Uxo Report Printable Form

What is the Uxo Report Printable

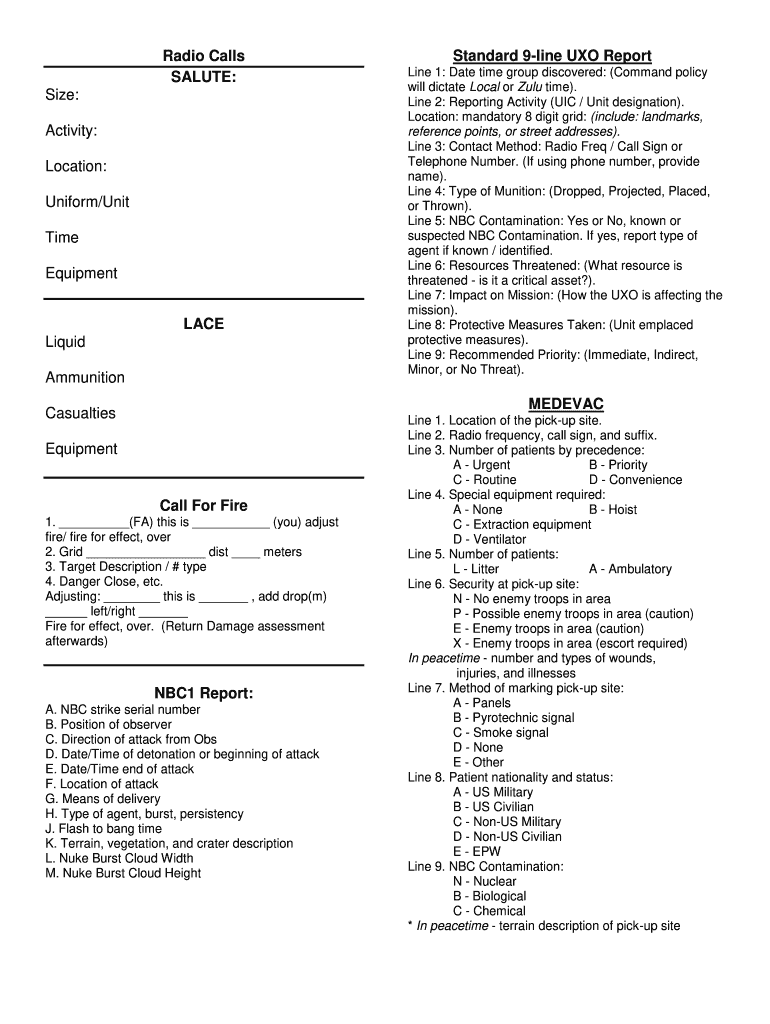

The Uxo Report Printable serves as a critical document used in military operations to report unexploded ordnance (UXO). This form is essential for ensuring safety and accountability when dealing with munitions that have not detonated as intended. By documenting the specifics of the UXO, including its location and condition, personnel can effectively communicate risks and facilitate appropriate responses.

How to use the Uxo Report Printable

Using the Uxo Report Printable involves filling out specific sections that capture vital information about the unexploded ordnance. Users should accurately detail the type of ordnance, its precise location, and any observable hazards. It is crucial to follow the established guidelines for completing the form to ensure clarity and compliance with military standards. This report should be submitted to the appropriate authorities for further action.

Steps to complete the Uxo Report Printable

Completing the Uxo Report Printable requires careful attention to detail. Here are the steps to follow:

- Begin by entering the date and time of the discovery.

- Provide a detailed description of the UXO, including its type and size.

- Record the exact location using GPS coordinates if available.

- Note any immediate hazards or concerns related to the UXO.

- Sign and date the report to confirm its accuracy.

Legal use of the Uxo Report Printable

The Uxo Report Printable is legally recognized within military and regulatory frameworks. Proper completion and submission of this form are essential for compliance with safety regulations governing unexploded ordnance. Failure to adhere to these legal requirements can result in penalties and increased risks to personnel and civilians. Ensuring that the report is filled out correctly and submitted promptly is vital for maintaining safety and accountability.

Key elements of the Uxo Report Printable

Key elements of the Uxo Report Printable include:

- Identification of the UXO: Clear details about the type and condition of the ordnance.

- Location: Accurate GPS coordinates or descriptive location information.

- Hazard Assessment: Observations regarding any potential risks associated with the UXO.

- Reporting Personnel: Name and contact information of the individual completing the report.

Examples of using the Uxo Report Printable

Examples of using the Uxo Report Printable can vary based on the context of the discovery. For instance, if a military unit encounters an unexploded bomb during training exercises, they would complete the report to document the find and notify explosive ordnance disposal (EOD) teams. Similarly, civilian contractors working on construction sites near former military installations may use the form to report any UXO discovered during excavation.

Quick guide on how to complete 9 line cas smart card form

Complete Uxo Report Printable seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to quickly locate the right document and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents efficiently without delays. Manage Uxo Report Printable on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Uxo Report Printable effortlessly

- Locate Uxo Report Printable and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the files or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional signed signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or missing documents, time-consuming search processes, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Uxo Report Printable while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I change my address in the Aadhar card?

You can change the following details in Aadhar Card:NameGenderDate of BirthAddressE-mail IDTHINGS TO REMEMBER BEFORE APPLYING FOR AADHAR CARD DETAILS CHANGE:Your Registered Mobile Number is mandatory in the online process.You need to submit Documents for change of – Name, Date of Birth and Address. However, Change in Gender and E-mail ID do not require any document.You have to fill details in both – English and Regional/Local language (Eg. Hindi, Oriya, Bengali etc)Aadhar Card Details are not changed instantly. It is changed after Verification and Validation by the authoritySTEPS TO AADHAR CARD DETAILS CHANGE ONLINE:Click Here for going to the link.Enter your Aadhar Number.Fill Text VerificationClick on Send OTP. OTP is sent on your Registered mobile number.Also Read: Simple Steps to Conduct Aadhar Card Status Enquiry by NameYou will be asked to choose the Aadhar Card Details that you want to change.You can select multiple fields. Select the field and Submit.In next window fill the Correct Detail in both – English and Local language (if asked) and Submit.For Example – Here one has to fill the Email IdNOTE – If you are changing – Name, Date of Birth or Address, you have to upload the scanned documents. Click Here to know the Documents or Check them here.Verify the details that you have filled. If all the details look good then proceed or you can go back and edit once again.You may be asked for BPO Service Provider Selection. Select the provider belonging to your region.At last – You will be given an Update Request Number. Download or Print the document and keep it safe. It is required in checking the status of the complaint in future.So this step completes the process of Aadhar Card details change online.CHECK THE STATUS OF YOUR AADHAR CARD DETAILS CHANGE REQUESTStep 1 – Go the website by Clicking HereStep 2 – Fill the Aadhaar No. and URN – Update Request NumberStep 3 – Click on “Get Status”You are done. The new window on the screen will show the status of your request for change in Aadhar Card Details.

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How can one fill a PAN card application with initials?

The PAN Card Application has specific guidelines that no initials be included for the First Name, Middle Name, and Last Name fields of the applicant, his/her father and mother.While initials are not permitted in the above mentioned fields, you have the option to choose how your name appears on the PAN Card. There you could have initials listed.For example, lets take the name Virat Kholi.First Name would be Virat.Last Name would be Kholi.Name on Card can be any of the following:Virat KholiViratK ViratVirat KIf you would like to check how the application turns out, you could submit an online PAN Card Application and download the pre-filled PDF form for free at Brokerage Free - New PAN ApplicationHope this information is helpful.Thanks.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

Create this form in 5 minutes!

How to create an eSignature for the 9 line cas smart card form

How to create an electronic signature for your 9 Line Cas Smart Card Form in the online mode

How to make an electronic signature for the 9 Line Cas Smart Card Form in Chrome

How to create an eSignature for putting it on the 9 Line Cas Smart Card Form in Gmail

How to make an eSignature for the 9 Line Cas Smart Card Form straight from your smart phone

How to generate an eSignature for the 9 Line Cas Smart Card Form on iOS

How to create an eSignature for the 9 Line Cas Smart Card Form on Android devices

People also ask

-

What is the 9 line cas feature in airSlate SignNow?

The 9 line cas feature in airSlate SignNow simplifies the process of capturing essential information on documents. It allows users to fill out key data points efficiently, making document management faster. This feature is designed for businesses looking to streamline their signing process.

-

How does airSlate SignNow's 9 line cas improve document workflow?

The 9 line cas feature enhances document workflow by enabling quick and efficient data entry. This reduces time spent on paperwork and minimizes errors, leading to increased productivity. By implementing the 9 line cas in your workflow, you can ensure a smoother signing experience.

-

Is the 9 line cas feature included in all airSlate SignNow pricing plans?

Yes, the 9 line cas feature is included in all airSlate SignNow pricing plans. Whether you choose the basic or premium plan, you'll benefit from the efficiency of the 9 line cas. This ensures that businesses of all sizes can access this valuable tool without additional costs.

-

What are the benefits of using the 9 line cas feature?

The benefits of using the 9 line cas feature include quicker document completion, reduction of manual errors, and improved compliance with data capture. By employing the 9 line cas in airSlate SignNow, businesses can enhance their operational efficiencies and improve client satisfaction.

-

Can the 9 line cas feature integrate with other applications?

Yes, the 9 line cas feature of airSlate SignNow can seamlessly integrate with various applications. This ability allows businesses to connect their current tools and use the 9 line cas functionality across platforms. Integrations enhance overall productivity by ensuring a unified workflow.

-

How secure is the 9 line cas in airSlate SignNow?

The 9 line cas feature is built with high-level security protocols to protect sensitive information. airSlate SignNow employs encryption and compliance with industry standards to safeguard data. You can trust that your documents processed with the 9 line cas feature are secure.

-

What types of documents can be processed using the 9 line cas feature?

The 9 line cas feature can be applied to a variety of documents, including contracts, agreements, and forms. It is versatile and designed for any document requiring specific data points. Businesses can utilize the 9 line cas across different industries to enhance their document processing.

Get more for Uxo Report Printable

Find out other Uxo Report Printable

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now