Form K 1 2018

What is the Form K-1?

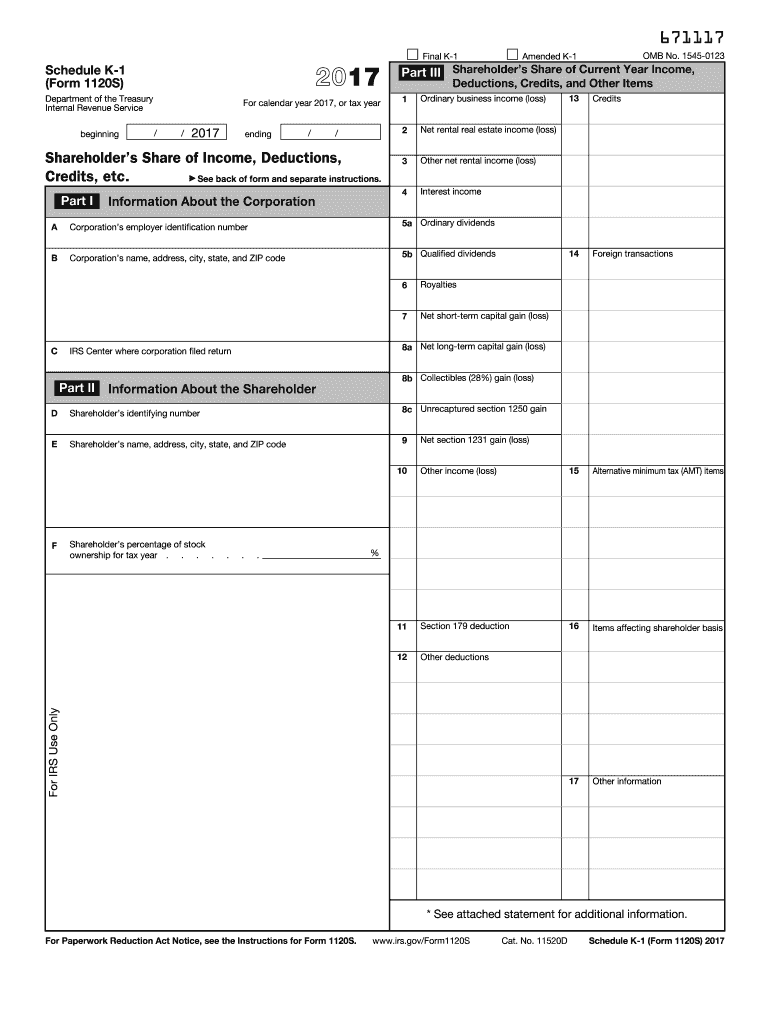

The Form K-1 is a tax document used to report income, deductions, and credits from partnerships, S-corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income and losses, which they must report on their personal tax returns. This form is essential for ensuring that all income is accurately reported to the Internal Revenue Service (IRS) and that partners or shareholders fulfill their tax obligations based on their share of the entity's profits.

Steps to complete the Form K-1

Completing the Form K-1 involves several steps to ensure accuracy and compliance with IRS regulations. Here’s a straightforward guide:

- Gather necessary financial information, including income, deductions, and credits related to the partnership or S-corporation.

- Open the Form K-1 template using a reliable digital platform.

- Fill in Part I with the entity's details, including name, address, and Employer Identification Number (EIN).

- In Part II, enter the partner’s or shareholder's information, such as name and address.

- Complete Part III by providing the relevant financial figures, ensuring that only applicable fields are filled out.

- Review the completed form for accuracy before saving or sending it.

How to obtain the Form K-1

The Form K-1 can be obtained from various sources, depending on the entity type. Partnerships and S-corporations typically provide the form to their partners or shareholders at the end of the tax year. If you are a partner or shareholder, you should receive your K-1 directly from the entity. Alternatively, the form is available on the IRS website for download, ensuring that you have access to the most current version. It is crucial to use the correct form for the tax year you are filing.

IRS Guidelines

Understanding the IRS guidelines for the Form K-1 is essential for compliance. The IRS requires that all income, deductions, and credits reported on the K-1 be accurately reflected on the individual tax returns of partners or shareholders. The form must be filed with the IRS along with the entity's tax return. Additionally, the IRS provides specific instructions on how to fill out the form, including what information must be reported and deadlines for submission. Familiarizing yourself with these guidelines can help prevent errors and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form K-1 are crucial to ensure compliance with IRS regulations. Generally, partnerships and S-corporations must file their tax returns by March 15. Consequently, they should provide K-1 forms to their partners or shareholders by this date as well. Individual partners or shareholders must then report the information from their K-1 on their personal tax returns, typically due by April 15. It is essential to be aware of these deadlines to avoid late filing penalties.

Penalties for Non-Compliance

Failing to file the Form K-1 or inaccuracies in reporting can lead to significant penalties. The IRS imposes fines for late filing, which can accumulate over time. Additionally, if the information reported on the K-1 does not match what the IRS has on record, it may trigger an audit or further scrutiny of the taxpayer's return. Ensuring that the K-1 is completed accurately and submitted on time is vital to avoid these potential consequences.

Quick guide on how to complete form k 1 2017 2018

Discover the simplest method to complete and endorse your Form K 1

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and endorse your Form K 1 and related forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle documents swiftly and in line with official standards - powerful PDF editing, management, protection, signing, and sharing tools all readily available within a user-friendly interface.

Only a few steps are required to complete and endorse your Form K 1:

- Load the editable template into the editor with the Get Form button.

- Review what information you need to include in your Form K 1.

- Navigate through the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Blackout sections that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and complete your task with the Done button.

Store your finalized Form K 1 in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also provides versatile file sharing options. There's no requirement to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form k 1 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the form k 1 2017 2018

How to generate an electronic signature for the Form K 1 2017 2018 online

How to generate an electronic signature for your Form K 1 2017 2018 in Google Chrome

How to create an eSignature for signing the Form K 1 2017 2018 in Gmail

How to create an eSignature for the Form K 1 2017 2018 right from your mobile device

How to generate an electronic signature for the Form K 1 2017 2018 on iOS devices

How to generate an electronic signature for the Form K 1 2017 2018 on Android devices

People also ask

-

What is Form K 1 and how is it used in business?

Form K 1 is a tax document used to report income, deductions, and credits from partnerships or S corporations. It provides partners or shareholders with the necessary information to include on their personal tax returns. Understanding how to effectively manage Form K 1 is essential for accurate tax reporting.

-

How can airSlate SignNow help with Form K 1 management?

airSlate SignNow streamlines the process of sending and signing Form K 1 documents electronically, ensuring that all partners receive their forms quickly and efficiently. Our user-friendly platform allows for easy tracking and management of these important tax documents, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form K 1 documents?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Each plan includes features specifically designed to simplify the handling of Form K 1, making it a cost-effective solution for managing your document needs.

-

What features does airSlate SignNow offer for Form K 1 eSigning?

With airSlate SignNow, you can easily eSign Form K 1 documents, track their status, and send reminders to recipients. Our platform supports multiple file formats and offers customizable workflows, ensuring that your Form K 1 processes are efficient and compliant.

-

Can I integrate airSlate SignNow with other software for Form K 1 processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business software, allowing for efficient data flow and management of Form K 1 documents. This integration helps streamline your workflows and reduces the need for manual data entry.

-

What benefits does airSlate SignNow provide for managing Form K 1 documents?

Using airSlate SignNow for Form K 1 management provides numerous benefits, including enhanced security for sensitive tax information, faster turnaround times for document signing, and improved organization of your tax-related documents. Our platform also promotes collaboration among team members for better accuracy.

-

How secure is my data when using airSlate SignNow for Form K 1?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your Form K 1 documents and any sensitive information are protected. You can trust us to keep your data safe while you manage your eSigning needs.

Get more for Form K 1

Find out other Form K 1

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document