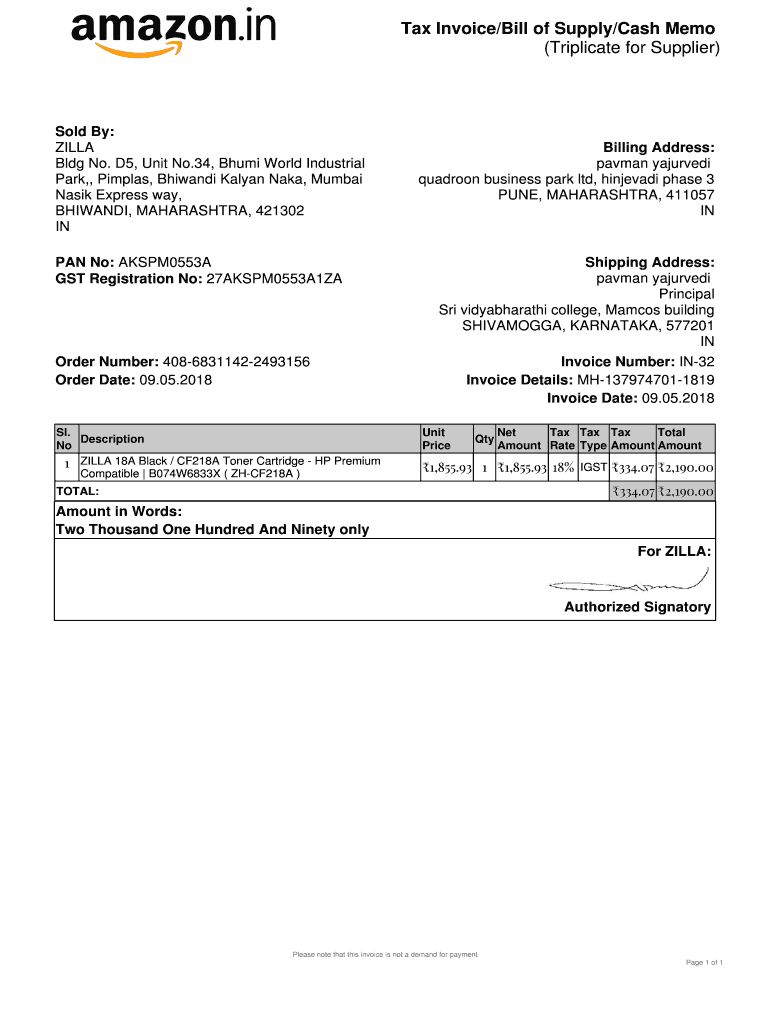

Tax InvoiceBill of SupplyCash Memo Triplicate for Supplier Form

What is the tax memo example?

A tax memo example serves as a formal document that outlines the details related to a specific tax situation. This document typically includes information such as the taxpayer's identification, the nature of the transaction, and any relevant tax laws or regulations that apply. It is often used by accountants or tax professionals to provide clarity on tax obligations and to ensure compliance with federal and state tax laws.

Key elements of the tax memo example

When creating a tax memo example, several key elements should be included to ensure its effectiveness:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Transaction Details: Description of the transaction, including dates and amounts.

- Applicable Tax Laws: References to specific IRS codes or state regulations that pertain to the transaction.

- Analysis: A detailed explanation of how the tax laws apply to the situation.

- Conclusion: A summary of the findings and recommendations for the taxpayer.

How to use the tax memo example

Using a tax memo example involves several steps to ensure that it meets the necessary legal and professional standards. First, gather all relevant information regarding the taxpayer and the transaction. Next, structure the memo according to the key elements outlined previously. Ensure that the analysis is thorough and that all applicable laws are cited accurately. Finally, review the memo for clarity and completeness before sharing it with the taxpayer or submitting it to the IRS.

IRS guidelines

The IRS provides specific guidelines for tax documentation, including memos. It is essential to adhere to these guidelines to avoid penalties and ensure compliance. Key aspects include maintaining accurate records, timely filing, and providing clear documentation of all deductions and credits claimed. Tax memos should also be prepared in accordance with IRS standards to support any claims made in the taxpayer's return.

Filing deadlines / important dates

Filing deadlines for tax-related documents, including memos, can vary based on the type of tax and the taxpayer's situation. For individual taxpayers, the standard deadline for filing federal income tax returns is April 15. However, extensions may be available, and specific deadlines may apply to different forms of taxation, such as corporate taxes or estate taxes. It is crucial to stay informed about these dates to ensure compliance and avoid late fees.

Penalties for non-compliance

Failure to comply with tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. For tax memos, inaccuracies or omissions can lead to audits or disputes with the IRS. It is vital to ensure that all information is accurate and that the memo is filed on time to avoid these potential consequences.

Quick guide on how to complete tax invoicebill of supplycash memo triplicate for supplier

Effortlessly prepare Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier on any device

Managing documents online has become increasingly favored by organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier with ease

- Find Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your updates.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax invoicebill of supplycash memo triplicate for supplier

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax memo example?

A tax memo example is a document that outlines the key elements of tax-related issues, providing clarity on tax positions and regulations. This example helps businesses understand how to approach tax matters and ensures compliance with tax laws. Using a structured tax memo example can enhance communication with stakeholders regarding tax strategies.

-

How can airSlate SignNow help with creating tax memo examples?

airSlate SignNow provides a user-friendly platform that streamlines the creation and signing of documents, including tax memo examples. With customizable templates, users can easily draft a tax memo example tailored to their needs while ensuring all relevant information is included. The platform's eSigning features allow for quick approval and distribution, enhancing efficiency.

-

Are there any costs associated with using airSlate SignNow for tax memo examples?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including tools for creating tax memo examples. Pricing is competitive and reflects the comprehensive features available, including document storage and custom branding. Prospective customers can choose a plan that best fits their volume of document needs, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other applications for tax memo examples?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This capability allows users to access and manage their documents, including tax memo examples, across different platforms efficiently. Integrations streamline your workflow, making it easier to collaborate on tax-related documents.

-

What features does airSlate SignNow offer for tax memo examples?

airSlate SignNow includes several features designed to enhance the creation of tax memo examples, such as customizable templates, cloud storage, and advanced eSigning capabilities. Users can easily create, edit, and share their tax memo examples in real-time, ensuring collaboration and quick resolution of tax matters. Automation features also help minimize errors and save time.

-

How secure is the information in my tax memo examples with airSlate SignNow?

Security is a top priority for airSlate SignNow, which employs bank-level encryption to protect your documents, including tax memo examples. The platform also includes features such as user authentication and audit trails to ensure that your tax memos are secure and compliant. This level of security gives businesses confidence when handling sensitive tax information.

-

What are the benefits of using airSlate SignNow for tax memo examples?

Using airSlate SignNow for tax memo examples enhances efficiency, reduces turnaround times, and offers a cost-effective solution for document management. With its intuitive design, users can create and sign tax memos quickly, facilitating better communication and decision-making. The ability to collaborate in real time also ensures that all stakeholders stay informed and engaged.

Get more for Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier

Find out other Tax InvoiceBill Of SupplyCash Memo Triplicate For Supplier

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast