Au 196 10 Form 2010

What is the Au 196 10 Form

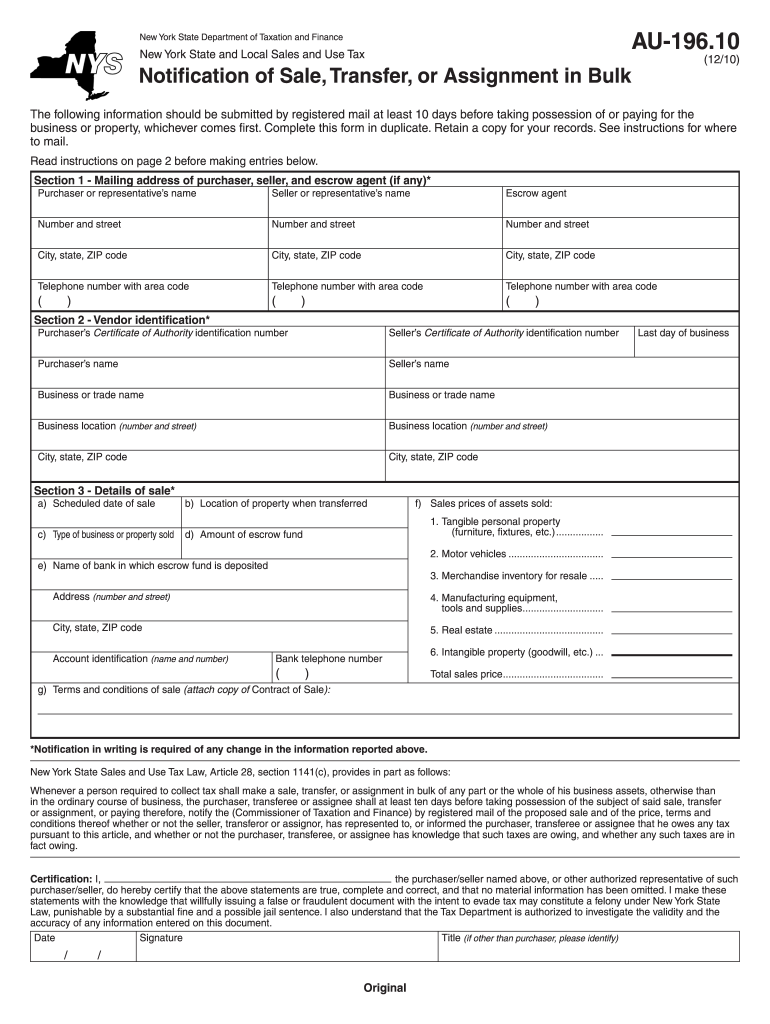

The Au 196 10 Form is a specific document used primarily for tax purposes in the United States. This form is designed to gather essential information from taxpayers, ensuring compliance with federal regulations. It includes sections for personal identification, income reporting, and deductions, making it a crucial tool for accurate tax filing. Understanding the purpose and structure of the Au 196 10 Form can help individuals and businesses navigate their tax responsibilities more effectively.

How to use the Au 196 10 Form

Using the Au 196 10 Form involves several key steps. First, gather all necessary documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Once verified, the form can be signed electronically or printed for submission. Using a reliable eSignature solution can streamline this process, making it easier to submit the form on time.

Steps to complete the Au 196 10 Form

Completing the Au 196 10 Form requires a systematic approach. Start by downloading the form from a trusted source. Fill in your personal information, including your name, address, and Social Security number. Next, report your income by entering figures from your W-2 or 1099 forms. Deduct any eligible expenses in the designated sections. Finally, sign and date the form. Once completed, ensure that you keep a copy for your records before submitting it to the appropriate tax authority.

Legal use of the Au 196 10 Form

The legal use of the Au 196 10 Form is governed by IRS regulations. It is essential that taxpayers use the form as intended to avoid penalties. The form must be filled out truthfully and submitted by the designated deadlines. Electronic signatures are legally valid, provided they meet the requirements set forth by the ESIGN Act. Understanding these legal parameters ensures that users can confidently file their taxes without fear of non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Au 196 10 Form are critical to ensure timely submission. Typically, individual tax returns are due on April fifteenth of each year. However, extensions may be available, allowing additional time for filing. It is important to stay informed about any changes to deadlines, especially in light of recent adjustments made by the IRS. Marking these important dates on a calendar can help taxpayers avoid late fees and penalties.

Required Documents

To complete the Au 196 10 Form accurately, several documents are required. Key documents include W-2 forms from employers, 1099 forms for freelance work, and any relevant receipts for deductions. Additionally, taxpayers should have their Social Security number and bank account information ready for direct deposit options. Collecting these documents in advance can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

The Au 196 10 Form can be submitted through various methods, providing flexibility for taxpayers. Online submission is often the fastest option, allowing users to file their forms electronically through approved channels. Alternatively, the form can be printed and mailed to the appropriate tax office. For those who prefer in-person interactions, visiting a local IRS office is also an option. Each method has its own set of guidelines, so it is essential to follow the instructions carefully to ensure successful submission.

Quick guide on how to complete au 196 10 2010 form

Your assistance manual on how to prepare your Au 196 10 Form

If you're curious about how to create and submit your Au 196 10 Form, here are a few brief instructions on making tax filing simpler.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to edit, draft, and finalize your income tax forms without hassle. With its editor, you can navigate between text, checkboxes, and eSignatures and return to modify responses as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Au 196 10 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our library to acquire any IRS tax form; explore different versions and schedules.

- Click Get form to access your Au 196 10 Form in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to mistakes and delay refunds. Additionally, before e-filing your taxes, check the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct au 196 10 2010 form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the au 196 10 2010 form

How to create an eSignature for the Au 196 10 2010 Form online

How to generate an eSignature for the Au 196 10 2010 Form in Google Chrome

How to create an electronic signature for signing the Au 196 10 2010 Form in Gmail

How to generate an electronic signature for the Au 196 10 2010 Form from your smart phone

How to make an electronic signature for the Au 196 10 2010 Form on iOS devices

How to make an electronic signature for the Au 196 10 2010 Form on Android OS

People also ask

-

What is the Au 196 10 Form and how is it used?

The Au 196 10 Form is a crucial document used for various business processes, including contract approvals and compliance verification. With airSlate SignNow, you can easily fill out, sign, and manage the Au 196 10 Form digitally, ensuring a streamlined workflow and reducing paper clutter.

-

How does airSlate SignNow simplify the completion of the Au 196 10 Form?

airSlate SignNow simplifies the completion of the Au 196 10 Form by providing an intuitive interface that allows you to fill in information, add signatures, and send documents electronically. This eliminates the need for printing, scanning, and mailing, making the process faster and more efficient.

-

Is there a cost associated with using the Au 196 10 Form on airSlate SignNow?

Yes, using the Au 196 10 Form on airSlate SignNow involves subscription pricing, which varies based on the features you select. However, the service is designed to be cost-effective, providing signNow savings by reducing operational costs associated with traditional document management.

-

What features does airSlate SignNow offer for the Au 196 10 Form?

airSlate SignNow offers a range of features for the Au 196 10 Form, including customizable templates, real-time tracking, and secure cloud storage. These features enhance collaboration and ensure that your documents remain organized and easily accessible.

-

Can I integrate the Au 196 10 Form with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications, enabling you to connect the Au 196 10 Form with your existing software tools. This integration helps streamline your workflows and enhances productivity across different platforms.

-

What benefits can I expect from using airSlate SignNow for the Au 196 10 Form?

By using airSlate SignNow for the Au 196 10 Form, you can expect increased efficiency, reduced turnaround times, and enhanced security for your documents. The platform's electronic signature capabilities also ensure that you remain compliant with legal standards.

-

Is airSlate SignNow secure for handling the Au 196 10 Form?

Yes, airSlate SignNow prioritizes security for all documents, including the Au 196 10 Form. The platform employs advanced encryption and complies with industry regulations to protect your sensitive information throughout the signing process.

Get more for Au 196 10 Form

- Form osc 11

- Rental agreement form 1167

- Unconditional waiver and release on progress payment unconditional waiver and release on progress payment california civil code form

- Dental referral form

- Authorization for minor child visitation colorado form

- Form sf300 online

- Notary attestation form simmons college simmons

- Concrete checklist form

Find out other Au 196 10 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors