South Dakota Bank Franchise Tax Form

What is the South Dakota Bank Franchise Tax

The South Dakota Bank Franchise Tax is a tax imposed on financial institutions operating within the state. This tax is calculated based on the institution's net income and is designed to ensure that banks contribute fairly to the state's revenue. Unlike traditional income taxes, the bank franchise tax is specifically tailored for financial institutions, reflecting their unique business operations. It is essential for banks to understand this tax to maintain compliance and avoid penalties.

Steps to complete the South Dakota Bank Franchise Tax

Completing the South Dakota Bank Franchise Tax involves several key steps:

- Gather financial information: Collect all necessary financial documents, including income statements and balance sheets, to accurately report your institution's net income.

- Calculate the tax: Use the appropriate formulas to determine the amount owed based on your financial data. The tax rate may vary, so ensure you are using the current rate.

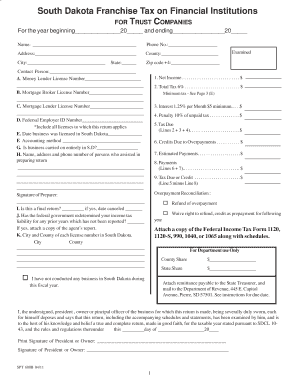

- Complete the required forms: Fill out the South Dakota bank franchise tax form, ensuring all information is accurate and complete.

- Review for accuracy: Double-check all calculations and information on the form to avoid errors that could lead to penalties.

- Submit the form: File the completed form by the designated deadline, using the preferred submission method.

Filing Deadlines / Important Dates

It is crucial for financial institutions to be aware of the filing deadlines associated with the South Dakota Bank Franchise Tax. Typically, the tax return is due on the last day of the fourth month following the end of the tax year. For most banks, this means the deadline falls on April 30. Institutions should also keep an eye on any changes to deadlines that may occur due to legislative updates or other factors.

Required Documents

To successfully file the South Dakota Bank Franchise Tax, institutions must prepare and submit several key documents, including:

- Financial statements, including income statements and balance sheets.

- The completed South Dakota bank franchise tax form.

- Any supporting documentation that verifies the reported income and expenses.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with the South Dakota Bank Franchise Tax requirements can result in significant penalties. Institutions may face fines, interest on unpaid taxes, and potential legal action. It is essential for banks to adhere to all filing requirements and deadlines to avoid these consequences. Regular audits and reviews of tax obligations can help institutions stay compliant and mitigate risks associated with non-compliance.

Digital vs. Paper Version

When filing the South Dakota Bank Franchise Tax, institutions have the option to submit their forms digitally or via paper. The digital version often allows for quicker processing and may offer features like automatic calculations. Conversely, the paper version might be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring accuracy and meeting deadlines remains paramount.

Quick guide on how to complete south dakota bank franchise tax form

Easily Prepare south dakota bank franchise tax form on Any Device

The management of online documents has become increasingly popular among enterprises and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage south dakota income tax on any platform using airSlate SignNow apps for Android or iOS and enhance any document-based transaction today.

Effortlessly Modify and eSign south dakota bank franchise tax

- Locate south dakota franchise tax on financial institutions and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of your documents or obscure private information with the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or an invitation link, or download it to your computer.

Don’t worry about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign south dakota franchise tax while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to south dakota franchise tax on financial institutions

Create this form in 5 minutes!

How to create an eSignature for the south dakota franchise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask south dakota spt 600b

-

What is airSlate SignNow and how does it relate to South Dakota income tax?

airSlate SignNow is a versatile eSignature solution that allows users to send and sign documents easily. When dealing with South Dakota income tax documents, using SignNow can streamline the process of obtaining signatures and ensure compliance, making it a valuable tool for both individuals and businesses.

-

How can airSlate SignNow help me manage my South Dakota income tax paperwork?

Using airSlate SignNow can simplify the management of your South Dakota income tax paperwork by enabling you to electronically sign documents and share them securely. This not only saves time but also reduces the risk of errors, allowing you to focus on preparing your taxes rather than processing paperwork.

-

What are the pricing options for airSlate SignNow that can assist with South Dakota income tax forms?

airSlate SignNow offers several pricing plans tailored to meet various needs, whether for individuals or businesses dealing with South Dakota income tax forms. Each plan includes the essential features needed for document management and eSigning, ensuring you can complete your tax documents efficiently.

-

Are there specific features in airSlate SignNow designed for handling South Dakota income tax documents?

Yes, airSlate SignNow includes features specifically advantageous for handling South Dakota income tax documents. These features encompass template creation for frequently used forms, reminders for important tax deadlines, and secure cloud storage to protect sensitive tax information.

-

Can I integrate airSlate SignNow with other software to help with South Dakota income tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easier to manage your South Dakota income tax preparations. This integration can streamline the process by automatically importing necessary documents and ensuring that all signatures are collected within your preferred platforms.

-

What are the benefits of using airSlate SignNow for South Dakota income tax submissions?

The benefits of using airSlate SignNow for South Dakota income tax submissions include improved efficiency, reduced processing time, and enhanced accuracy. With electronic signatures and easy document sharing, you can ensure that your tax submissions are timely and correctly filled out, minimizing any potential issues with the state.

-

Is airSlate SignNow compliant with South Dakota income tax regulations?

Yes, airSlate SignNow is fully compliant with eSignature laws and regulations, including those relevant to South Dakota income tax. This compliance gives users peace of mind that their electronically signed documents will be considered valid and legally binding in tax contexts.

Get more for south dakota income tax

- Encounterlib report form

- Dental services western dental insurance amp orthodontics form

- Individual application for insurance license individual application for insurance license form

- Authorization for use and ordisclosure of memberpatient health information

- If you see something fill and sign printable template form

- Patient information form sfvimaging com

- 1 daniel burnham court 330c san francisco ca 94109 415668 0888 form

- 45 cfr164 508 uses and disclosures for which anguidance on hipaa and individual authorization of uses andauthorization for use form

Find out other south dakota bank franchise tax

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document