Rental and Royalty Income Schedule E Organizer Form

What is the Rental and Royalty Income Schedule E Organizer

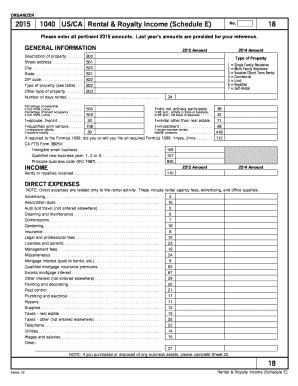

The Rental and Royalty Income Schedule E Organizer is a crucial tool for individuals and businesses that earn income from rental properties or royalties. This organizer helps taxpayers systematically gather and report their income and expenses related to these sources. It is designed to simplify the process of completing IRS Form Schedule E, which is necessary for reporting income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. By using this organizer, taxpayers can ensure that they accurately capture all relevant financial information required for tax reporting.

Steps to Complete the Rental and Royalty Income Schedule E Organizer

Completing the Rental and Royalty Income Schedule E Organizer involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the essential steps:

- Gather all income documentation, including rental agreements and royalty statements.

- List all rental properties or royalty sources, including their addresses and ownership details.

- Document all related expenses, such as maintenance costs, property management fees, and mortgage interest.

- Calculate the total income and expenses for each property or source of royalty income.

- Review the completed organizer for accuracy before transferring the information to IRS Form Schedule E.

IRS Guidelines for the Rental and Royalty Income Schedule E Organizer

Understanding IRS guidelines is essential for effectively using the Rental and Royalty Income Schedule E Organizer. The IRS provides specific instructions on how to report rental and royalty income, including what qualifies as deductible expenses. Taxpayers must comply with these guidelines to avoid penalties and ensure proper reporting. Key points include:

- Income must be reported in the year it is received.

- Expenses must be ordinary and necessary for the operation of the rental property or royalty income.

- Taxpayers should maintain records of all income and expenses for at least three years in case of an audit.

Required Documents for the Rental and Royalty Income Schedule E Organizer

To effectively complete the Rental and Royalty Income Schedule E Organizer, taxpayers need to gather several documents. These documents provide the necessary information for accurately reporting income and expenses. Required documents include:

- Rental agreements or lease contracts.

- Statements of royalty income received.

- Receipts for repairs and maintenance costs.

- Mortgage statements and property tax records.

- Utility bills related to rental properties.

Form Submission Methods for the Rental and Royalty Income Schedule E Organizer

Taxpayers have multiple options for submitting the Rental and Royalty Income Schedule E Organizer along with their tax returns. Understanding these methods can help ensure timely and accurate submission. The available submission methods include:

- Online submission through tax preparation software that supports e-filing.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this method is less common.

Legal Use of the Rental and Royalty Income Schedule E Organizer

The Rental and Royalty Income Schedule E Organizer is legally recognized as a tool for documenting income and expenses related to rental properties and royalties. Proper use of this organizer ensures compliance with tax laws and regulations set forth by the IRS. It is essential for taxpayers to accurately report their financial activities to avoid potential legal issues, including audits or penalties. Utilizing this organizer can help maintain transparency and accountability in financial reporting.

Quick guide on how to complete rental and royalty income schedule e organizer

Complete Rental And Royalty Income Schedule E Organizer effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Rental And Royalty Income Schedule E Organizer on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Rental And Royalty Income Schedule E Organizer seamlessly

- Obtain Rental And Royalty Income Schedule E Organizer and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Rental And Royalty Income Schedule E Organizer and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rental and royalty income schedule e organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rent and royalty income form used for?

The rent and royalty income form is designed to help individuals and businesses report income received from rental properties and royalties from intellectual properties. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that you keep your documentation organized and compliant with tax regulations.

-

How can I create a rent and royalty income form using airSlate SignNow?

Creating a rent and royalty income form with airSlate SignNow is straightforward. Simply log in to your account, select the document template you need, and customize it to fit your specific rental or royalty details. Our user-friendly interface makes the process quick and efficient.

-

Is there a cost associated with using the rent and royalty income form?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that fits your budget and needs. Many plans include access to the rent and royalty income form, enabling you to manage your documents without incurring excessive costs. Start with our free trial to evaluate the service before committing.

-

What features does airSlate SignNow offer for the rent and royalty income form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure document sharing for your rent and royalty income form. You can also track the status of your documents in real-time, ensuring you stay informed about the signing process and deadlines.

-

Can I share my rent and royalty income form with others?

Absolutely! airSlate SignNow allows you to easily share your rent and royalty income form with collaborators, co-signers, or clients. You can send the document via email or generate a shareable link, making it convenient for all parties to access and eSign the form.

-

Are there any integrations available for managing the rent and royalty income form?

Yes, airSlate SignNow supports integrations with various applications and services, enhancing your document management for the rent and royalty income form. You can connect with tools like Google Drive, Dropbox, and more, streamlining your workflow and keeping your documents organized.

-

How secure is the rent and royalty income form on airSlate SignNow?

Security is a priority for airSlate SignNow. When you use the rent and royalty income form, your documents are protected with bank-grade encryption and secure storage. This ensures that all sensitive data remains confidential and safe from unauthorized access.

Get more for Rental And Royalty Income Schedule E Organizer

- American popular music from minstrelsy to mp3 6th edition pdf form

- Joint declaration by the member and the employer form

- Bmet registration 472511778 form

- Owens corning l77 attic card form

- Radio show sponsorship proposal form

- Certificacin de uso de vehculo autoexpreso form

- Fillable application for an alarm license state of new form

- Concierge service contract template form

Find out other Rental And Royalty Income Schedule E Organizer

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now