Nationwide 401k Withdrawal Form

What is the Nationwide 401k Withdrawal Form

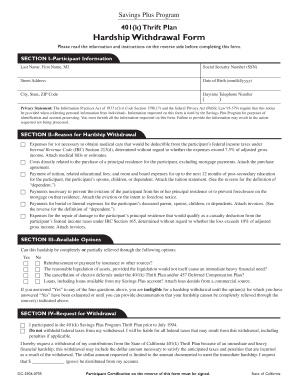

The nationwide 401k withdrawal form is a crucial document for individuals seeking to withdraw funds from their 401k retirement accounts. This form is essential for initiating a withdrawal request, whether for hardship, early withdrawal, or other qualifying reasons. It outlines the specific details of the withdrawal, including the amount requested and the reason for the withdrawal, ensuring compliance with both federal and plan-specific regulations.

How to Use the Nationwide 401k Withdrawal Form

Using the nationwide 401k withdrawal form involves several steps to ensure proper completion and submission. First, gather all necessary personal information, including your account number and details about your employer’s 401k plan. Next, fill out the form accurately, providing all requested information. It is important to review the form for any errors before submission. Once completed, the form can typically be submitted online, via mail, or in person, depending on your plan's requirements.

Steps to Complete the Nationwide 401k Withdrawal Form

Completing the nationwide 401k withdrawal form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide your 401k account number and the name of your employer.

- Indicate the type of withdrawal you are requesting, such as hardship or early withdrawal.

- Specify the amount you wish to withdraw.

- Sign and date the form, ensuring that all information is accurate and complete.

Legal Use of the Nationwide 401k Withdrawal Form

The legal use of the nationwide 401k withdrawal form is governed by federal regulations and the specific terms of your retirement plan. To ensure that your withdrawal is compliant, it is essential to understand the conditions under which withdrawals are permitted. For example, hardship withdrawals must meet specific criteria set forth by the IRS. Additionally, the form must be signed and submitted according to your plan’s guidelines to be considered valid.

Eligibility Criteria

Eligibility for using the nationwide 401k withdrawal form varies based on the type of withdrawal being requested. Generally, participants must meet certain criteria, such as:

- Being a current or former employee of the company sponsoring the 401k plan.

- Experiencing a qualifying event for hardship withdrawals, such as medical expenses or purchasing a primary home.

- Reaching the age of fifty-nine and a half for early withdrawals without penalty.

Required Documents

When submitting the nationwide 401k withdrawal form, you may need to provide additional documentation to support your request. Commonly required documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Documentation of the hardship, if applicable, such as medical bills or a purchase agreement for a home.

- Any additional forms required by your specific 401k plan.

Quick guide on how to complete nationwide 401k withdrawal form

Accomplish Nationwide 401k Withdrawal Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the suitable form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nationwide 401k Withdrawal Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to adjust and eSign Nationwide 401k Withdrawal Form without exerting effort

- Obtain Nationwide 401k Withdrawal Form and click on Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any chosen device. Modify and eSign Nationwide 401k Withdrawal Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nationwide 401k withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nationwide 401k withdrawal form?

The nationwide 401k withdrawal form is a legal document that allows individuals to request funds from their 401k retirement accounts. This form is essential for employees seeking to access their retirement savings, either for financial emergencies or to fund signNow life events. Ensuring you have the correct nationwide 401k withdrawal form is crucial to avoid delays in accessing your funds.

-

How can I obtain the nationwide 401k withdrawal form?

You can easily obtain the nationwide 401k withdrawal form through your employer's HR department or financial advisor. Additionally, you can download the form from the official nationwide website or platforms like airSlate SignNow that facilitate document services. Having the right form readily accessible makes the withdrawal process more straightforward.

-

What features does airSlate SignNow offer for the nationwide 401k withdrawal form?

airSlate SignNow offers features such as eSigning capability, document template creation, and secure storage, which streamline the process of handling your nationwide 401k withdrawal form. The platform's user-friendly interface allows you to fill out and send documents quickly. It also integrates with various platforms to make accessing your retirement savings easier.

-

Is there a cost associated with using airSlate SignNow for the nationwide 401k withdrawal form?

Yes, airSlate SignNow provides cost-effective plans tailored to meet the needs of different users. While the basic features may be available at no cost, premium features, such as advanced integrations and additional document storage, may incur charges. However, many users find the investment worthwhile for the efficiency it brings to managing nationwide 401k withdrawal forms.

-

Can I edit the nationwide 401k withdrawal form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and edit your nationwide 401k withdrawal form easily. You can add necessary details, customize sections, and ensure all information is accurate before sending it out for eSignature. This flexibility helps you keep your documents up to date.

-

What benefits do I gain from using airSlate SignNow for my nationwide 401k withdrawal form?

Using airSlate SignNow for your nationwide 401k withdrawal form offers several benefits, including faster processing times and the ability to track document status in real-time. The platform enhances collaboration by allowing you to share documents securely and obtain signatures from multiple parties efficiently. It's designed to simplify your compliance and document management.

-

Does airSlate SignNow integrate with other software for managing the nationwide 401k withdrawal form?

Yes, airSlate SignNow integrates seamlessly with various software and applications like Google Drive, Dropbox, and CRM systems. This integration allows you to organize, track, and manage your nationwide 401k withdrawal form within your existing workflows. Enhanced connectivity ensures that you're always aligned with your financial management tools.

Get more for Nationwide 401k Withdrawal Form

- Concrete mason contract for contractor virginia form

- Demolition contract for contractor virginia form

- Framing contract for contractor virginia form

- Security contract for contractor virginia form

- Insulation contract for contractor virginia form

- Paving contract for contractor virginia form

- Site work contract for contractor virginia form

- Siding contract for contractor virginia form

Find out other Nationwide 401k Withdrawal Form

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed