Maryland 502r Instructions Form

What is the Maryland 502r Instructions

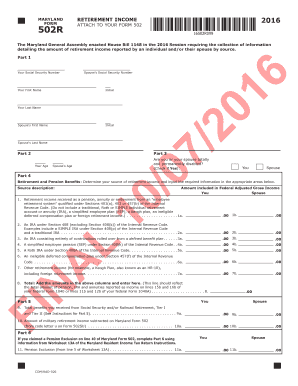

The Maryland 502r form is a tax document used by residents of Maryland to report their income tax credits. Specifically, it is utilized to claim the Maryland Earned Income Tax Credit (EITC) and the Maryland Child Tax Credit. The instructions for this form provide essential guidance on how to accurately complete it, ensuring that taxpayers can effectively claim their eligible credits while complying with state tax regulations.

Steps to complete the Maryland 502r Instructions

Completing the Maryland 502r form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements and details about dependents. Next, follow the instructions carefully, filling out each section of the form with the required information. Pay special attention to the eligibility requirements for the credits being claimed. After completing the form, review it for any errors before submitting it. This careful approach helps to avoid delays in processing and potential penalties.

Legal use of the Maryland 502r Instructions

The Maryland 502r form and its accompanying instructions are legally binding documents. To ensure compliance with state tax laws, it is crucial to follow the guidelines provided in the instructions. This includes understanding the legal definitions of terms used in the form, as well as the eligibility criteria for claiming tax credits. Proper completion and submission of the form can protect taxpayers from legal repercussions and ensure they receive the benefits they are entitled to.

Required Documents

To complete the Maryland 502r form, several documents are necessary. Taxpayers should have their W-2 forms or 1099 forms that report their income. Additionally, documentation for any dependents, such as Social Security numbers, is required. If claiming the Maryland EITC or Child Tax Credit, gather any relevant information that supports eligibility for these credits. Having these documents ready will streamline the process of filling out the form.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland 502r form typically align with federal tax deadlines. Generally, taxpayers must submit their forms by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties and to ensure timely processing of their tax credits.

Form Submission Methods (Online / Mail / In-Person)

The Maryland 502r form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using the Maryland Comptroller's e-filing system, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits individual needs.

Quick guide on how to complete maryland 502r instructions

Complete Maryland 502r Instructions effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed materials, as you can access the necessary form and store it securely online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without interruptions. Handle Maryland 502r Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Maryland 502r Instructions with ease

- Obtain Maryland 502r Instructions and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Maryland 502r Instructions and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland 502r instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 502R, and why is it important?

The Maryland Form 502R is the state's income tax return form that allows residents to report their tax liabilities. It is essential for ensuring compliance with Maryland tax laws and helps taxpayers calculate their refund or balance due. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help me with the Maryland Form 502R?

airSlate SignNow enables users to easily create, send, and eSign Maryland Form 502R documents securely online. Our platform simplifies the process, ensuring that your documents are legally binding and stored safely. This makes filing your taxes quicker and more efficient.

-

What are the costs associated with using airSlate SignNow for Maryland Form 502R?

airSlate SignNow offers competitive pricing plans that provide access to all features, including the easy management of Maryland Form 502R. We cater to various budgets, ensuring that you find a plan that suits your needs. Additionally, our cost-effective solution can save you time and effort in processing tax documents.

-

Does airSlate SignNow integrate with other tax software for Maryland Form 502R?

Yes, airSlate SignNow offers integrations with popular tax software, allowing you to streamline your workflow when managing the Maryland Form 502R. These integrations ensure that you can import and export necessary information seamlessly. This saves time and reduces the chances of errors in your tax filings.

-

What features does airSlate SignNow provide for managing Maryland Form 502R?

With airSlate SignNow, you can easily fill out, send, and eSign Maryland Form 502R documents electronically. Our platform also includes features like template creation, reminders, and tracking, which ensure that you never miss a deadline. These tools enhance your productivity when handling your tax returns.

-

Is it secure to use airSlate SignNow for Maryland Form 502R?

Absolutely! airSlate SignNow employs top-tier security measures to protect your personal and financial information while you work on Maryland Form 502R. Our platform complies with industry standards for data encryption and security, ensuring that your documents remain confidential and secure.

-

Can I access airSlate SignNow on any device for Maryland Form 502R?

Yes, airSlate SignNow is designed to be accessible from any device, whether you're using a desktop, tablet, or smartphone. This flexibility allows you to manage your Maryland Form 502R anytime, anywhere, making it easier to stay on top of your tax obligations. Our user-friendly interface ensures a seamless experience across all devices.

Get more for Maryland 502r Instructions

- Services contract therapist form

- Resume cover letter for firefighter form

- Resume cover letter for english teacher form

- Resume cover letter for retail sales associate form

- Resume cover letter for stage carpenter form

- Resume cover letter for theatrical costume designer form

- Resume cover letter for chef form

- Resume cover letter for film actor or actress form

Find out other Maryland 502r Instructions

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF