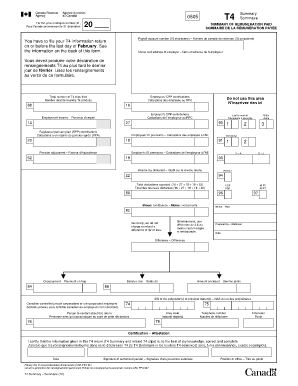

T4sum Example Form

What is the T4sum Example

The T4sum, or T4 summary of remuneration paid, is a crucial document used in the United States for reporting income and tax deductions. This form is typically issued by employers to summarize the total earnings of an employee for a specific tax year. It consolidates various income sources and deductions, making it easier for both employees and tax authorities to understand the financial standing of an individual. The T4sum is essential for accurate tax filing and compliance with federal regulations.

How to use the T4sum Example

Using the T4sum involves several steps to ensure accurate reporting of income. First, gather all relevant financial documents, including previous pay stubs and any other income statements. Next, input the information from your T4sum into your tax preparation software or on paper forms. Ensure that all amounts reflect the total remuneration paid, as well as any deductions that apply. It is important to review the completed form for accuracy before submission to avoid any discrepancies with the IRS.

Steps to complete the T4sum Example

Completing the T4sum requires careful attention to detail. Follow these steps:

- Collect all necessary financial documents, including previous tax returns and pay stubs.

- Fill in your personal information, such as name, address, and Social Security number.

- Enter the total earnings from your employment, ensuring accuracy with the figures provided by your employer.

- Include any applicable deductions, such as retirement contributions or health insurance premiums.

- Review the completed form for any errors or omissions before submission.

Legal use of the T4sum Example

The T4sum is legally recognized as a valid document for reporting income in the United States. It must comply with federal regulations, including the IRS guidelines for tax reporting. To be considered legally binding, the T4sum must accurately reflect the remuneration paid and any deductions taken. Using a reliable platform like airSlate SignNow ensures that the electronic version of the T4sum meets legal standards, providing a secure and compliant method for submission.

Key elements of the T4sum Example

Several key elements are essential to the T4sum. These include:

- Employee Information: This includes the employee's name, address, and Social Security number.

- Employer Information: The name and address of the employer must be clearly stated.

- Total Remuneration: The total amount paid to the employee during the tax year.

- Deductions: Any deductions taken from the employee's earnings, such as taxes or retirement contributions.

Who Issues the Form

The T4sum is typically issued by employers to their employees at the end of the tax year. Employers are responsible for ensuring that the information reported on the T4sum is accurate and complies with IRS regulations. It is important for employees to receive this form in a timely manner to facilitate their tax filing process. Employers must also retain copies of the T4sum for their records and potential audits.

Quick guide on how to complete t4sum example

Effortlessly Prepare T4sum Example on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without hold-ups. Manage T4sum Example on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign T4sum Example with Ease

- Locate T4sum Example and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of the documents or redact sensitive details using features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign T4sum Example and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t4sum example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t4sum and how does it relate to airSlate SignNow?

t4sum is a powerful feature within airSlate SignNow that allows businesses to streamline their document signing processes. By using t4sum, users can efficiently manage multiple signatures and ensure compliance with their document workflows, ultimately saving time and resources.

-

How much does airSlate SignNow cost for using t4sum?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including the t4sum feature. Depending on your plan choice, you can access t4sum along with other functionalities, ensuring you get the most value for your investment.

-

What are the key features of t4sum in airSlate SignNow?

The t4sum feature in airSlate SignNow includes customizable templates, real-time tracking, and robust security measures. These functionalities enhance the document signing experience and improve operational efficiency, making t4sum an essential tool for businesses.

-

How can t4sum benefit my business?

By implementing t4sum, your business can signNowly reduce turnaround times for document signing and improve collaboration among team members. This feature benefits organizations by automating workflows and minimizing errors, allowing you to focus on more critical tasks.

-

Can t4sum integrate with other applications?

Yes, t4sum in airSlate SignNow seamlessly integrates with various applications, enhancing your workflow capabilities. This integration allows users to connect with CRM systems, project management tools, and other software, making document management more efficient.

-

Is there a mobile app for using t4sum in airSlate SignNow?

Absolutely! AirSlate SignNow offers a mobile app that enables users to access t4sum on the go. This convenience allows you to manage and sign documents anytime and anywhere, ensuring that you never miss critical deadlines or opportunities.

-

How secure is t4sum in airSlate SignNow?

Security is a top priority for airSlate SignNow, and t4sum adheres to industry-leading security protocols. With features such as encryption and two-factor authentication, you can rest assured that your documents are safe and compliant with regulations.

Get more for T4sum Example

Find out other T4sum Example

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document