It 245 Form

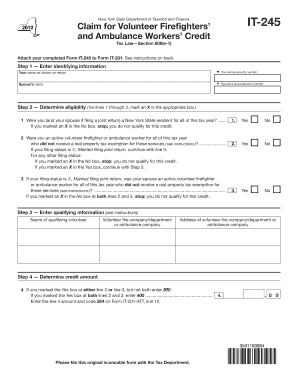

What is the IT 245?

The IT 245 is a form used in the state of New York for tax purposes, specifically related to the calculation of certain tax credits. It serves as a declaration for taxpayers to report their eligibility for various credits that may reduce their overall tax liability. Understanding the specifics of the IT 245 is crucial for ensuring accurate tax filings and maximizing potential refunds.

How to use the IT 245

To effectively use the IT 245, taxpayers should first gather all necessary documentation related to their income, deductions, and any applicable tax credits. The form requires specific information about the taxpayer's financial situation, including income sources and amounts. After filling out the form, it should be submitted alongside the main tax return to the appropriate tax authority, ensuring all information is accurate and complete to avoid delays or penalties.

Steps to complete the IT 245

Completing the IT 245 involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099s.

- Review the instructions for the IT 245 to understand the required information.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the form for any errors or omissions.

- Submit the completed IT 245 with your tax return by the designated deadline.

Legal use of the IT 245

The IT 245 must be used in compliance with state tax laws. It is essential for taxpayers to understand that submitting this form is a legal declaration of their eligibility for tax credits. Misrepresentation or errors on the form can lead to penalties, including fines or audits. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding the completion or submission of the IT 245.

Filing Deadlines / Important Dates

Filing deadlines for the IT 245 align with the general tax filing deadlines in New York. Typically, individual tax returns are due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that their IT 245 is submitted by this date to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the IT 245 accurately, taxpayers need to provide various documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any deductions or credits being claimed

- Previous year’s tax return for reference

Eligibility Criteria

Eligibility for using the IT 245 varies based on specific tax credits and the taxpayer's financial situation. Generally, individuals must meet income thresholds and other requirements set forth by the New York State Department of Taxation and Finance. It is crucial for taxpayers to review these criteria carefully to determine their eligibility before submitting the form.

Quick guide on how to complete it 245

Effortlessly Complete It 245 on Any Device

Digital document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage It 245 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign It 245 without hassle

- Locate It 245 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow handles all your document management needs with just a few clicks from any device you prefer. Alter and eSign It 245 and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 245

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IT 245 in relation to airSlate SignNow?

IT 245 refers to our specialized solutions and integrations designed for organizations looking to streamline their document management processes. With airSlate SignNow, businesses can easily eSign documents while ensuring compliance and security. Our IT 245 framework supports a variety of customizable workflows.

-

How does airSlate SignNow's IT 245 enhance document workflows?

The IT 245 features allow users to automate repetitive tasks and manage document flows efficiently. By leveraging airSlate SignNow for IT 245, businesses can reduce turnaround times and minimize human error. This integration supports seamless collaboration across teams and departments.

-

What pricing plans are available for the IT 245 features?

airSlate SignNow offers various pricing tiers tailored to diverse business needs. Our IT 245 features are included in these plans to ensure all users can access essential tools without financial strain. Detailed pricing information can be found on our website.

-

Can airSlate SignNow's IT 245 integrate with other software?

Yes, airSlate SignNow's IT 245 capabilities allow for easy integration with popular software platforms such as CRM systems and document management tools. This flexibility enables users to connect their preferred applications and streamline their processes efficiently. The integration ensures that data flows seamlessly across systems.

-

What benefits does airSlate SignNow offer with IT 245 functionalities?

By utilizing airSlate SignNow's IT 245 functionalities, businesses can improve efficiency, reduce costs, and enhance security in document management. These benefits lead to faster transaction times and a more streamlined experience for both employees and clients. Ultimately, IT 245 contributes to improved productivity and customer satisfaction.

-

Is airSlate SignNow suitable for small businesses using IT 245?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises looking to implement IT 245. With its cost-effective solutions, small businesses can reduce paperwork and focus on what matters most—growing their operations. Our user-friendly platform supports easy adoption and implementation.

-

How can I get support for issues related to IT 245 on airSlate SignNow?

For support related to IT 245 features, airSlate SignNow provides a comprehensive help center and dedicated customer support. Users can access tutorials, FAQs, and live assistance to help troubleshoot any challenges they may encounter. Our team is committed to ensuring a smooth experience with IT 245.

Get more for It 245

Find out other It 245

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed