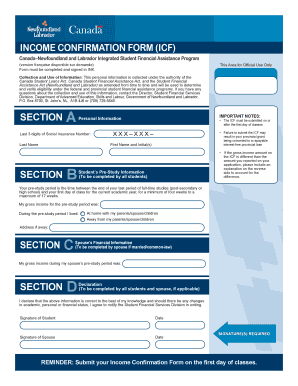

INCOME CONFIRMATION FORM ICF

What is the income confirmation form?

The income confirmation form, often referred to as the ICF, is a crucial document used to verify an individual's income for various purposes, including financial assistance applications, loan approvals, and government benefits. This form provides a standardized way to report income details, ensuring that the information is clear and consistent. It typically includes sections for personal identification, income sources, and supporting documentation, making it essential for anyone seeking financial aid or assistance programs.

Steps to complete the income confirmation form

Completing the income confirmation form involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary documents: Collect pay stubs, tax returns, and any other relevant income statements.

- Fill out personal information: Enter your name, address, and contact details in the designated sections.

- Report income sources: Clearly list all sources of income, including wages, self-employment earnings, and any government assistance.

- Attach supporting documents: Include copies of your income verification documents to substantiate the information provided.

- Review for accuracy: Double-check all entries for errors or omissions before submission.

- Submit the form: Follow the specified submission guidelines, whether online, by mail, or in person.

Legal use of the income confirmation form

The income confirmation form is legally recognized in various contexts, particularly when applying for financial assistance or loans. To ensure its legal validity, the form must be completed accurately and submitted with the required supporting documentation. Compliance with relevant regulations, such as the ESIGN Act, is essential for electronic submissions. This ensures that the document holds the same legal weight as a paper form, provided that all necessary signatures and certifications are included.

Eligibility criteria for financial assistance

Eligibility for financial assistance programs often hinges on the information provided in the income confirmation form. Key criteria typically include:

- Income level: Applicants must demonstrate that their income falls within the limits set by the assistance program.

- Household size: The number of individuals living in the household can affect eligibility and assistance amounts.

- Residency status: Many programs require applicants to be residents of the state or region offering the assistance.

- Specific circumstances: Certain programs may cater to specific groups, such as students, seniors, or individuals with disabilities.

Required documents for the income confirmation form

When completing the income confirmation form, several documents are typically required to verify income accurately. These may include:

- Recent pay stubs or salary statements.

- Tax returns from the previous year.

- Social Security statements or disability income documents.

- Bank statements showing regular deposits.

- Any additional income verification letters from employers or government agencies.

Form submission methods

The income confirmation form can be submitted through various methods, depending on the requirements of the program or institution. Common submission methods include:

- Online: Many organizations allow electronic submissions through secure portals, which can expedite processing.

- Mail: Applicants can send completed forms and supporting documents via postal services, ensuring they keep copies for their records.

- In-person: Some programs may require or allow applicants to submit forms directly at designated offices.

Quick guide on how to complete income confirmation form icf

Complete INCOME CONFIRMATION FORM ICF seamlessly on any device

Online document administration has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely maintain it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents quickly without delays. Manage INCOME CONFIRMATION FORM ICF on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and electronically sign INCOME CONFIRMATION FORM ICF with ease

- Locate INCOME CONFIRMATION FORM ICF and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically available through airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to misplaced or lost documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign INCOME CONFIRMATION FORM ICF and guarantee clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Canada income form and how do I use it?

The Canada income form is a crucial document for reporting income to the Canadian tax authorities. It outlines your earnings, deductions, and tax credits. To use it effectively, you can start by collecting all relevant financial data, then utilize airSlate SignNow to easily fill, sign, and send your completed form digitally.

-

How can airSlate SignNow assist with filling out the Canada income form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Canada income form. You can easily drag and drop fields, ensuring all necessary information is included. This eliminates confusion and helps ensure that forms are accurately filled out and submitted on time.

-

Are there any costs associated with using airSlate SignNow for the Canada income form?

Yes, while airSlate SignNow offers various pricing plans, the basic features allow you to fill and eSign the Canada income form without any hidden fees. Upgraded plans may include additional features, such as enhanced document security or integration options, which can optimize your experience further.

-

Can I integrate airSlate SignNow with my existing accounting software for Canada income forms?

Absolutely! airSlate SignNow allows seamless integration with popular accounting software, enabling you to streamline your workflow when handling Canada income forms. This integration makes it easier to manage your financial documents and ensures accuracy in your tax filings.

-

What security measures does airSlate SignNow offer for Canada income forms?

airSlate SignNow prioritizes security, especially for sensitive documents like the Canada income form. The platform includes features such as encrypted data transmission and secure cloud storage to keep your information safe from unauthorized access.

-

Is it possible to track the status of my Canada income form when using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Canada income form. You can receive notifications when the form is viewed, signed, or completed, giving you greater control over your documentation process.

-

Can multiple users collaborate on a Canada income form using airSlate SignNow?

Yes, airSlate SignNow enables multiple users to collaborate on the Canada income form in real time. This feature is especially useful for teams who need to work together on filing taxes, ensuring that everyone can contribute and make amendments quickly and efficiently.

Get more for INCOME CONFIRMATION FORM ICF

- Deed secure debt georgia form

- Georgia payment form

- Georgia subordination agreement of mortgage form

- Georgia commercial rental lease application questionnaire form

- Georgia residential application form

- Georgia trustees deed form

- Ga affidavit form

- Georgia request to proceed in forma pauperis habeas corpus

Find out other INCOME CONFIRMATION FORM ICF

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself