Nebraska Department of Revenue Form 6

What is the Nebraska Department of Revenue Form 6

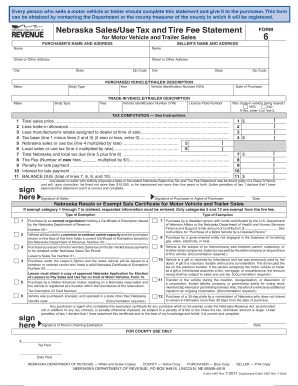

The Nebraska Department of Revenue Form 6 is officially known as the Nebraska Sales Use Tax and Tire Fee Statement. This form is primarily used to report and pay sales tax on vehicle purchases in Nebraska. It serves as a crucial document for individuals and businesses involved in buying or selling vehicles, ensuring compliance with state tax regulations. The form captures essential information such as the purchase price, vehicle identification number (VIN), and details about the buyer and seller.

How to use the Nebraska Department of Revenue Form 6

Utilizing the Nebraska Sales Tax Form 6 involves several steps. First, ensure you have the correct version of the form, which can be obtained from the Nebraska Department of Revenue website or through authorized distribution points. Once you have the form, fill it out by entering the required information accurately. This includes details about the vehicle, the transaction, and the parties involved. After completing the form, you can submit it along with the necessary payment to the appropriate state office, either online or via traditional mail.

Steps to complete the Nebraska Department of Revenue Form 6

Completing the Nebraska Sales Tax Form 6 requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary documents, including the vehicle title and proof of purchase.

- Download or request the Nebraska Form 6 from the Nebraska Department of Revenue.

- Fill in your personal information, including name, address, and contact details.

- Provide details about the vehicle, including the VIN, make, model, and year.

- Enter the purchase price and calculate the applicable sales tax.

- Review the completed form for accuracy.

- Submit the form along with payment, ensuring you keep a copy for your records.

Legal use of the Nebraska Department of Revenue Form 6

The Nebraska Sales Use Tax and Tire Fee Statement is legally binding when filled out correctly and submitted as required. To ensure its legal validity, the form must be completed in accordance with Nebraska state laws regarding vehicle sales and taxation. This includes providing accurate information and adhering to submission deadlines. Failure to comply with these regulations may result in penalties or delays in processing the vehicle title.

Key elements of the Nebraska Department of Revenue Form 6

Several key elements are essential for the Nebraska Form 6 to be considered complete and valid. These include:

- Purchaser Information: Name, address, and contact details of the buyer.

- Seller Information: Name, address, and contact details of the seller.

- Vehicle Details: VIN, make, model, year, and purchase price.

- Sales Tax Calculation: Accurate calculation of the sales tax based on the purchase price.

- Signature: Required signatures from both the buyer and seller to validate the transaction.

Form Submission Methods

The Nebraska Sales Tax Form 6 can be submitted through various methods to accommodate different preferences. These methods include:

- Online Submission: Many users prefer to complete and submit the form electronically through the Nebraska Department of Revenue’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate state office along with the payment.

- In-Person: Individuals may also choose to submit the form in person at designated state offices for immediate processing.

Quick guide on how to complete nebraska department of revenue form 6

Complete Nebraska Department Of Revenue Form 6 effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It presents an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without any delays. Manage Nebraska Department Of Revenue Form 6 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Nebraska Department Of Revenue Form 6 with ease

- Obtain Nebraska Department Of Revenue Form 6 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Department Of Revenue Form 6 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska department of revenue form 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 6 Nebraska' and why is it important?

The 'form 6 Nebraska' is a crucial document for various official processes within the state. Understanding its requirements and proper submission can help ensure compliance with Nebraska's regulations, which is essential for businesses operating in the area.

-

How can airSlate SignNow assist with completing the form 6 Nebraska?

airSlate SignNow simplifies the process of completing the form 6 Nebraska by providing templates and easy eSignature capabilities. Our platform allows users to fill out and send the form electronically, signNowly reducing paperwork and increasing efficiency.

-

Is there a cost associated with using airSlate SignNow for the form 6 Nebraska?

Yes, airSlate SignNow offers various subscription plans that accommodate different business needs. Investing in our services for handling the form 6 Nebraska can lead to saved time and resources, making it a cost-effective solution for document management.

-

What features does airSlate SignNow provide for the form 6 Nebraska?

Our platform provides features such as document templates, eSigning, file sharing, and compliance tracking specifically tailored for the form 6 Nebraska. These tools facilitate easy and secure submission, ensuring that your documents are handled effectively.

-

Can I track the status of my submitted form 6 Nebraska with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your submitted form 6 Nebraska in real time. This feature gives you peace of mind knowing exactly where your document stands in the process.

-

Does airSlate SignNow integrate with other software for managing the form 6 Nebraska?

Yes, airSlate SignNow seamlessly integrates with various platforms such as CRM systems and project management tools for managing the form 6 Nebraska. This integration helps streamline your workflows, making document management more efficient.

-

What are the benefits of using airSlate SignNow for the form 6 Nebraska?

Using airSlate SignNow for the form 6 Nebraska offers numerous benefits, including enhanced security, reduced turnaround times, and increased operational efficiency. Our user-friendly platform ensures that you can focus on your business rather than paperwork.

Get more for Nebraska Department Of Revenue Form 6

Find out other Nebraska Department Of Revenue Form 6

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship