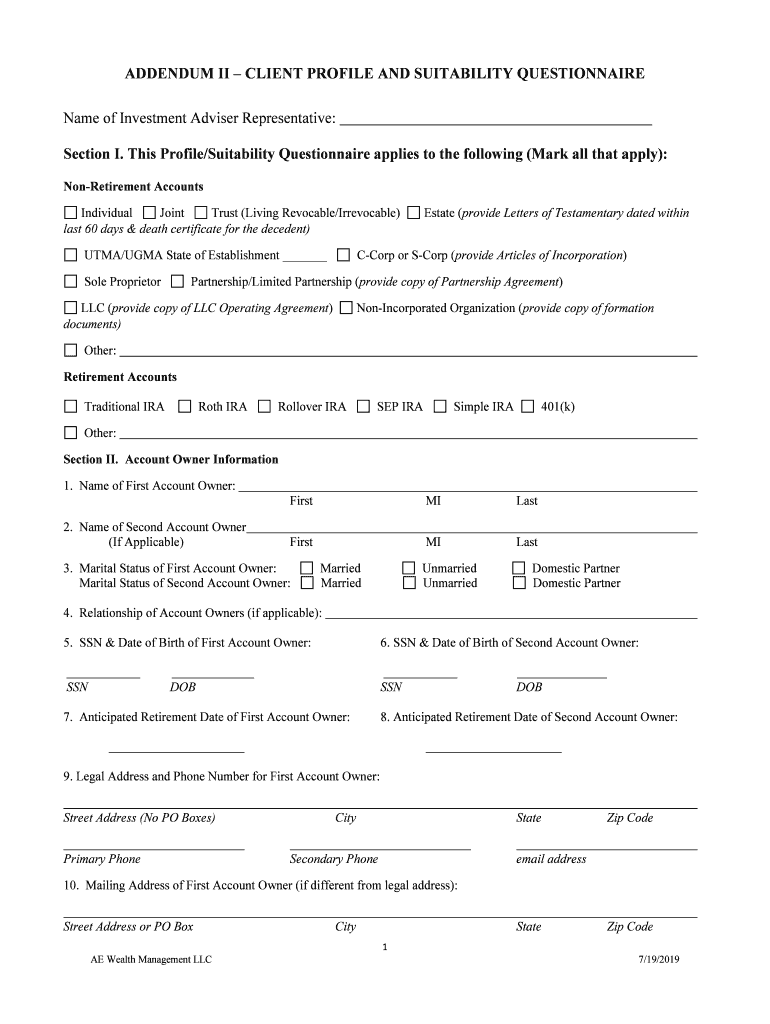

Suitability Questionnaire Form

What is the investor suitability questionnaire?

The investor suitability questionnaire is a critical tool used by financial institutions to assess an individual's investment profile. It gathers essential information regarding a person's financial situation, investment goals, risk tolerance, and experience. This questionnaire helps advisers determine whether specific investment products are appropriate for the client, ensuring that recommendations align with their unique circumstances.

Typically, the questionnaire covers various aspects, including:

- Personal financial information

- Investment objectives

- Time horizon for investments

- Risk tolerance levels

- Previous investment experience

By understanding these factors, advisers can provide tailored investment strategies that meet the client's needs and preferences.

Steps to complete the investor suitability questionnaire

Completing the investor suitability questionnaire involves several straightforward steps that ensure accurate and comprehensive responses. Follow these steps to effectively fill out the form:

- Gather financial documents: Collect relevant financial statements, tax returns, and investment records to provide accurate information.

- Read instructions carefully: Review any guidelines provided with the questionnaire to understand what information is required.

- Answer all questions: Provide detailed responses to each question, ensuring that you are honest and thorough.

- Review your answers: Double-check your responses for accuracy and completeness before submission.

- Submit the questionnaire: Follow the specified submission method, whether online or via traditional mail.

Completing these steps will help ensure that the questionnaire accurately reflects your investment profile, leading to better financial advice.

Legal use of the investor suitability questionnaire

The investor suitability questionnaire is not only a practical tool but also has legal implications. Financial institutions are required to adhere to regulations that protect investors, making the completion of this questionnaire a legal necessity in many cases. By filling out the questionnaire, clients provide consent for their financial advisers to assess their suitability for various investment products.

Compliance with regulations such as the Securities Exchange Commission (SEC) guidelines ensures that advisers act in the best interest of their clients. Proper documentation of the suitability assessment can protect both the adviser and the client in case of disputes or legal challenges regarding investment recommendations.

Key elements of the investor suitability questionnaire

Understanding the key elements of the investor suitability questionnaire can enhance your ability to provide accurate information. The following components are typically included:

- Personal Information: Name, address, and contact details.

- Financial Status: Income, net worth, and existing investments.

- Investment Goals: Short-term and long-term objectives, such as retirement planning or wealth accumulation.

- Risk Tolerance: Assessment of how much risk the investor is willing to take, often categorized as conservative, moderate, or aggressive.

- Investment Experience: Previous experience with various types of investments, including stocks, bonds, mutual funds, and alternative investments.

These elements are crucial for advisers to create a suitable investment strategy that aligns with the client's expectations and financial situation.

How to obtain the investor suitability questionnaire

Obtaining the investor suitability questionnaire is a straightforward process. Clients typically receive this form from their financial advisers or investment firms. Here are the common ways to access the questionnaire:

- Directly from your adviser: Many advisers provide the questionnaire during initial consultations or as part of their onboarding process.

- Online portals: Financial institutions often have secure online platforms where clients can download or complete the questionnaire electronically.

- Request via email: Clients can request the questionnaire through email or by contacting customer service at their investment firm.

Ensuring you have the correct and updated version of the questionnaire is essential for accurate assessment and compliance.

Examples of using the investor suitability questionnaire

The investor suitability questionnaire is utilized in various scenarios to tailor investment strategies to individual clients. Here are some examples of its application:

- New Client Onboarding: When a new client engages with a financial adviser, the questionnaire helps establish a baseline for investment recommendations.

- Portfolio Reviews: Existing clients may complete the questionnaire periodically to reassess their investment goals and risk tolerance as life circumstances change.

- Compliance Checks: Financial institutions may use the questionnaire to ensure ongoing compliance with regulatory standards and to document the suitability of investment recommendations.

These examples illustrate the versatility of the investor suitability questionnaire in facilitating informed investment decisions and maintaining regulatory compliance.

Quick guide on how to complete suitability questionnaire

Complete Suitability Questionnaire effortlessly on any device

Online document management has become widely adopted by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Suitability Questionnaire on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Suitability Questionnaire with ease

- Find Suitability Questionnaire and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select the method by which you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Suitability Questionnaire and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the suitability questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an investor suitability questionnaire?

An investor suitability questionnaire is a tool designed to assess an investor's financial situation, investment goals, and risk tolerance. It helps financial advisors tailor their services to meet the unique needs of each investor. airSlate SignNow simplifies the creation and distribution of these questionnaires, ensuring a smooth eSigning experience.

-

How does airSlate SignNow streamline the investor suitability questionnaire process?

airSlate SignNow provides an intuitive platform for creating, sending, and signing investor suitability questionnaires electronically. Users can easily customize templates to suit their specific requirements, reducing paperwork and improving efficiency. The platform also allows for real-time tracking of document status.

-

What are the pricing options for using airSlate SignNow for investor suitability questionnaires?

airSlate SignNow offers flexible pricing plans catering to various business needs. Users can choose from monthly or annual subscriptions, with options that allow for unlimited document sending and eSigning. This cost-effective solution makes it accessible for businesses of all sizes to handle investor suitability questionnaires.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow offers seamless integrations with popular software applications, allowing users to streamline their workflow. Whether you're using CRM tools, document management systems, or accounting software, you can easily incorporate investor suitability questionnaires into your existing processes. This flexibility enhances overall productivity.

-

What are the benefits of using airSlate SignNow for investor suitability questionnaires?

Using airSlate SignNow for investor suitability questionnaires offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signing process not only saves time but also minimizes the risk of errors associated with manual entries. Additionally, all documents are stored securely, ensuring compliance with legal standards.

-

Is airSlate SignNow compliant with financial regulations for investor suitability questionnaires?

Absolutely! airSlate SignNow is designed to comply with various financial regulations, providing the security and validation needed for investor suitability questionnaires. The platform adheres to eSignature laws, ensuring that electronically signed documents are legally binding and recognized in court, thereby protecting your business and clients.

-

How can I ensure the security of my investor suitability questionnaires in airSlate SignNow?

airSlate SignNow utilizes advanced encryption and security measures to protect your investor suitability questionnaires. All documents are securely stored and accessible only to authorized users, ensuring that sensitive information remains confidential. Additionally, the platform offers audit trails to monitor who accessed the documents and when.

Get more for Suitability Questionnaire

Find out other Suitability Questionnaire

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free