Employee Time Sheets Form

Understanding the Foreign Location Record

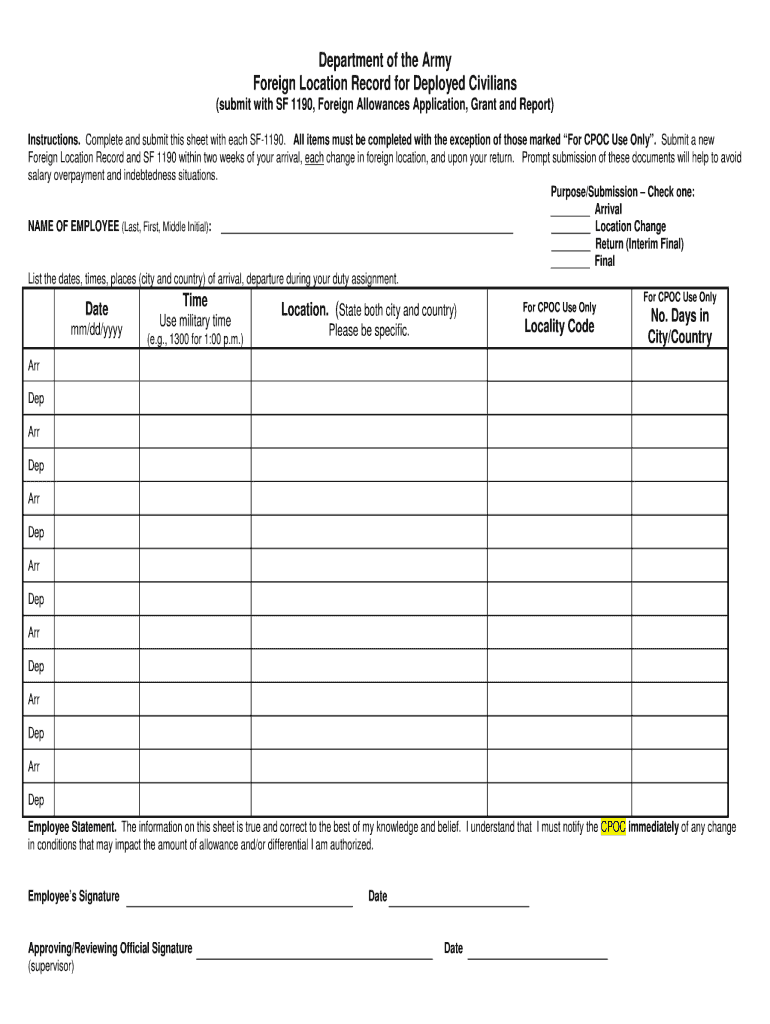

The foreign location record is a crucial document for U.S. military and civilian personnel deployed overseas. It serves to establish the official location of an employee or service member while stationed abroad. This document is vital for processing foreign allowances and ensuring that personnel receive the appropriate benefits while serving in a foreign environment. Understanding the specifics of this record can help streamline the administrative processes involved in overseas assignments.

Steps to Complete the Foreign Location Record

Completing the foreign location record involves several key steps. First, gather all necessary personal information, including your current assignment details and the specific foreign location. Next, ensure that you accurately fill out all required fields on the form, including any attachments that may be necessary. It is important to double-check the information for accuracy to avoid delays in processing. Finally, submit the completed form through the appropriate channels, which may include online submission or mailing it to the designated office.

Legal Use of the Foreign Location Record

The foreign location record must be completed and submitted in accordance with U.S. legal requirements. This includes adhering to any specific guidelines outlined by the Department of Defense or other relevant agencies. Using outdated or incorrect forms can lead to complications in benefits processing, so it is essential to ensure that you are using the most current version of the form. Familiarizing yourself with the legal implications of this document can help prevent issues during your deployment.

Required Documents for Submission

When submitting the foreign location record, certain documents may be required to support your application. These can include identification documents, proof of assignment, and any additional forms specified by your commanding officer or administrative office. Ensuring that you have all necessary documentation ready can facilitate a smoother submission process and reduce the likelihood of delays.

Form Submission Methods

The foreign location record can typically be submitted through various methods, including online platforms, mail, or in-person delivery. If your organization allows for electronic submissions, using a secure digital signature service can enhance the security of your submission. For those opting for mail or in-person submission, ensure that you follow the specified guidelines for each method to guarantee that your form is processed efficiently.

Examples of Using the Foreign Location Record

Understanding practical applications of the foreign location record can be beneficial. For instance, service members stationed in Germany may need to complete this record to qualify for specific overseas allowances. Similarly, civilian employees working for the government in foreign locations must also submit this record to ensure they receive the appropriate compensation and benefits. These examples illustrate the importance of accurate and timely completion of the foreign location record for various personnel.

Quick guide on how to complete foreign location record for deployed civilians form

Uncover the easiest method to complete and endorse your Employee Time Sheets

Are you still spending time preparing your official documents in hard copy instead of doing it online? airSlate SignNow provides a superior way to complete and endorse your Employee Time Sheets and related forms for public services. Our intelligent electronic signature solution equips you with all you require to handle documents swiftly and in accordance with formal standards - robust PDF editing, management, security, signing, and sharing tools all readily available within an easy-to-use interface.

There are just a few steps needed to finalize the completion and signing of your Employee Time Sheets:

- Add the editable template to the editor by using the Get Form option.

- Review the information you need to submit in your Employee Time Sheets.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Modify the content with Text boxes or Images from the top bar.

- Emphasize what is truly important or Blackout sections that are no longer relevant.

- Hit Sign to generate a legally binding electronic signature using any method that suits you.

- Insert the Date adjacent to your signature and finish your task with the Done button.

Store your completed Employee Time Sheets in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our service also provides versatile form sharing. There's no need to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

Create this form in 5 minutes!

How to create an eSignature for the foreign location record for deployed civilians form

How to create an electronic signature for the Foreign Location Record For Deployed Civilians Form online

How to generate an electronic signature for the Foreign Location Record For Deployed Civilians Form in Google Chrome

How to create an electronic signature for signing the Foreign Location Record For Deployed Civilians Form in Gmail

How to create an eSignature for the Foreign Location Record For Deployed Civilians Form right from your mobile device

How to create an electronic signature for the Foreign Location Record For Deployed Civilians Form on iOS devices

How to generate an eSignature for the Foreign Location Record For Deployed Civilians Form on Android

People also ask

-

What is airSlate SignNow, and how does it work for businesses operating in a foreign location?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents online securely. For companies operating in a foreign location, it simplifies the process of document management by ensuring that contracts and agreements can be signed from anywhere, facilitating international workflows.

-

How can airSlate SignNow help with document compliance in a foreign location?

Using airSlate SignNow ensures that your documents meet all necessary compliance and legal standards, even in a foreign location. Our platform offers customizable templates and audit trails that are essential for maintaining compliance with varying international regulations related to eSignatures.

-

What are the pricing options for airSlate SignNow for businesses in a foreign location?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses operating in a foreign location. You can start with a free trial, and as your needs grow, we provide affordable plans that scale with your business, ensuring cost-effectiveness no matter where you are.

-

Are there any specific features of airSlate SignNow that benefit users in a foreign location?

Yes, airSlate SignNow includes features specifically beneficial for users in a foreign location, such as multi-language support and the ability to customize workflows. These features ensure that teams can collaborate efficiently, regardless of geographical barriers, enhancing overall productivity.

-

Can airSlate SignNow be integrated with other tools when working from a foreign location?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications that businesses often use, which is especially useful for teams collaborating from a foreign location. This ensures a smooth workflow across multiple platforms, making document signing a breeze.

-

What benefits does airSlate SignNow provide for companies dealing with international clients in a foreign location?

For companies engaging with international clients in a foreign location, airSlate SignNow offers fast and secure document signing that enhances client experience. This speed and convenience not only improve customer satisfaction but also foster trust and streamline transactions across borders.

-

How does airSlate SignNow ensure security for documents sent from a foreign location?

Security is a top priority at airSlate SignNow, which is why we use advanced encryption technologies to protect documents, regardless of their origin. This commitment to security allows businesses to confidently send and sign documents from a foreign location while safeguarding sensitive information.

Get more for Employee Time Sheets

Find out other Employee Time Sheets

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later