Hsbc Home Loan Application Form

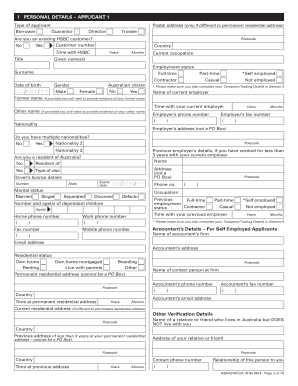

What is the HSBC Home Loan Application Form?

The HSBC home loan application form is a crucial document used by individuals seeking to secure a mortgage from HSBC Australia. This form collects essential information about the applicant's financial situation, employment history, and property details. Completing this form accurately is vital for the bank to assess the applicant's eligibility for a home loan. It serves as the foundation for the loan approval process, enabling the bank to determine the terms and conditions of the mortgage.

Steps to Complete the HSBC Home Loan Application Form

Completing the HSBC home loan application form involves several important steps:

- Gather Required Information: Collect details such as your personal identification, income statements, and information about the property you wish to purchase.

- Fill Out the Form: Provide accurate and complete information in each section of the application. Ensure that all financial details are current and reflect your situation.

- Review Your Application: Double-check all entries for accuracy and completeness. Mistakes or omissions can delay the approval process.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person, and send the completed form to HSBC.

Legal Use of the HSBC Home Loan Application Form

The HSBC home loan application form is legally binding once submitted, provided it meets certain requirements. To ensure its validity, applicants must follow the legal stipulations surrounding eSignatures and documentation. This includes using a reliable electronic signature platform that complies with relevant laws, such as the ESIGN Act and UETA. These regulations ensure that the digital signatures are recognized as legally enforceable, safeguarding both the applicant and the financial institution.

Required Documents for the HSBC Home Loan Application

To successfully complete the HSBC home loan application form, applicants must provide several key documents:

- Identification: A government-issued ID, such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements that demonstrate your financial stability.

- Property Information: Details about the property you intend to purchase, including its address and purchase price.

- Credit History: Consent to access your credit report, which helps the bank evaluate your creditworthiness.

Application Process & Approval Time

The application process for the HSBC home loan typically involves several stages:

- Initial Submission: After submitting the application form and required documents, the bank will review your information.

- Assessment: HSBC will assess your financial situation, credit history, and the property details to determine eligibility.

- Approval Decision: Once the assessment is complete, you will receive a decision regarding your loan application.

- Funding: If approved, the bank will provide the loan funds, allowing you to complete the property purchase.

The entire process can take anywhere from a few days to several weeks, depending on the complexity of the application and the bank's workload.

Quick guide on how to complete hsbc home loan application form

Finish Hsbc Home Loan Application Form effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Hsbc Home Loan Application Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Hsbc Home Loan Application Form with ease

- Find Hsbc Home Loan Application Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes moments and has the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or inaccuracies that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Hsbc Home Loan Application Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc home loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Australia bank home loan?

An Australia bank home loan is a financial product offered by banks in Australia that allows individuals to borrow money to purchase a home. These loans typically come with varied interest rates and repayment terms, tailored to meet different financial situations. It's essential to compare options to find the best Australia bank home loan for your needs.

-

What are the typical interest rates for Australia bank home loans?

Interest rates for Australia bank home loans can vary signNowly depending on factors such as the lender, the type of loan, and your financial profile. As of now, interest rates can range from variable to fixed rates, with many banks offering competitive rates to attract borrowers. Always check the current rates and any promotional offers available for Australia bank home loans.

-

What features should I look for in an Australia bank home loan?

When choosing an Australia bank home loan, consider features such as repayment flexibility, offset accounts, and redraw facilities. These features can help you manage your loan more effectively and potentially save on interest. Additionally, look for loans that offer no or low fees to ensure your overall cost remains low.

-

How can I determine my eligibility for an Australia bank home loan?

To determine your eligibility for an Australia bank home loan, banks typically assess your income, credit score, employment history, and existing debts. Each lender may have different criteria, so it's advisable to check with multiple banks to see what they require. Preparing documents such as payslips and identification will streamline the application process.

-

What are the benefits of choosing an Australia bank home loan over other financing options?

Choosing an Australia bank home loan often comes with benefits such as competitive interest rates, tailored repayment plans, and the potential for tax advantages. Banks also provide expertise in home financing, ensuring you receive guidance throughout the process. This can make the loan process easier and more reliable.

-

Are there any hidden fees associated with Australia bank home loans?

It's crucial to review all terms and conditions when applying for an Australia bank home loan, as some lenders may charge establishment or ongoing fees. Hidden fees can include administrative charges or early repayment fees, so always ask for a detailed list. Transparent lenders will provide you with a comprehensive breakdown of all fees involved.

-

What integrations can I expect with an Australia bank home loan application process?

Most banks offering Australia bank home loans have integrated online tools and platforms to simplify the application process. This may include digital document submissions, online calculators for repayments, and automated status updates for your application. Look for banks that embrace technology for a smoother borrowing experience.

Get more for Hsbc Home Loan Application Form

- Photo with plain background customer service point msp msd form

- United kingdom motor vehicle form

- First time buyers declaration form

- Sdlt46 notice of appeal against a penalty stamp duty land tax form

- Dt individual spain form

- Forever aloe vera gel forever living products form

- Form a rera

- Jamaica application tax administration form

Find out other Hsbc Home Loan Application Form

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free