Initial ReturnNotice of Change by an Ontario Corporation Form 1 Forms Ssb Gov on

What is the Initial Return for an Ontario Corporation?

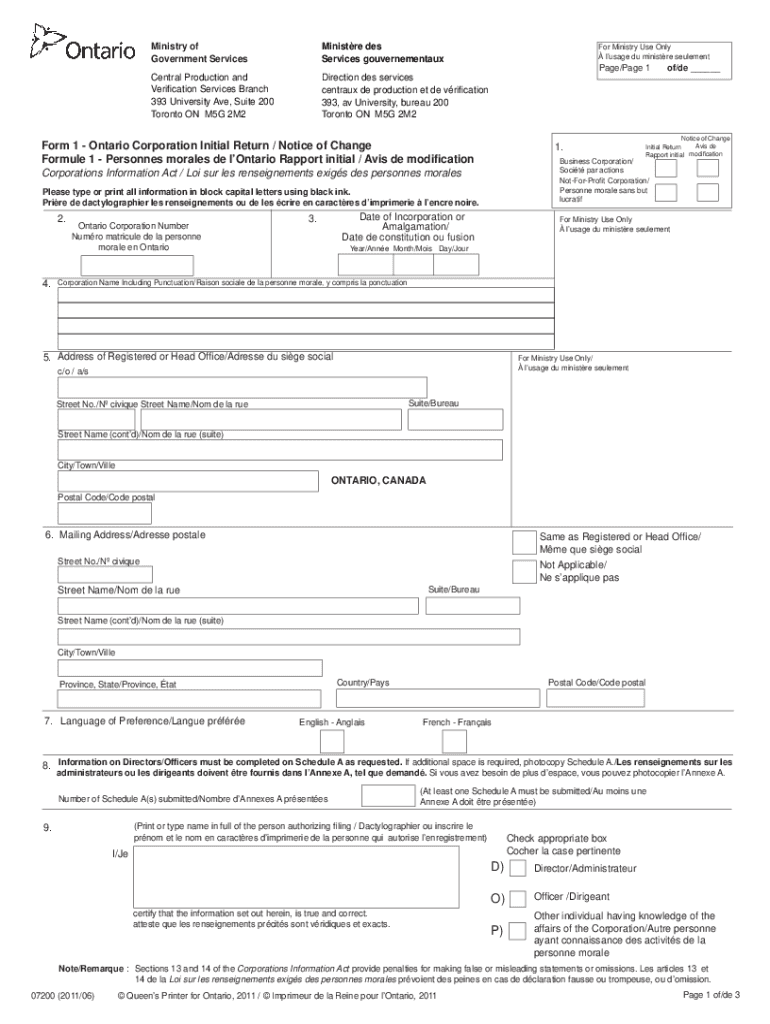

The Ontario corporation initial return is a crucial document required by the province for newly incorporated businesses. This form, often referred to as Form 1, provides essential information about the corporation, including its name, registered office address, and details of the directors and officers. It serves to officially register the corporation's existence and is typically required to be filed within a specific timeframe after incorporation.

Key Elements of the Initial Return

The initial return contains several key elements that must be accurately completed to ensure compliance with Ontario regulations. These elements include:

- Corporation Name: The legal name of the corporation as registered.

- Registered Office Address: The official address where the corporation will conduct its business.

- Directors and Officers Information: Names and addresses of the individuals serving as directors and officers.

- Business Number: A unique identifier assigned by the Canada Revenue Agency.

Steps to Complete the Initial Return

Filing the initial return involves several straightforward steps:

- Gather the necessary information about your corporation, including names and addresses of directors and officers.

- Access the Form 1 for the initial return from the appropriate government website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information.

- Submit the completed form either online or via mail, depending on your preference.

Legal Use of the Initial Return

The initial return is not just a formality; it has legal implications. Filing this document ensures that the corporation is recognized by the government and can operate legally within Ontario. Failure to submit the initial return can result in penalties, including the potential dissolution of the corporation. Thus, it is vital to understand the legal requirements surrounding this form.

Form Submission Methods

Corporations have multiple options for submitting their initial return. These methods typically include:

- Online Submission: Many corporations opt to file their initial return electronically through the appropriate government portal, which is often quicker and more efficient.

- Mail Submission: Alternatively, the completed form can be printed and mailed to the designated government office.

- In-Person Submission: Some may choose to deliver the form in person, ensuring immediate confirmation of receipt.

Filing Deadlines and Important Dates

It is essential to be aware of the deadlines associated with the initial return. Generally, the form must be filed within sixty days of the corporation's incorporation date. Missing this deadline can lead to complications, including fines or administrative actions. Keeping track of these dates is crucial for maintaining compliance.

Quick guide on how to complete initial returnnotice of change by an ontario corporation form 1 forms ssb gov on 42211103

Effortlessly Prepare Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to access the required form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On with Ease

- Obtain Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact confidential information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional ink signature.

- Verify all details and click the Done button to save your adjustments.

- Decide how you wish to share your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choice. Edit and electronically sign Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the initial returnnotice of change by an ontario corporation form 1 forms ssb gov on 42211103

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1 corporation initial return Ontario?

The 1 corporation initial return Ontario is a mandatory document that newly incorporated businesses must file with the provincial government. This return must be submitted within 60 days of incorporation, providing essential information about the corporation, including its directors and registered address.

-

How does airSlate SignNow help with the 1 corporation initial return Ontario?

AirSlate SignNow streamlines the process of completing and submitting the 1 corporation initial return Ontario by allowing users to fill out, eSign, and send documents electronically. This not only saves time but also ensures that your submissions are accurate and compliant with Ontario regulations.

-

What are the benefits of using airSlate SignNow for my 1 corporation initial return Ontario?

Using airSlate SignNow for your 1 corporation initial return Ontario simplifies document management and enhances workflow efficiency. The platform offers robust eSigning features, ensuring that your initial return is handled securely and swiftly, thereby reducing stress for business owners.

-

Is there a cost associated with using airSlate SignNow for the 1 corporation initial return Ontario?

Yes, airSlate SignNow offers several pricing plans that cater to different business sizes and needs. These plans provide access to essential features for managing your 1 corporation initial return Ontario, making it a cost-effective choice for many organizations.

-

Can I integrate airSlate SignNow with other tools for my 1 corporation initial return Ontario?

Absolutely! airSlate SignNow features seamless integrations with various CRM and document management systems, enhancing your ability to manage the 1 corporation initial return Ontario. These integrations help centralize your operations, making document processing and filing more efficient.

-

How secure is my information when I file the 1 corporation initial return Ontario using airSlate SignNow?

AirSlate SignNow employs advanced security measures to protect your data while you complete your 1 corporation initial return Ontario. With encryption and compliance with legal standards, your sensitive information remains safe throughout the entire process.

-

What features does airSlate SignNow offer for filing the 1 corporation initial return Ontario?

AirSlate SignNow provides a variety of features to assist in filing your 1 corporation initial return Ontario, including eSigning, document templates, and automated workflows. These tools enhance the filing experience, ensuring you can complete everything efficiently and accurately.

Get more for Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On

- Declaration of mount declaration of mount 4 h alberta northwest region form

- Imm 5283 form

- Minimum data set home care canadian version pdf form

- Income confirmation form icf

- Colonoscopy report format

- Professional responsibility concern united nurses of alberta form

- Consent to disclose personal health information form st josephamp39s

- Form iprc 3s secondary

Find out other Initial ReturnNotice Of Change By An Ontario Corporation Form 1 Forms Ssb Gov On

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form