Form 8038 Rev October Information Return for Tax Exempt Private Activity Bond Issues 2021

Understanding Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues

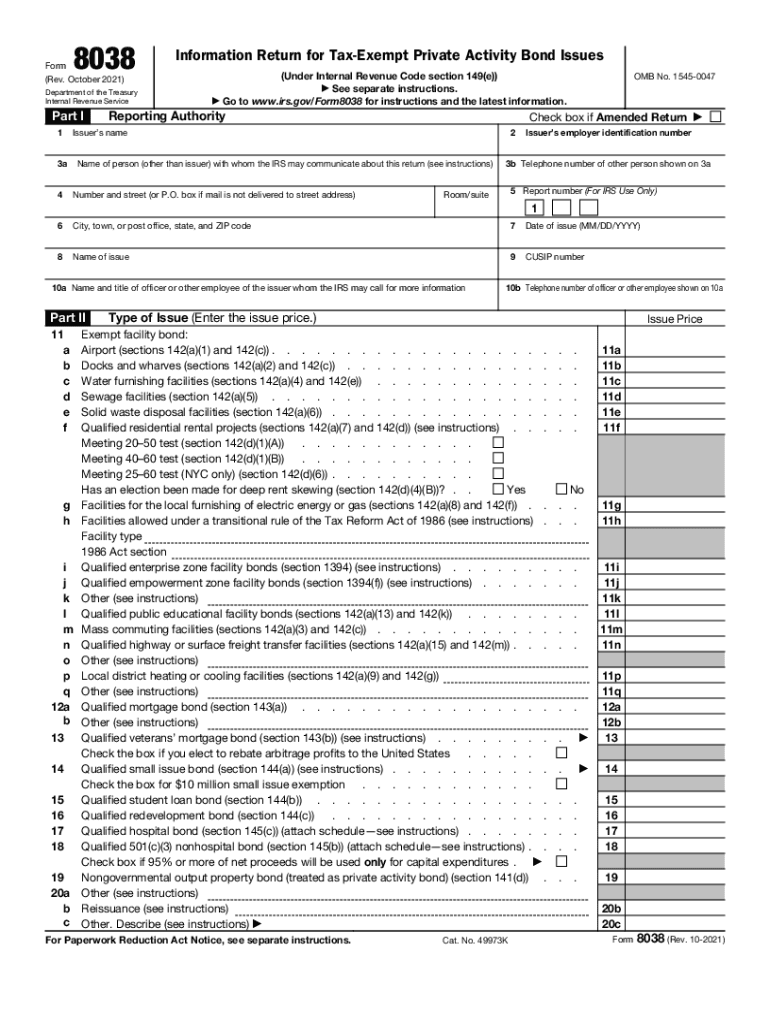

Form 8038 Rev October is a crucial document used in the United States for reporting information related to tax-exempt private activity bond issues. This form is primarily filed by issuers of these bonds to provide the Internal Revenue Service (IRS) with necessary details about the bonds, including their purpose, amount, and the projects they finance. It ensures compliance with federal tax laws, helping to maintain the tax-exempt status of the bonds issued.

Steps to Complete Form 8038 Rev October

Completing Form 8038 Rev October involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the bond issue, including the issuer's details, the purpose of the bonds, and the expected use of the proceeds. Next, fill out each section of the form carefully, providing all required information such as the bond issue date, the total amount of bonds issued, and the specific projects financed. After completing the form, review it thoroughly for any errors or omissions before submitting it to the IRS.

Filing Deadlines for Form 8038 Rev October

Timely filing of Form 8038 Rev October is essential to avoid penalties. The form must be submitted to the IRS within a specific timeframe following the bond issuance. Generally, the deadline is 90 days after the date of the bond issue. It is important to mark this date on your calendar and ensure that all required information is submitted promptly to maintain compliance with IRS regulations.

Legal Use of Form 8038 Rev October

The legal use of Form 8038 Rev October is defined by IRS regulations governing tax-exempt bonds. This form serves as a formal declaration to the IRS that the issuer is complying with tax laws related to private activity bonds. Proper completion and timely submission of the form are necessary to uphold the tax-exempt status of the bonds, which can significantly impact the financing of various public projects.

Key Elements of Form 8038 Rev October

Form 8038 Rev October contains several key elements that must be accurately reported. These include the issuer's name and address, the type of bond being issued, the amount of bonds, the date of issue, and a description of the projects being financed. Additionally, the form requires information about the bond's maturity and interest rates. Each element plays a vital role in ensuring the IRS has a complete understanding of the bond issue and its compliance with tax regulations.

How to Obtain Form 8038 Rev October

Form 8038 Rev October can be obtained directly from the IRS website or through authorized tax professionals. It is available in a downloadable format, allowing users to print and fill it out manually or complete it digitally. Ensuring you have the most current version of the form is essential, as the IRS may update it periodically to reflect changes in tax laws and regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 8038 rev october information return for tax exempt private activity bond issues

Create this form in 5 minutes!

How to create an eSignature for the form 8038 rev october information return for tax exempt private activity bond issues

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

The Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues is a tax form used by issuers of tax-exempt private activity bonds to report information to the IRS. This form ensures compliance with federal tax laws and provides essential details about the bond issue, including the purpose and amount of the bonds.

-

How can airSlate SignNow help with the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

airSlate SignNow offers a streamlined solution for preparing and eSigning the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues. With our platform, you can easily fill out the form, gather necessary signatures, and securely send it to the IRS, ensuring a hassle-free filing process.

-

What features does airSlate SignNow provide for managing Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

Our platform includes features such as customizable templates, automated workflows, and real-time tracking for the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues. These tools enhance efficiency and accuracy, allowing you to manage your documents with ease.

-

Is airSlate SignNow cost-effective for filing the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to file the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues. Our pricing plans are competitive, ensuring you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other software for Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues alongside your existing tools. This flexibility enhances your workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

Using airSlate SignNow for the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while handling the Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues, ensuring that your sensitive information remains confidential and secure.

Get more for Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues

- Himrcm screening within health program participat form

- Exchange student applicationstudy abroad form

- Heavy comsports entertainment breaking news ampamp shopping form

- Application for certified accounting technician cat status form

- Application for foreign outward remittance dear si form

- Modulo fast claim deutsche bank form

- New artist showcase form gospel music workshop of america

- Sample of participant form

Find out other Form 8038 Rev October Information Return For Tax Exempt Private Activity Bond Issues

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document