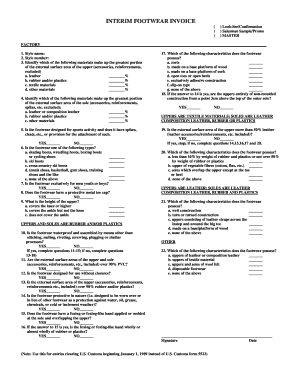

Interim Footwear Invoice Form

What is the Interim Footwear Invoice

The interim footwear invoice is a specialized document used in the footwear industry, particularly for customs purposes. It serves as a temporary invoice that outlines the details of footwear shipments, including the quantity, description, and value of the items. This form is crucial for importers and exporters to ensure compliance with customs regulations and to facilitate the smooth processing of goods across borders.

How to use the Interim Footwear Invoice

Using the interim footwear invoice involves several steps to ensure accuracy and compliance. First, gather all necessary information regarding the footwear shipment, including product descriptions, quantities, and values. Next, fill out the invoice accurately, ensuring that all details match the accompanying shipping documents. Once completed, the invoice can be submitted to customs authorities or used for internal record-keeping. It is important to retain a copy for your records, as it may be needed for future reference or audits.

Steps to complete the Interim Footwear Invoice

Completing the interim footwear invoice requires careful attention to detail. Follow these steps:

- Begin with the invoice header, including your business name and contact information.

- Provide the recipient's details, including their name and address.

- List each footwear item with a clear description, quantity, and unit price.

- Calculate the total value of the shipment and include any applicable taxes or fees.

- Sign and date the invoice to validate it.

Ensure that all information is accurate to avoid delays in customs processing.

Legal use of the Interim Footwear Invoice

The interim footwear invoice is legally binding when completed correctly. It must comply with relevant customs regulations and eSignature laws to be considered valid. This includes adhering to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By using a secure platform for electronic signatures, businesses can ensure that their invoices are legally recognized and enforceable.

Key elements of the Interim Footwear Invoice

Several key elements must be included in the interim footwear invoice to ensure its effectiveness:

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date the invoice is created.

- Seller and Buyer Information: Names, addresses, and contact details.

- Item Descriptions: Detailed descriptions of each footwear item.

- Pricing Information: Unit prices, total amounts, and any discounts.

- Payment Terms: Conditions under which payment is expected.

Examples of using the Interim Footwear Invoice

The interim footwear invoice can be utilized in various scenarios, such as:

- When importing footwear from international suppliers.

- For temporary shipments where a full invoice is not yet available.

- To facilitate trade shows or exhibitions where footwear samples are displayed.

In each case, the invoice helps ensure compliance with customs and provides a clear record of transactions.

Quick guide on how to complete interim footwear invoice

Complete Interim Footwear Invoice effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Interim Footwear Invoice on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Interim Footwear Invoice effortlessly

- Locate Interim Footwear Invoice and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Interim Footwear Invoice and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the interim footwear invoice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an interim footwear invoice?

An interim footwear invoice is a billing document specifically designed for transactions within the footwear industry. It includes details such as product descriptions, quantities, prices, and payment information, ensuring clarity and transparency in financial exchanges.

-

How can airSlate SignNow help with interim footwear invoices?

airSlate SignNow streamlines the process of creating and managing interim footwear invoices by providing customizable templates and secure e-signature capabilities. This helps businesses ensure prompt and accurate invoicing while minimizing errors and delays in payment collection.

-

What are the pricing options for using airSlate SignNow for interim footwear invoices?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of various sizes. With options ranging from basic to advanced plans, users can choose a solution that best fits their needs for handling interim footwear invoices effectively and affordably.

-

What features does airSlate SignNow provide for managing interim footwear invoices?

Key features of airSlate SignNow for interim footwear invoices include customizable invoice templates, easy document sharing, e-signature support, and real-time tracking of document status. These features help enhance efficiency and ensure that all invoicing processes run smoothly.

-

Can airSlate SignNow integrate with other software for interim footwear invoices?

Yes, airSlate SignNow offers integration capabilities with a variety of accounting and business management software, allowing for seamless data transfer for interim footwear invoices. This integration helps streamline workflows and reduce manual entry, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for interim footwear invoices?

Using airSlate SignNow for interim footwear invoices offers numerous benefits, including improved accuracy, faster payment processing, and enhanced overall productivity. With an easy-to-use platform, businesses can ensure that their invoicing is professional and effective.

-

Is airSlate SignNow secure for managing interim footwear invoices?

Yes, airSlate SignNow prioritizes security by employing industry-standard encryption and authentication methods. This ensures that all interim footwear invoices and sensitive business information are protected during the invoicing process.

Get more for Interim Footwear Invoice

- Consent authorization form

- Authorization letter for cremation form

- Arbitration agreement sample form

- Sample letter property form

- Sample letter incorporation form

- Lease booth form

- Notice of forfeiture and acceleration of rent due failure to cure default eviction or ejectment form

- Voting agreement form

Find out other Interim Footwear Invoice

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form