Ucsc W 9 Form

What is the Ucsc W-9?

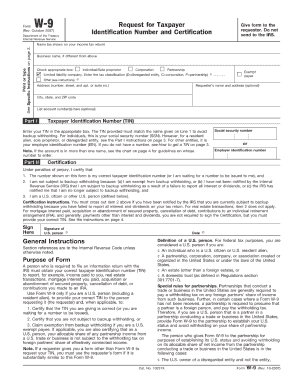

The Ucsc W-9 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to entities that will be paying them. This form is essential for reporting income to the Internal Revenue Service (IRS) and is commonly used by freelancers, contractors, and other self-employed individuals. By completing the Ucsc W-9, you ensure that the payer has the correct information to report payments made to you, which helps maintain compliance with tax regulations.

How to Use the Ucsc W-9

Using the Ucsc W-9 is straightforward. First, download the form from a reliable source or obtain it directly from the entity requesting it. Fill out your name, business name (if applicable), address, and taxpayer identification number, which could be your Social Security Number (SSN) or Employer Identification Number (EIN). Once completed, submit the form to the requesting party, ensuring that you keep a copy for your records. This process helps facilitate accurate tax reporting and compliance.

Steps to Complete the Ucsc W-9

Completing the Ucsc W-9 involves several key steps:

- Download the Ucsc W-9 form from an official source.

- Provide your legal name as it appears on your tax return.

- Include your business name if you operate under a different name.

- Fill in your address, ensuring it matches IRS records.

- Enter your taxpayer identification number, either your SSN or EIN.

- Sign and date the form to certify that the information provided is accurate.

Once you have completed these steps, submit the form to the requesting entity.

Legal Use of the Ucsc W-9

The Ucsc W-9 is legally recognized as a valid document for tax purposes in the United States. It serves as a declaration of your taxpayer status and is crucial for entities that need to report payments made to you. Compliance with IRS guidelines when using the Ucsc W-9 ensures that both you and the payer fulfill your tax obligations. It is important to provide accurate information to avoid potential penalties or issues with the IRS.

IRS Guidelines

The IRS has specific guidelines regarding the use of the Ucsc W-9. It is important to ensure that the information provided on the form is correct and up-to-date. The IRS may require this form from individuals and businesses that receive payments that need to be reported, such as independent contractors and freelancers. Failure to provide a completed Ucsc W-9 may result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes.

Form Submission Methods

The Ucsc W-9 can be submitted through various methods depending on the preferences of the requesting entity. Common submission methods include:

- Online submission via secure portals or email.

- Mailing a physical copy to the requesting party.

- In-person delivery if required.

It is essential to confirm the preferred submission method with the entity requesting the form to ensure timely processing.

Quick guide on how to complete ucsc w 9

Complete Ucsc W 9 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ucsc W 9 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ucsc W 9 effortlessly

- Obtain Ucsc W 9 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Alter and eSign Ucsc W 9 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ucsc w 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UCSC W-9 form and how can airSlate SignNow help?

The UCSC W-9 form is a tax document used for providing taxpayer information. airSlate SignNow simplifies the completion and signing process for the UCSC W-9, allowing users to eSign the document securely and efficiently from anywhere, ensuring compliance and accuracy in submissions.

-

Is there a cost associated with using airSlate SignNow for UCSC W-9 transactions?

airSlate SignNow offers a range of pricing plans designed to accommodate different business needs, from freelancers to large organizations. Users can take advantage of a free trial to evaluate how airSlate SignNow can streamline their UCSC W-9 handling without any upfront costs.

-

What features does airSlate SignNow offer for managing UCSC W-9 forms?

airSlate SignNow provides a robust set of features for managing UCSC W-9 forms, including customizable templates, automated workflows, and real-time tracking of document status. These tools make it easy to ensure that your W-9 documents are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other applications for UCSC W-9 processing?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and Salesforce, enhancing your workflow for UCSC W-9 forms. This integration facilitates effortless document exchange and management across platforms, saving you time and reducing errors.

-

How secure is the process of signing UCSC W-9 forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and industry-standard security protocols to protect your UCSC W-9 forms, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow help me with storing completed UCSC W-9 forms?

Absolutely! airSlate SignNow includes secure cloud storage options for all your completed UCSC W-9 forms. This allows for easy access and retrieval, making document management straightforward and organized, while also reducing the need for physical storage.

-

What are the benefits of using airSlate SignNow for UCSC W-9 submissions?

Using airSlate SignNow for UCSC W-9 submissions streamlines the entire process, reducing paper waste and turnaround time. Its intuitive interface and powerful features enhance productivity while ensuring compliance, making it a smart choice for businesses of all sizes.

Get more for Ucsc W 9

Find out other Ucsc W 9

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast