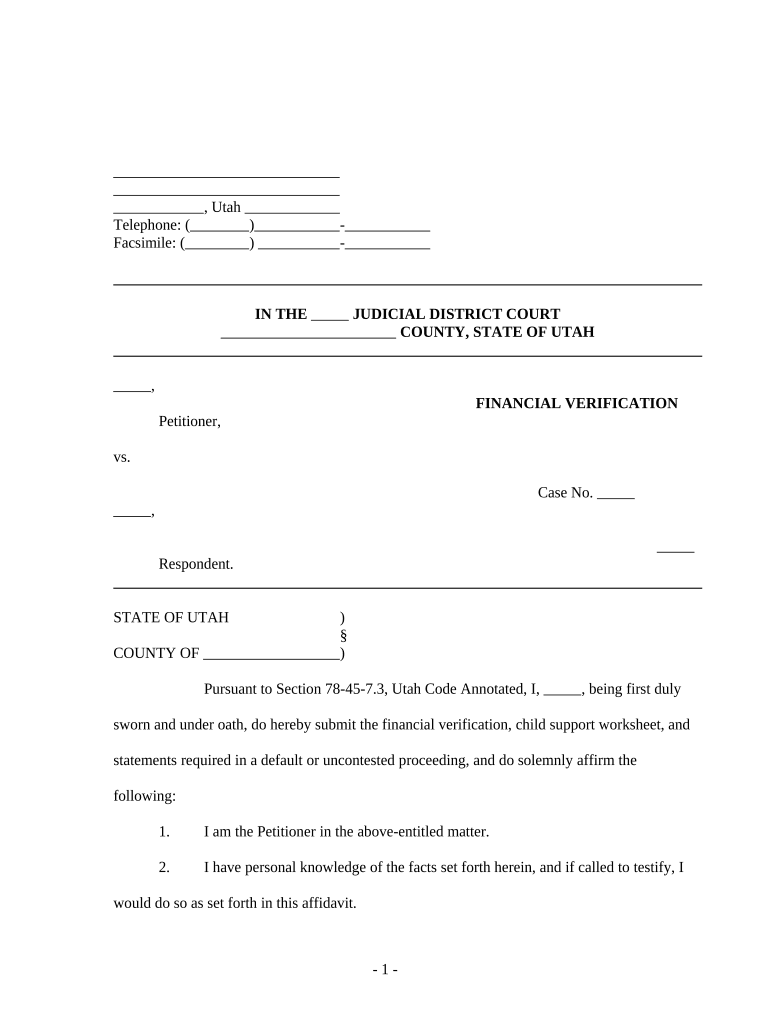

Financial Verification Utah Form

What is the Financial Verification Utah

The Financial Verification Utah form is a crucial document used to confirm an individual's or entity's financial status within the state of Utah. This form is often required by financial institutions, government agencies, or other organizations to assess creditworthiness, eligibility for loans, or compliance with specific regulations. It typically includes information regarding income, assets, liabilities, and other financial details pertinent to the verification process.

How to Use the Financial Verification Utah

Using the Financial Verification Utah form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents, such as bank statements, pay stubs, and tax returns. Next, fill out the form with precise details regarding your financial situation. It is essential to review the completed form for accuracy before submission. Utilizing a reliable electronic signature platform can streamline this process, ensuring that the form is submitted securely and efficiently.

Steps to Complete the Financial Verification Utah

Completing the Financial Verification Utah form involves a systematic approach:

- Gather necessary financial documents, including income statements and asset declarations.

- Fill out the form with accurate financial details, ensuring all sections are completed.

- Review the information for any errors or omissions.

- Sign the form electronically using a trusted eSignature service to ensure legal validity.

- Submit the completed form to the requesting institution or agency.

Legal Use of the Financial Verification Utah

The legal use of the Financial Verification Utah form is governed by various state and federal regulations. To be considered valid, the form must meet specific requirements, including proper signatures and adherence to eSignature laws. Utilizing a compliant eSignature platform ensures that the form is legally binding and recognized by institutions and courts alike. Compliance with regulations such as ESIGN and UETA is essential for the electronic submission of this form.

Key Elements of the Financial Verification Utah

Several key elements are essential for the Financial Verification Utah form to be effective:

- Personal identification information, including name, address, and contact details.

- Detailed financial information, such as income sources, assets, and liabilities.

- Signature of the individual or authorized representative to validate the information provided.

- Date of completion to establish the timeline of the verification process.

State-Specific Rules for the Financial Verification Utah

Utah has specific rules governing the use of the Financial Verification form. These may include guidelines on how the information should be presented, the required supporting documentation, and deadlines for submission. Understanding these state-specific regulations is crucial for ensuring compliance and avoiding potential penalties. It is advisable to consult with a legal expert or financial advisor familiar with Utah's requirements to navigate these rules effectively.

Quick guide on how to complete financial verification utah

Finalize Financial Verification Utah effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Financial Verification Utah across any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Financial Verification Utah with ease

- Locate Financial Verification Utah and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in a few clicks from any device you prefer. Modify and eSign Financial Verification Utah to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Financial Verification Utah and why is it important?

Financial Verification Utah is a crucial process that ensures the accuracy and legitimacy of financial documents. It helps businesses mitigate risks by confirming the identity of clients and their financial backgrounds. This process is essential for maintaining compliance with state regulations and fostering trust in transactions.

-

How does airSlate SignNow assist with Financial Verification Utah?

airSlate SignNow streamlines the Financial Verification Utah process by allowing users to easily send and sign documents electronically. Our platform provides tools for secure document management and enables real-time tracking of each document's status. This simplifies the entire verification process, making it faster and more efficient.

-

Are there any specific features for Financial Verification Utah in airSlate SignNow?

Yes, airSlate SignNow includes features designed specifically for Financial Verification Utah, such as secure electronic signatures and customizable document templates. With these features, businesses can ensure that all necessary financial documents are accurately completed and signed. Enhanced security protocols also safeguard sensitive financial information throughout the process.

-

What are the pricing options for using airSlate SignNow for Financial Verification Utah?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on Financial Verification Utah. You can select from monthly or annual subscriptions, with different tiers offering varying features. This ensures businesses of all sizes can find a solution that fits their budget while enhancing their financial verification processes.

-

Can airSlate SignNow integrate with other software for Financial Verification Utah?

Absolutely! airSlate SignNow easily integrates with various accounting and financial software which can enhance the Financial Verification Utah process. These integrations help automate data transfer, reduce manual entry errors, and ensure seamless workflows across platforms. This connectivity simplifies the financial verification process for users.

-

What benefits does airSlate SignNow provide for Financial Verification Utah?

airSlate SignNow provides multiple benefits for Financial Verification Utah, including improved efficiency and quicker turnaround times. By using our electronic signature solution, businesses can reduce the time spent on manual paperwork, allowing them to focus on their core operations. Enhanced security features protect sensitive financial information, boosting overall compliance.

-

Is airSlate SignNow compliant with financial regulations in Utah?

Yes, airSlate SignNow is designed to be compliant with all relevant financial regulations in Utah, including those pertaining to digital signatures and document management. Our platform adheres to industry standards that govern electronic transactions, ensuring that your Financial Verification Utah processes are legally sound. Users can confidently conduct their business knowing that they are compliant.

Get more for Financial Verification Utah

- Bill of lading hawaii form

- Affidavit to accompany joint application for order dissolving marriage justice govt form

- Hartford funds ira distribution request form

- Eastern idaho technical college transcript request form eitc

- Background check authorization rochester institute of technology rit form

- 2004 california forms 593 c 593 l and instructions form 593 c real estate withholding certificate for individual sellers and

- Contractor statement contractor statement non construction catalogue no 45062893 form no 921

- Pa dmv physical forms to print

Find out other Financial Verification Utah

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors