Form TR 698111 PrompTax Petroleum Business Tax Change of Tax Ny

Understanding the Form TR-698111 PrompTax Petroleum Business Tax

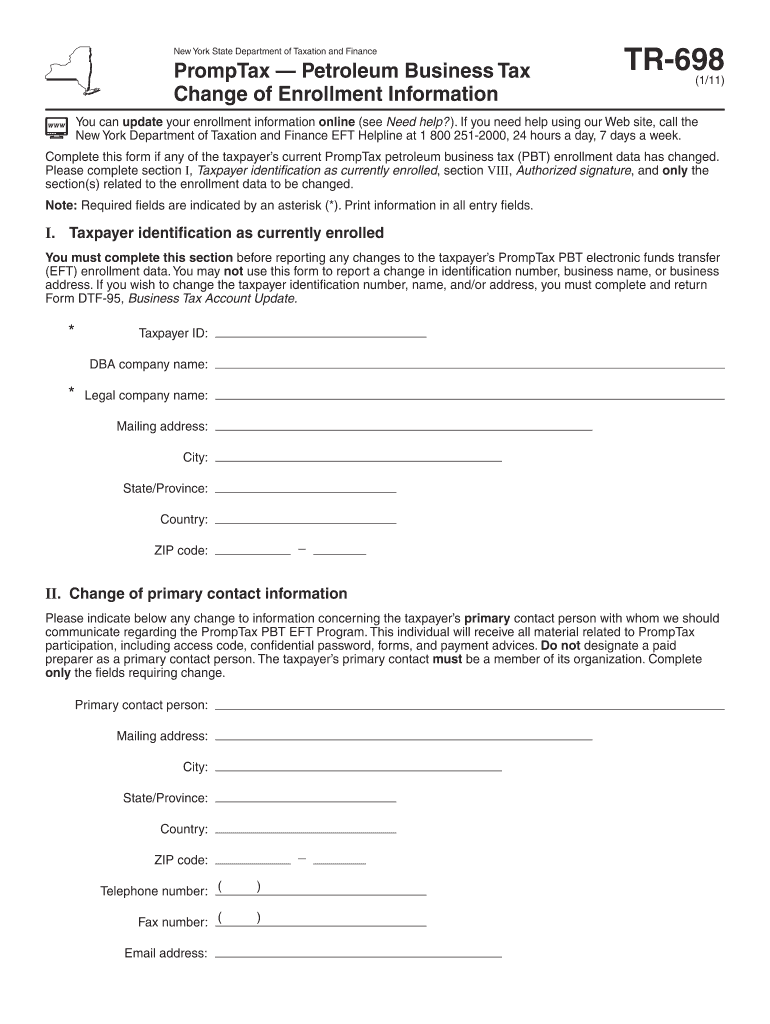

The Form TR-698111, commonly referred to as the PrompTax Petroleum Business Tax Change of Tax form, is essential for businesses in the petroleum sector operating in New York. This form is specifically designed for tax reporting and compliance related to petroleum business activities. It allows businesses to report changes in their tax status or to update information regarding their petroleum tax obligations. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the Form TR-698111

Completing the Form TR-698111 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information regarding your business, including your tax identification number and details about your petroleum operations. Follow these steps:

- Provide your business name and address in the designated fields.

- Indicate the specific changes you are reporting, such as changes in ownership or operational status.

- Complete the financial sections, detailing your petroleum sales and tax calculations.

- Review the form for accuracy before submission to avoid delays or penalties.

How to Obtain the Form TR-698111

The Form TR-698111 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format. Additionally, businesses can request a physical copy by contacting the department directly. Ensuring you have the most current version of the form is essential for compliance with state regulations.

Legal Use of the Form TR-698111

The Form TR-698111 is legally binding when completed accurately and submitted in accordance with New York State tax laws. It must be filled out completely and submitted by the specified deadlines to avoid penalties. Utilizing electronic tools for submission can enhance the security and efficiency of the filing process, ensuring that the form is legally recognized.

Filing Deadlines and Important Dates

Timely submission of the Form TR-698111 is crucial for compliance. The filing deadlines typically align with quarterly tax reporting periods. Businesses should be aware of these dates to avoid late fees and penalties. It is advisable to consult the New York State Department of Taxation and Finance for the most current deadlines and any changes that may occur.

Penalties for Non-Compliance

Failure to submit the Form TR-698111 on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance emphasizes the importance of accurate and timely filing.

Quick guide on how to complete form tr 698111 promptax petroleum business tax change of tax ny

Effortlessly prepare Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny on any platform with airSlate SignNow for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny effortlessly

- Find Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny and ensure seamless communication at any step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tr 698111 promptax petroleum business tax change of tax ny

How to create an electronic signature for the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny online

How to make an eSignature for the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny in Google Chrome

How to make an electronic signature for signing the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny in Gmail

How to create an electronic signature for the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny from your smart phone

How to create an electronic signature for the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny on iOS devices

How to generate an electronic signature for the Form Tr 698111 Promptax Petroleum Business Tax Change Of Tax Ny on Android devices

People also ask

-

What is Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny is a tax form used by petroleum businesses in New York to report changes in tax obligations. This form allows businesses to update their tax information efficiently and ensure compliance with state regulations. Utilizing airSlate SignNow makes it easy to complete and submit this form electronically.

-

How can airSlate SignNow help with Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

airSlate SignNow streamlines the process of completing Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny by providing a user-friendly interface for document management and electronic signatures. With our platform, you can fill out the form, sign it, and send it securely, all in one place, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Our plans are designed to be cost-effective while providing essential features for managing documents like Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny. You can choose a plan that best suits your volume of usage and feature requirements.

-

What features does airSlate SignNow offer for managing Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and the ability to track document status. These features ensure that your Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny is completed accurately and submitted on time, enhancing your overall efficiency.

-

Can I integrate airSlate SignNow with other software for filing Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

Yes, airSlate SignNow integrates seamlessly with various applications like CRM systems, cloud storage, and accounting software. This integration allows you to manage Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny more effectively by linking your tax information with your business tools, ensuring a smooth workflow.

-

What are the benefits of using airSlate SignNow for Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

Using airSlate SignNow for Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive tax information is protected while simplifying the filing process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for submitting Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your submissions of Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny. You can trust our platform to keep your confidential information safe and compliant with industry standards.

Get more for Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny

- Community health needs assessment final report women and form

- Yearbook jostens form

- Mn department of motor vehicles locations form

- Motion scheduling and order praecipe formpub 36th district court

- Dagorhir waiver form

- Sports registration cards templates with insurance liability form

- Ga affidavit residency form

- Tpsgc 2012 form

Find out other Form TR 698111 PrompTax Petroleum Business Tax Change Of Tax Ny

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo