Njw4 Form

What is the NJW4?

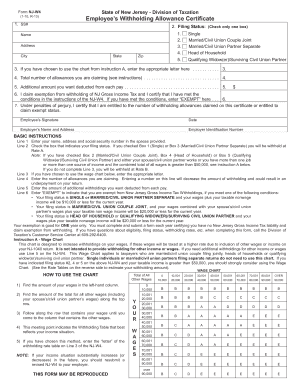

The NJW4 form, also known as the New Jersey Employee's Withholding Allowance Certificate, is a crucial document used by employees in New Jersey to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted based on an employee's personal circumstances, such as marital status and number of dependents. By accurately completing the NJW4, employees can help prevent underpayment or overpayment of state taxes throughout the year.

How to Obtain the NJW4

To obtain the NJW4 form, individuals can visit the official New Jersey Division of Taxation website, where the form is available for download. It is also possible to request a physical copy from the employer or local tax office. Ensuring that you have the most current version of the NJW4 is important, as tax laws and withholding requirements may change. Always check for the latest updates before completing the form.

Steps to Complete the NJW4

Completing the NJW4 involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim the number of allowances you are entitled to, which can reduce the amount of tax withheld.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the NJW4 should be submitted to your employer, who will use it to adjust your tax withholdings accordingly.

Legal Use of the NJW4

The NJW4 serves as a legally binding document that dictates the withholding of state income taxes from an employee's wages. It is important to complete this form accurately, as incorrect information can lead to penalties or unexpected tax liabilities. The form must be signed by the employee, affirming that the details provided are true and complete. Employers are required to keep this form on file for reference and compliance with state tax regulations.

Key Elements of the NJW4

Several key elements are essential to understand when filling out the NJW4:

- Personal Information: Accurate personal details are crucial for proper identification.

- Filing Status: This determines the tax rate applicable to the employee.

- Allowances: Employees can claim allowances based on their personal and financial situation, affecting withholding amounts.

- Signature: The employee's signature validates the form and confirms the accuracy of the information provided.

IRS Guidelines for the NJW4

While the NJW4 is a state-specific form, it is important to be aware of the IRS guidelines regarding withholding allowances. The IRS provides general rules and recommendations for determining the number of allowances to claim, which can influence state withholding as well. Employees should review both state and federal guidelines to ensure compliance and optimize their tax situation. Regularly updating the NJW4 in response to life changes, such as marriage or the birth of a child, is also advisable to maintain accurate withholdings.

Quick guide on how to complete njw4

Prepare Njw4 seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Njw4 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Njw4 effortlessly

- Locate Njw4 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that reason.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Njw4 and ensure effective communication at any point of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the njw4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is njw4 and how does it relate to airSlate SignNow?

Njw4 is a unique identifier related to specific document signing processes within airSlate SignNow. This feature allows users to easily manage and track their documents, ensuring a smooth workflow. By utilizing njw4, businesses can enhance their eSigning experience and improve operational efficiency.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to cater to various business needs. With flexible plans available, users can choose options that best suit their requirements while leveraging features associated with njw4. For detailed pricing, visit our website and explore our affordable packages.

-

What features does airSlate SignNow offer that utilize njw4?

airSlate SignNow offers a range of robust features that incorporate njw4 for efficient document management. These include secure eSigning, template creation, and customizable workflows, all aimed at simplifying the signing process. Each feature is designed to enhance user experience and streamline operations.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is an ideal solution for small businesses looking to streamline their document signing processes. With features like njw4, small businesses can effectively manage their documents without the burden of high costs. The user-friendly interface makes it accessible regardless of technical expertise.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows for seamless integrations with various applications, boosting productivity and workflow efficiency. Using the njw4 identifier during integrations ensures that documents are processed efficiently, allowing businesses to leverage existing tools alongside our platform.

-

What are the benefits of using airSlate SignNow?

The benefits of utilizing airSlate SignNow include improved efficiency, cost savings, and enhanced document security. By implementing njw4, users can automate their signing processes and reduce turnaround times signNowly. This makes it easier for businesses to keep pace in a fast-moving digital environment.

-

How does njw4 enhance document security in airSlate SignNow?

Njw4 is integrated into airSlate SignNow's security protocols, providing an added layer of protection for your documents. This unique identifier ensures that all signatures are verified and that document integrity is maintained throughout the signing process. Security is a top priority to protect sensitive business information.

Get more for Njw4

- Transfer death deed 497430540 form

- Wisconsin llc company form

- Wisconsin claim online form

- Quitclaim deed by two individuals to llc wisconsin form

- Warranty deed from two individuals to llc wisconsin form

- Subcontractors claim of lien by corporation or llc wisconsin form

- Public demand for payment individual wisconsin form

- Quitclaim deed by two individuals to corporation wisconsin form

Find out other Njw4

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement