Employee Pay Restitution Worksheet Form

What is the Employee Pay Restitution Worksheet

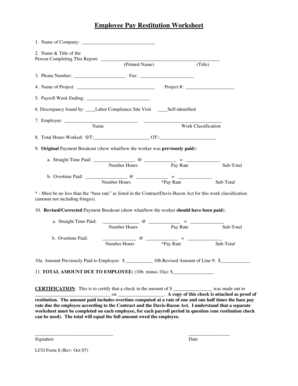

The Employee Pay Restitution Worksheet is a crucial document used by employers to calculate the amount owed to employees in cases of overpayment or wage discrepancies. This form serves as a formal record that details the calculations and justifications for restitution, ensuring transparency and accountability in payroll practices. It typically includes sections for employee information, the reason for restitution, and the specific amounts involved. By utilizing this worksheet, businesses can maintain compliance with labor laws and foster trust with their workforce.

How to use the Employee Pay Restitution Worksheet

Using the Employee Pay Restitution Worksheet involves several straightforward steps. First, gather all relevant payroll records and documentation related to the overpayment. Next, fill in the employee's details, including their name, employee ID, and the pay period in question. Then, outline the reasons for the restitution and calculate the total amount owed. It is essential to ensure that all figures are accurate and well-documented to prevent disputes. Once completed, both the employer and employee should review the worksheet for accuracy before signing it to acknowledge the agreement.

Steps to complete the Employee Pay Restitution Worksheet

Completing the Employee Pay Restitution Worksheet requires careful attention to detail. Follow these steps for effective completion:

- Gather necessary documents, including pay stubs and employment contracts.

- Enter the employee's personal information, such as name and ID.

- Specify the pay period during which the overpayment occurred.

- Detail the reasons for the restitution, providing context for the calculations.

- Calculate the total amount owed, ensuring all figures are accurate.

- Review the worksheet with the employee to confirm agreement on the details.

- Obtain signatures from both parties to finalize the document.

Legal use of the Employee Pay Restitution Worksheet

To ensure the legal validity of the Employee Pay Restitution Worksheet, it must adhere to federal and state labor laws governing wage payments and deductions. The worksheet should be completed accurately and transparently, reflecting the actual circumstances of the overpayment. Proper documentation and signatures from both the employer and employee are essential for the worksheet to be considered legally binding. Additionally, employers must retain copies of the completed worksheet for their records, as this may be required for audits or legal inquiries.

Key elements of the Employee Pay Restitution Worksheet

Several key elements should be included in the Employee Pay Restitution Worksheet to ensure it serves its purpose effectively:

- Employee Information: Name, ID number, and contact details.

- Pay Period: The specific dates during which the overpayment occurred.

- Reason for Restitution: Clear explanation of why the restitution is necessary.

- Amount Owed: Detailed calculations showing how the total was determined.

- Signatures: Both employer and employee signatures confirming agreement.

Examples of using the Employee Pay Restitution Worksheet

The Employee Pay Restitution Worksheet can be applied in various scenarios. For instance, if an employee was mistakenly paid a higher hourly rate than agreed upon, the worksheet can document the overpayment and outline the restitution process. Another example is when bonuses are calculated incorrectly, leading to excess payments. In both cases, the worksheet provides a structured approach to rectify the situation, ensuring both parties understand the financial implications and agree on the resolution.

Quick guide on how to complete employee pay restitution worksheet

Effortlessly prepare Employee Pay Restitution Worksheet on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Employee Pay Restitution Worksheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Employee Pay Restitution Worksheet with ease

- Locate Employee Pay Restitution Worksheet and click on Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Employee Pay Restitution Worksheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee pay restitution worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee Pay Restitution Worksheet?

The Employee Pay Restitution Worksheet is a vital tool designed to help businesses accurately account for employee wages and restitution calculations. By using this worksheet, companies can ensure compliance with labor laws and maintain transparency in payroll processes.

-

How can the Employee Pay Restitution Worksheet benefit my business?

Utilizing the Employee Pay Restitution Worksheet can streamline payroll processes, reduce errors, and facilitate better management of employee compensation disputes. This not only saves time but also enhances employee satisfaction and trust within the organization.

-

Is the Employee Pay Restitution Worksheet customizable?

Yes, the Employee Pay Restitution Worksheet can be tailored to meet the specific needs of your business. With airSlate SignNow, you can modify the worksheet to incorporate unique parameters and reports that align with your payroll policies.

-

What features does the airSlate SignNow platform offer for managing the Employee Pay Restitution Worksheet?

airSlate SignNow provides features such as document templates, electronic signatures, and secure collaboration tools to enhance the efficiency of managing the Employee Pay Restitution Worksheet. These functionalities ensure that all documentation is accurate and easy to share among stakeholders.

-

How does airSlate SignNow ensure data security for the Employee Pay Restitution Worksheet?

Data security is a top priority at airSlate SignNow. The platform employs advanced encryption methods, secure access controls, and compliance with industry standards to protect sensitive information associated with the Employee Pay Restitution Worksheet.

-

Can I integrate airSlate SignNow with my existing HR software to use the Employee Pay Restitution Worksheet?

Absolutely, airSlate SignNow supports multiple integrations with popular HR and payroll software. This allows you to seamlessly use the Employee Pay Restitution Worksheet alongside your existing systems for a streamlined experience.

-

What pricing options are available for using the Employee Pay Restitution Worksheet with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Employee Pay Restitution Worksheet features. You can choose from various subscription tiers based on your business size and needs, ensuring you get the best value.

Get more for Employee Pay Restitution Worksheet

- Financial statement applicant addresscoapplicant form

- Dishes and their allergen content form

- Certificate of nys workers compensation insurance coverage form

- Form 8736 rev 10 application for automatic extension of time to file us return for a partnership remic or for certain trusts

- Attention copy a of this form is provided for inf

- Form 8038 rev october information return for tax exempt private activity bond issues

- Llc loan agreement template form

- Llc management agreement template form

Find out other Employee Pay Restitution Worksheet

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement