Massachusetts Schedule C Form

What is the Massachusetts Schedule C

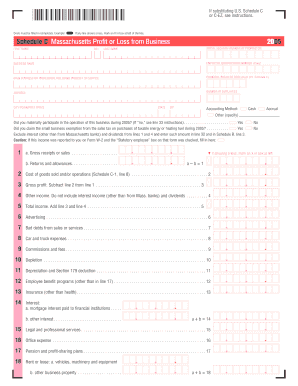

The Massachusetts Schedule C is a tax form used by self-employed individuals and business owners to report income earned from their business activities. This form is essential for individuals who operate as sole proprietors, freelancers, or independent contractors. It allows taxpayers to detail their business income and expenses, ultimately determining their taxable income for the state of Massachusetts. The Schedule C is a vital component of the Massachusetts personal income tax return, ensuring that self-employed individuals comply with state tax regulations.

How to use the Massachusetts Schedule C

Using the Massachusetts Schedule C involves several steps to accurately report your business income and expenses. First, gather all relevant financial documents, including income statements, receipts, and records of expenses. Next, complete the form by entering your gross income, followed by your business expenses, which may include costs like supplies, utilities, and advertising. After calculating your net profit or loss, ensure all figures are accurate and complete. Finally, attach the Schedule C to your Massachusetts personal income tax return when filing.

Steps to complete the Massachusetts Schedule C

Completing the Massachusetts Schedule C requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary financial records, including income and expense documentation.

- Fill in your business information at the top of the form, including your name and Social Security number.

- Report your gross receipts or sales in the designated section.

- List all allowable business expenses in the appropriate categories, ensuring you have documentation for each.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Review the completed form for accuracy and completeness.

- Attach the Schedule C to your Massachusetts personal income tax return.

Legal use of the Massachusetts Schedule C

The legal use of the Massachusetts Schedule C is governed by state tax laws, which require accurate reporting of income and expenses for self-employed individuals. To ensure compliance, it is crucial to maintain thorough records and documentation of all business transactions. The information provided on the Schedule C must reflect true and accurate figures to avoid potential penalties or audits from the Massachusetts Department of Revenue. Utilizing electronic filing options can enhance the security and efficiency of submitting your Schedule C.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Schedule C align with the personal income tax return deadlines. Typically, the due date for filing your Massachusetts personal income tax return, including the Schedule C, is April fifteenth of each year. If you require additional time, you may file for an extension, which generally provides an extra six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When completing the Massachusetts Schedule C, certain documents are essential for accurate reporting. These include:

- Income statements or 1099 forms that detail all earnings.

- Receipts for business expenses, such as supplies, utilities, and travel.

- Bank statements that reflect business transactions.

- Previous year’s tax return for reference and consistency.

Examples of using the Massachusetts Schedule C

Examples of using the Massachusetts Schedule C can include various scenarios for self-employed individuals. For instance, a freelance graphic designer would report income from client projects, along with expenses for software subscriptions and office supplies. Similarly, a consultant would detail income from contracts while deducting expenses related to travel and marketing. Each example highlights the importance of accurately reporting income and expenses to ensure compliance with state tax laws.

Quick guide on how to complete massachusetts schedule c

Complete Massachusetts Schedule C effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without any hold-ups. Handle Massachusetts Schedule C on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Massachusetts Schedule C with ease

- Obtain Massachusetts Schedule C and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Massachusetts Schedule C and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts schedule c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mass schedule c?

Mass schedule c refers to the method used for coordinating and managing tax collection for various entities. It helps businesses ensure they meet their tax obligations efficiently. Understanding mass schedule c is crucial for proper financial planning and compliance.

-

How can airSlate SignNow assist with mass schedule c?

airSlate SignNow offers tools that streamline document management, which is essential for handling mass schedule c efficiently. With our eSignature capabilities, you can easily collect signatures on tax-related documents. This simplification allows your business to focus more on core tasks rather than administrative burdens.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides a range of pricing plans tailored to fit different business needs, including those focusing on mass schedule c. Our plans are designed to be cost-effective, helping businesses save money while effectively managing their document signing processes. You can choose the option that best fits your organizational requirements.

-

Are there any integrations available for mass schedule c?

Yes, airSlate SignNow integrates seamlessly with various applications that are useful for managing mass schedule c. This includes popular accounting, CRM, and productivity tools that enhance your workflow. Such integrations enable a smoother operational process and ensure that your document handling aligns with other business functions.

-

What features does airSlate SignNow offer to support mass schedule c?

AirSlate SignNow includes features specifically designed to support mass schedule c, such as customizable templates and automated reminders. These features enhance efficiency and ensure that you never miss deadlines related to tax filings or document signings. With our user-friendly interface, managing these tasks becomes signNowly easier.

-

How does airSlate SignNow ensure document security for mass schedule c?

airSlate SignNow prioritizes the security of your documents, especially those pertaining to mass schedule c. We use advanced encryption methods and offer authentication options to protect sensitive information. This commitment to security gives you peace of mind when signing and sending important tax-related documents.

-

Can airSlate SignNow help streamline the tax filing process?

Absolutely, airSlate SignNow can help streamline the tax filing process related to mass schedule c by providing an efficient way to prepare and sign necessary documents. Our system allows for easy tracking of document status and ensures that all required forms are completed correctly. This enhances your workflow and reduces the risk of errors.

Get more for Massachusetts Schedule C

Find out other Massachusetts Schedule C

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now