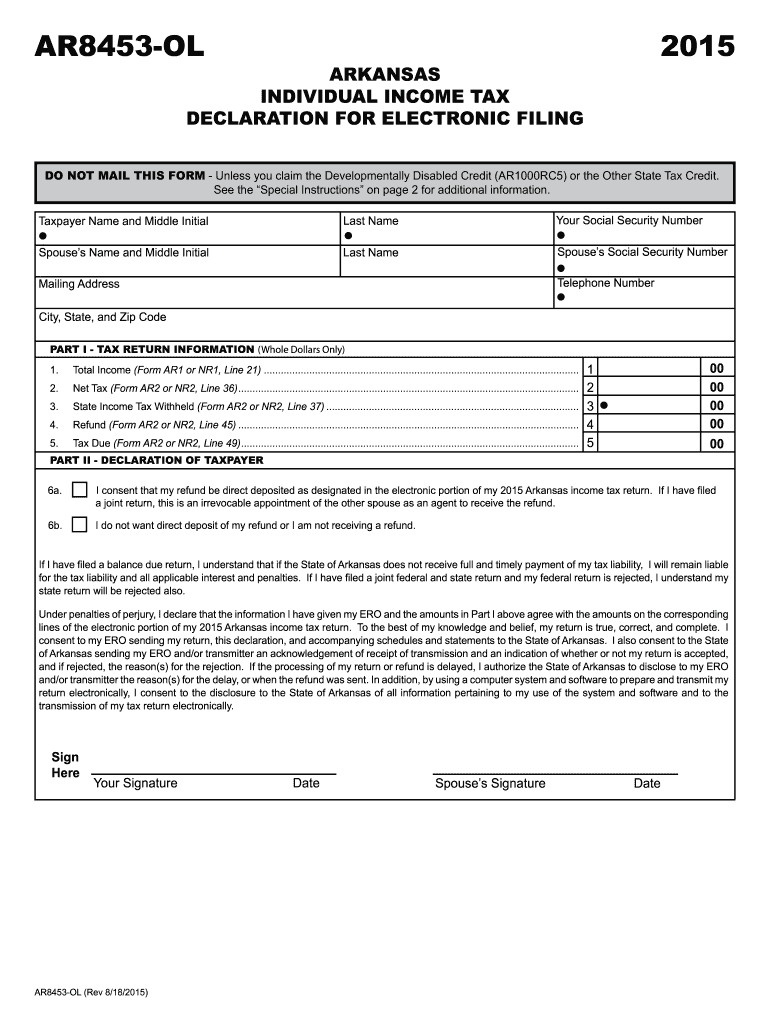

The Form 8453 Ol is a crucial document used in the electronic filing of tax returns in the United States. This form serves as a declaration that the taxpayer authorizes the electronic submission of their tax return and confirms the accuracy of the information provided. It is particularly relevant for individuals who file their taxes electronically and need to ensure compliance with IRS regulations. The form includes essential taxpayer information, such as name, Social Security number, and signature, which are necessary for validating the electronic submission.

Steps to complete the Form 8453 Ol

Completing the Form 8453 Ol involves several straightforward steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather necessary information, including your personal details and tax return data.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions before submitting.

- Sign the form electronically, which may require a digital signature or PIN.

- Submit the form alongside your electronic tax return to the IRS.

Legal use of the Form 8453 Ol

The legal use of the Form 8453 Ol is governed by IRS regulations that ensure electronic signatures are treated as valid as traditional handwritten signatures. To be legally binding, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. This compliance guarantees that the electronic submission holds the same legal weight as paper submissions, provided that the signer has followed the required procedures for authentication and verification.

How to obtain the Form 8453 Ol

The Form 8453 Ol can be obtained directly from the IRS website or through tax preparation software that supports electronic filing. It is typically available as a fillable PDF, which allows users to complete the form digitally. Additionally, tax professionals may provide this form as part of their services, ensuring that clients have the necessary documentation for their electronic filings.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 8453 Ol to ensure compliance with electronic filing requirements. Taxpayers must adhere to these guidelines to avoid issues with their tax submissions. Key points include:

- Ensure all information is accurate and complete.

- Maintain a copy of the signed form for personal records.

- Submit the form in conjunction with the electronic tax return.

Form Submission Methods

The Form 8453 Ol can be submitted electronically as part of the e-filing process. Taxpayers have the option to file their returns through various methods, including tax preparation software or through a tax professional. It is important to note that the form must be submitted alongside the electronic tax return to ensure proper processing by the IRS. Alternatively, if filing by mail, a paper version of the form should be included with the tax return documentation.

Quick guide on how to complete form 8453 ol 86540346

Effortlessly Prepare Form 8453 Ol on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Form 8453 Ol on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Edit and eSign Form 8453 Ol with Ease

- Locate Form 8453 Ol and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 8453 Ol to ensure exceptional communication at any step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 ol 86540346

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 8453 ol and why is it important?

The form 8453 ol is a crucial document used for electronic signature verification in tax filings. It ensures that your e-filed documents are authentic and comply with IRS requirements. Using airSlate SignNow to manage your form 8453 ol simplifies this process, saving you time and minimizing errors.

-

How does airSlate SignNow support the completion of form 8453 ol?

airSlate SignNow offers an intuitive platform that guides users through each step of completing their form 8453 ol. With features like electronic signatures, automated reminders, and secure document storage, you can manage your tax-related documents efficiently without any hassle.

-

Is airSlate SignNow cost-effective for filing the form 8453 ol?

Yes, airSlate SignNow provides a cost-effective solution for filing the form 8453 ol. With competitive pricing plans tailored to suit different needs, you can choose a plan that fits your budget while gaining access to powerful features that streamline your document management.

-

Can I integrate airSlate SignNow with other applications for form 8453 ol processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance the processing of your form 8453 ol. Whether you're using CRM systems, accounting software, or other productivity tools, our integrations help you streamline workflows and automate processes.

-

What security measures does airSlate SignNow implement for form 8453 ol transactions?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the form 8453 ol. We implement advanced encryption, secure data storage, and comply with industry standards to ensure your e-signatures and documents remain protected throughout the process.

-

How does airSlate SignNow enhance the user experience for completing form 8453 ol?

The user experience on airSlate SignNow is top-notch, thanks to its user-friendly interface and guided document workflows. Our platform allows users to easily navigate through the complexities of the form 8453 ol, ensuring a smooth and efficient e-signing experience.

-

Can I track the status of my form 8453 ol with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your form 8453 ol. You can monitor sent documents, see who has signed, and receive notifications when the document is completed, giving you peace of mind about the status of your important tax filings.

Get more for Form 8453 Ol

- Grant sale deed 497320591 form

- Quitclaim husband wife 497320592 form

- Nevada gift deed form

- Time share quitclaim deed three individuals to two individuals nevada form

- Quitclaim deed two individuals to two individuals nevada form

- Nevada time share form

- Nv limited company form

- Quitclaim deed from an individual to three individuals nevada form

Find out other Form 8453 Ol

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document