Va Fha Loan Real Estate Addendum Form Most Recent 2009-2026

Key elements of the FHA purchase agreement addendum

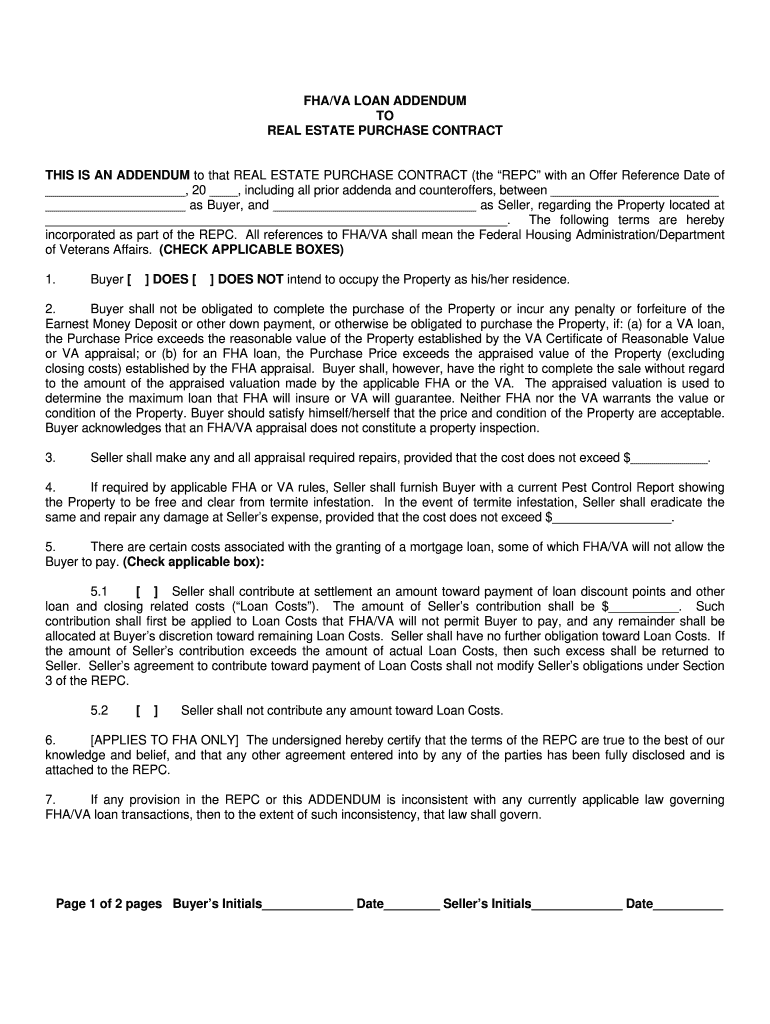

The FHA purchase agreement addendum is a crucial document in real estate transactions involving Federal Housing Administration (FHA) loans. It typically includes essential elements such as:

- Property Description: A clear identification of the property, including its address and legal description.

- Buyer and Seller Information: Full names and contact details of all parties involved in the transaction.

- Loan Details: Specifics about the FHA loan, including loan amount, interest rate, and terms of the mortgage.

- Contingencies: Conditions that must be met for the sale to proceed, such as home inspections or appraisals.

- Signatures: Required signatures from both the buyer and seller to validate the agreement.

Steps to complete the FHA purchase agreement addendum

Filling out the FHA purchase agreement addendum requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather Information: Collect all necessary details about the property, buyer, and seller.

- Fill Out the Form: Accurately enter the required information in the designated fields of the addendum.

- Review for Accuracy: Double-check all entries for correctness, ensuring that no details are overlooked.

- Obtain Signatures: Have all parties involved sign the document, either in person or electronically.

- Distribute Copies: Provide copies of the signed addendum to all parties for their records.

Legal use of the FHA purchase agreement addendum

The FHA purchase agreement addendum serves as a legally binding document once signed by all parties. To ensure its legal validity, it must include:

- Accurate and complete information about the transaction.

- Signatures from both the buyer and seller, indicating mutual consent to the terms.

- Compliance with state and federal regulations governing real estate transactions.

Using a compliant eSignature solution can further enhance the legal standing of the document by providing an audit trail and ensuring secure signing processes.

How to use the FHA purchase agreement addendum

The FHA purchase agreement addendum is used in conjunction with a standard purchase agreement to address specific conditions related to FHA financing. Here’s how to utilize it effectively:

- Attach the addendum to the main purchase agreement before presenting it to the seller.

- Ensure that all terms related to FHA financing are clearly outlined in the addendum.

- Communicate with all parties about the implications of the addendum, ensuring everyone understands their rights and obligations.

State-specific rules for the FHA purchase agreement addendum

Each state may have unique regulations regarding the use of the FHA purchase agreement addendum. It is important to be aware of:

- State-specific disclosures that may need to accompany the addendum.

- Variations in required terms or conditions that must be included based on local laws.

- Any additional forms that may be necessary to comply with state regulations.

Examples of using the FHA purchase agreement addendum

Understanding practical applications of the FHA purchase agreement addendum can help clarify its importance. Examples include:

- A buyer using the addendum to specify that the sale is contingent upon obtaining FHA financing.

- A seller agreeing to certain repairs or concessions outlined in the addendum as a condition of the sale.

- Incorporating specific timelines for inspections and appraisals as part of the FHA financing process.

Quick guide on how to complete utah fha va loan addendum form

Carefully review your t's and i's on Va Fha Loan Real Estate Addendum Document Latest Version

Managing contracts, overseeing listings, coordinating meetings, and showings—real estate professionals balance a variety of responsibilities on a daily basis. Numerous tasks entail substantial documentation, such as Va Fha Loan Real Estate Addendum Form Most Recent, which must be finalized promptly and as accurately as possible.

airSlate SignNow is a comprehensive solution that assists individuals in the real estate sector in reducing the paperwork load, enabling them to prioritize their clients’ objectives throughout the negotiation journey and secure optimal terms for the agreement.

Steps to complete Va Fha Loan Real Estate Addendum Form Most Recent using airSlate SignNow:

- Navigate to the Va Fha Loan Real Estate Addendum Form Most Recent section or utilize our library’s search tools to find the necessary document.

- Select Get form—you will be promptly directed to the editor.

- Begin completing the document by selecting fillable fields and inputting your text.

- Add additional text and modify its attributes if necessary.

- Select the Sign option in the upper toolbar to create your electronic signature.

- Explore other tools available to annotate and enhance your document, such as drawing, highlighting, inserting shapes, and beyond.

- Click on the notes tab and create annotations regarding your document.

- Conclude the process by downloading, sharing, or sending your document to your intended recipients or organizations.

Eliminate paper once and for all and optimize the homebuying process with our user-friendly and powerful platform. Experience greater convenience when authorizing Va Fha Loan Real Estate Addendum Form Most Recent and other real estate documents online. Try our tool today!

Create this form in 5 minutes or less

FAQs

-

Is the VA/FHA loan Addendum only for VA or FHA loans (i.e. not standard mortgages backed by commercial banks)? The sellers agent is asking me to sign this, and I don't want the terms to impact our agreement if the form is not required

As the name states, “VA/FHA Loan Addendum” is for those types of loans and spells out some buyer’s rights and obligations as well as certifies that all the terms of the contract are true and above board.Some firms require (or try to require) every addendum and clause under the sun to be included in purchase and sale agreements because they think is insures them from some potential liabilities. A common example is asking for a lead based paint addendum, which only applies to properties built before 1978, to later built homes.Personally I would not recommend any of our buyer clients sign unnecessary forms or addendum..

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How long do I have to live in my house if I take out an fha loan?

Check your loan documents, but the requirement used to be INTENDED to live in the home. Some years ago I had a pair of brothers who owned a head shop - sold pipes, etc. - a legal business. They were in their early 20’s making a lot of money - ALL TOTALLY LEGIT. They decided to buy a house, I found hem one they liked, they made an offer. The offer was accepted and they were approved for a no money down FHA loan. The week before closing the county they lived in banned head shops. BAM - they're out of business. They did not want to buy the house. The sellers had to sell by a specific date or loose a big down payment on their next house. Panic sets in, lawyers are called. The FHA was called, and REFUSED to cancel the loan approval. Once you’re approved, it is for good.In this case my company agreed to buy. the house from my buyers if they settled on the house first - because they could re-sell it with the assumable loan in place. The buyers decided to buy it and resell it if they could not afford to keep it. Last I heard they kept the house and now use it as a rental. This happened in 1980.

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the utah fha va loan addendum form

How to generate an eSignature for your Utah Fha Va Loan Addendum Form online

How to make an eSignature for your Utah Fha Va Loan Addendum Form in Google Chrome

How to create an eSignature for signing the Utah Fha Va Loan Addendum Form in Gmail

How to make an eSignature for the Utah Fha Va Loan Addendum Form straight from your smart phone

How to make an eSignature for the Utah Fha Va Loan Addendum Form on iOS

How to make an electronic signature for the Utah Fha Va Loan Addendum Form on Android OS

People also ask

-

What is an FHA purchase agreement addendum?

An FHA purchase agreement addendum is a document that outlines additional terms and conditions related to a purchase agreement for properties financed through an FHA loan. It serves to protect both buyers and sellers by clarifying aspects like repairs or contingencies. Understanding this addendum is crucial for a smooth transaction.

-

How does airSlate SignNow help with FHA purchase agreement addendums?

airSlate SignNow simplifies the creation and signing of FHA purchase agreement addendums by providing a user-friendly platform for document management. Users can easily draft, edit, and send these addendums for electronic signatures. This streamlines the process, ensuring efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for FHA purchase agreement addendums?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing FHA purchase agreement addendums. Each plan includes features relevant to document eSigning and storage, ensuring you get value for your investment. You can choose a plan based on your business size and requirements.

-

What features are available for managing FHA purchase agreement addendums?

AirSlate SignNow offers features such as customizable templates, secure electronic signing, document tracking, and cloud storage, all of which facilitate managing FHA purchase agreement addendums. These features help ensure that all parties can review, sign, and store documents safely and efficiently.

-

What are the benefits of using airSlate SignNow for FHA purchase agreement addendums?

Using airSlate SignNow for FHA purchase agreement addendums offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signing process reduces delays and allows for quick modifications to the addendum as needed. Furthermore, your documents are stored securely in the cloud, accessible at any time.

-

Can airSlate SignNow integrate with other real estate tools for FHA purchase agreement addendums?

Yes, airSlate SignNow supports integrations with various real estate tools and CRM systems, enhancing the management of FHA purchase agreement addendums. This seamless integration allows users to synchronize their workflows, making it easier to retrieve and manage documents along with other necessary resources.

-

How secure is airSlate SignNow for signing FHA purchase agreement addendums?

AirSlate SignNow prioritizes security with features including encryption and secure access controls, ensuring that your FHA purchase agreement addendums are protected. With compliance to major security standards, you can trust that your sensitive documents remain confidential and secure throughout the signing process.

Get more for Va Fha Loan Real Estate Addendum Form Most Recent

Find out other Va Fha Loan Real Estate Addendum Form Most Recent

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free