Iowa 706 Schedule J Form

What is the Iowa 706 Schedule J

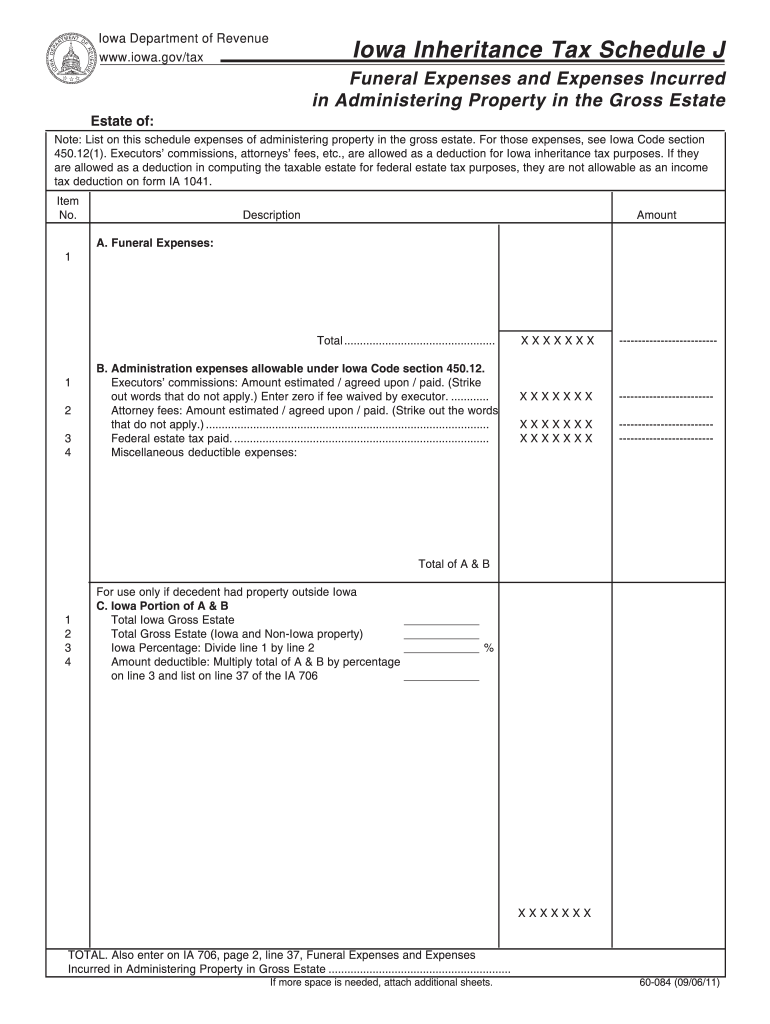

The Iowa 706 Schedule J is a crucial document used in the context of inheritance tax in Iowa. This form specifically outlines the deductions that can be claimed against the gross estate of a deceased individual. It plays a significant role in calculating the net taxable estate, which ultimately determines the amount of inheritance tax owed. Understanding this form is essential for executors and beneficiaries involved in estate settlement, as it helps ensure compliance with state tax regulations.

How to use the Iowa 706 Schedule J

Using the Iowa 706 Schedule J involves several steps to ensure accurate completion. First, gather all necessary information regarding the decedent's estate, including assets and liabilities. Next, identify the deductions that qualify under Iowa law, such as funeral expenses, debts, and certain property transfers. Once you have compiled this information, you can fill out the form by entering the relevant data in the appropriate sections. It is important to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the Iowa 706 Schedule J

Completing the Iowa 706 Schedule J requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant documents related to the estate, including the will, asset valuations, and debts.

- Identify and list all allowable deductions, ensuring they meet the criteria set by Iowa tax laws.

- Fill out the form, entering the collected data in the designated fields.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it to the appropriate state department.

Legal use of the Iowa 706 Schedule J

The legal use of the Iowa 706 Schedule J is paramount for ensuring that the estate is settled in accordance with state laws. This form must be filled out accurately and submitted within the specified time frame to avoid any legal complications. The completed schedule serves as a formal declaration of the deductions claimed, and it may be subject to review by the Iowa Department of Revenue. Proper use of this form not only facilitates the inheritance tax process but also protects the rights of beneficiaries.

Key elements of the Iowa 706 Schedule J

Understanding the key elements of the Iowa 706 Schedule J is essential for effective completion. The form typically includes sections for:

- Identification of the decedent and estate information.

- Listing of allowable deductions, including debts and funeral expenses.

- Calculating the total deductions to arrive at the net taxable estate.

- Signature lines for the executor or representative of the estate.

Each section must be filled out with accurate and complete information to ensure compliance with Iowa tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa 706 Schedule J are critical to avoid penalties. Generally, the form must be submitted within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is advisable to check with the Iowa Department of Revenue for any updates or specific deadlines related to your situation. Keeping track of these dates is essential for timely compliance and to prevent any unnecessary complications in the estate settlement process.

Quick guide on how to complete iowa 706 schedule j

Effortlessly Prepare Iowa 706 Schedule J on Any Device

The management of online documents has gained immense popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Iowa 706 Schedule J across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and eSign Iowa 706 Schedule J with Ease

- Obtain Iowa 706 Schedule J and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to preserve your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form navigation, or errors that require the printing of additional document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Iowa 706 Schedule J while ensuring seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa 706 schedule j

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia 706 fillable form schedule j?

The ia 706 fillable form schedule j is used to report the allowable deductions for estate taxes in Iowa. This form helps in calculating the state's estate tax liability more accurately. Utilizing the airSlate SignNow platform helps you fill out and submit this form conveniently.

-

How can airSlate SignNow assist with the ia 706 fillable form schedule j?

With airSlate SignNow, you can easily access the ia 706 fillable form schedule j and complete it online. Our user-friendly platform allows for quick edits and electronic signatures, ensuring your documents are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the ia 706 fillable form schedule j?

Yes, there is a subscription cost for using airSlate SignNow, but we offer various pricing plans to fit different needs. These plans provide access to the ia 706 fillable form schedule j and other document management features at a competitive price.

-

Can I integrate airSlate SignNow with other applications while managing the ia 706 fillable form schedule j?

Absolutely! AirSlate SignNow offers seamless integrations with various applications to enhance your workflow. This means you can easily manage the ia 706 fillable form schedule j alongside other tools you may already be using.

-

What are the benefits of using airSlate SignNow for electronic signatures on the ia 706 fillable form schedule j?

Using airSlate SignNow for the ia 706 fillable form schedule j provides you with a secure and efficient way to capture signatures. This eliminates the hassle of printing and scanning, streamlining your process and providing instant delivery of signed documents.

-

Is the ia 706 fillable form schedule j available in different formats with airSlate SignNow?

Yes, airSlate SignNow allows you to convert the ia 706 fillable form schedule j into various formats for easy accessibility. Whether you need a PDF, DOC, or other file types, our platform ensures that your form is versatile and compatible with your needs.

-

Can I save progress while filling out the ia 706 fillable form schedule j in airSlate SignNow?

Yes, airSlate SignNow enables you to save your progress while completing the ia 706 fillable form schedule j. This feature lets you revisit and finalize the form at your convenience without losing any previously entered information.

Get more for Iowa 706 Schedule J

- Hvac contract for contractor new york form

- Landscape contract for contractor new york form

- Commercial contract for contractor new york form

- New york contract sample form

- Renovation contract for contractor new york form

- Concrete mason contract for contractor new york form

- Demolition contract for contractor new york form

- Framing contract for contractor new york form

Find out other Iowa 706 Schedule J

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document