990ez Schedule a Form 2017

What is the 990ez Schedule A Form

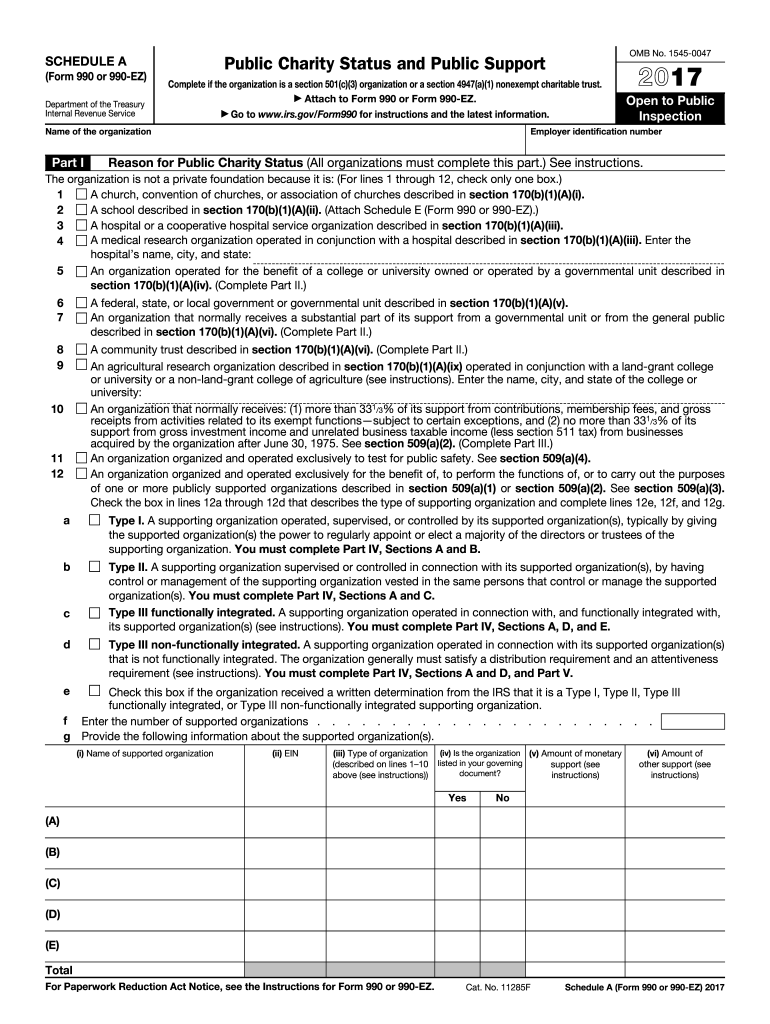

The 990ez Schedule A Form is a supplementary document required for certain tax-exempt organizations in the United States. It is part of the larger 990 and 990-EZ forms, which are used to report financial information to the IRS. This form provides detailed information about the organization’s public charity status and the sources of its public support. Nonprofit organizations typically use this form to demonstrate their compliance with federal tax regulations and to maintain their tax-exempt status.

How to use the 990ez Schedule A Form

Using the 990ez Schedule A Form involves several steps to ensure accurate reporting. First, organizations must gather relevant financial data, including income sources and donation records. Next, the form should be filled out carefully, paying close attention to the specific sections that require detailed information about public support and revenue. After completing the form, organizations must review it for accuracy before submission to the IRS. Utilizing digital tools, such as fillable templates, can streamline this process and help ensure that all required fields are completed correctly.

Steps to complete the 990ez Schedule A Form

Completing the 990ez Schedule A Form can be simplified by following these steps:

- Gather all necessary financial documents, including income statements and records of donations.

- Access the 990ez Schedule A Form, either through the IRS website or a digital platform that offers fillable forms.

- Fill out the form, ensuring that each section is completed accurately. Pay special attention to the public support section.

- Review the completed form to check for any errors or omissions.

- Submit the form to the IRS by the due date, which is typically May 15th for most organizations.

Filing Deadlines / Important Dates

Filing deadlines for the 990ez Schedule A Form are crucial for maintaining compliance. Generally, the form must be submitted by May 15th of the year following the end of the organization’s fiscal year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Organizations should also be aware of any extensions that may be available, allowing them additional time to file their forms without penalties.

Legal use of the 990ez Schedule A Form

The 990ez Schedule A Form serves a legal purpose in the context of tax-exempt organizations. It is used to report information required by the IRS to confirm an organization’s tax-exempt status. Accurate completion and timely submission of this form are essential to avoid penalties and maintain compliance with federal tax laws. Organizations should ensure that they understand the legal implications of the information reported on this form, as inaccuracies can lead to audits or loss of tax-exempt status.

Key elements of the 990ez Schedule A Form

Key elements of the 990ez Schedule A Form include:

- Public charity status: Organizations must indicate their classification as a public charity.

- Public support: Detailed reporting on the sources and amounts of public support received.

- Financial data: Information regarding the organization’s income, expenses, and assets.

- Compliance information: Statements confirming adherence to IRS regulations for tax-exempt organizations.

Quick guide on how to complete 990ez schedule a 2017 2018 form

Uncover the most efficient method to complete and endorse your 990ez Schedule A Form

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to complete and endorse your 990ez Schedule A Form and associated forms for public services. Our advanced eSignature solution equips you with all the tools necessary to manage documents swiftly and in line with official requirements - including robust PDF editing, handling, securing, endorsing, and sharing capabilities all accessible within an easy-to-use interface.

Only a few steps are needed to finalize and endorse your 990ez Schedule A Form:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to input in your 990ez Schedule A Form.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the sections with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Cover areas that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and complete your task with the Done button.

Store your finished 990ez Schedule A Form in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile file sharing. There's no need to print your forms when you can submit them to the appropriate public office - use email, fax, or request a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct 990ez schedule a 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 990ez schedule a 2017 2018 form

How to create an eSignature for the 990ez Schedule A 2017 2018 Form online

How to generate an electronic signature for your 990ez Schedule A 2017 2018 Form in Chrome

How to make an eSignature for putting it on the 990ez Schedule A 2017 2018 Form in Gmail

How to generate an eSignature for the 990ez Schedule A 2017 2018 Form straight from your smart phone

How to generate an electronic signature for the 990ez Schedule A 2017 2018 Form on iOS devices

How to generate an eSignature for the 990ez Schedule A 2017 2018 Form on Android OS

People also ask

-

What is the 990ez Schedule A Form?

The 990ez Schedule A Form is a part of the IRS Form 990 series, specifically designed for smaller tax-exempt organizations. It provides a streamlined way for these organizations to report their financial activities, ensuring compliance with federal regulations. Understanding how to correctly fill out the 990ez Schedule A Form is essential for maintaining your organization's tax-exempt status.

-

How can airSlate SignNow help with the 990ez Schedule A Form?

airSlate SignNow simplifies the process of completing and signing the 990ez Schedule A Form digitally. Our platform allows you to fill out the form, send it for eSignature, and track its status, all in one user-friendly interface. This efficiency not only saves time but also ensures that your form is completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for the 990ez Schedule A Form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, starting from a cost-effective basic plan. Each plan provides access to essential features for managing documents, including the 990ez Schedule A Form. You can choose a plan that fits your budget and unlock additional functionalities as your organization grows.

-

What features does airSlate SignNow offer for managing the 990ez Schedule A Form?

airSlate SignNow includes features like document templates, eSignature capabilities, and automated workflows specifically for the 990ez Schedule A Form. These tools streamline the process of preparing and signing your form, reducing the risk of errors and ensuring compliance. Additionally, you can easily integrate with other applications to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for my 990ez Schedule A Form?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, such as CRMs and accounting tools. This means you can easily manage your 990ez Schedule A Form alongside other business processes, improving overall productivity and data accuracy.

-

What are the benefits of using airSlate SignNow for the 990ez Schedule A Form?

Using airSlate SignNow for the 990ez Schedule A Form offers numerous benefits, including increased efficiency, enhanced security, and ease of use. You can complete and sign documents from anywhere, at any time, which is especially helpful for organizations with remote teams. Moreover, our platform helps you stay compliant with IRS regulations by providing a clear and organized way to manage your forms.

-

Is airSlate SignNow secure for signing the 990ez Schedule A Form?

Yes, airSlate SignNow prioritizes your security with advanced encryption and secure data storage. When signing the 990ez Schedule A Form on our platform, your information is protected, ensuring confidentiality and compliance with data protection regulations. You can trust that your sensitive documents are safe with us.

Get more for 990ez Schedule A Form

Find out other 990ez Schedule A Form

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document