8582 Worksheets 2023

What is the 8582 Worksheets

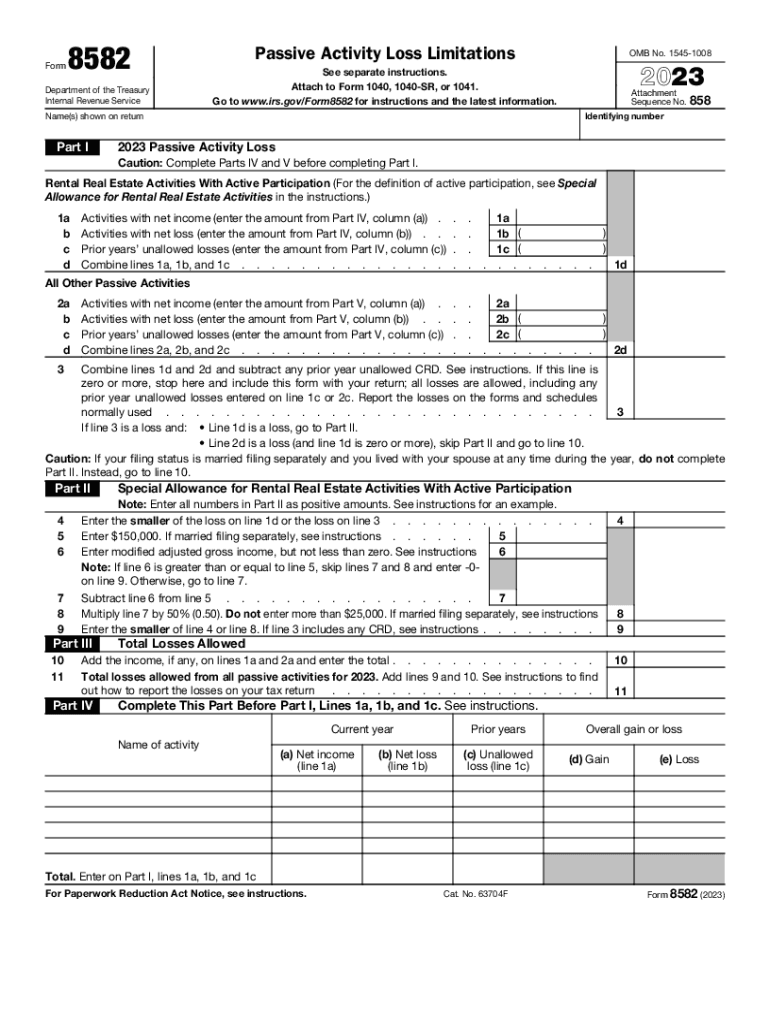

The 8582 Worksheets are essential tools used by taxpayers to report passive activity losses and credits. These worksheets help determine the amount of passive losses that can be deducted against other income, adhering to IRS guidelines. The IRS Form 8582 is specifically designed to track passive activities, which typically include rental real estate and limited partnerships. Understanding how to utilize these worksheets is crucial for accurate tax reporting and compliance.

How to use the 8582 Worksheets

Using the 8582 Worksheets involves several steps to ensure accurate reporting of passive activity losses. Taxpayers must first gather relevant information about their passive activities, including income and losses from rental properties or partnerships. Next, they will complete the worksheets by entering the necessary figures, following the IRS instructions closely. It is important to calculate the allowable losses correctly, as this can affect overall tax liability. Once completed, the worksheets should be attached to the IRS Form 8582 when filing taxes.

Steps to complete the 8582 Worksheets

Completing the 8582 Worksheets requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents related to passive activities.

- Identify and list all passive income and losses.

- Calculate the total passive losses and any carryover from previous years.

- Fill in the worksheets accurately, ensuring all figures are correct.

- Review the completed worksheets for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the 8582 Worksheets. These guidelines outline the rules for determining passive activity losses and the limitations on deducting these losses. Taxpayers should familiarize themselves with the IRS instructions for Form 8582, as it details eligibility criteria, filing requirements, and how to handle unallowed losses. Adhering to these guidelines is essential for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Worksheets align with the overall tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 each year, unless an extension is granted. It is important to keep track of any changes to these dates, especially for specific circumstances such as natural disasters or legislative updates. Missing the deadline may result in penalties or interest on unpaid taxes.

Key elements of the 8582 Worksheets

The 8582 Worksheets include several key elements that are crucial for accurate reporting. These elements consist of sections for listing passive activities, calculating allowable losses, and determining any carryover amounts from previous years. Additionally, the worksheets provide guidance on how to report income and losses correctly, ensuring compliance with IRS regulations. Understanding these elements helps taxpayers navigate the complexities of passive activity loss limitations.

Quick guide on how to complete 8582 worksheets

Complete 8582 Worksheets effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle 8582 Worksheets on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to edit and electronically sign 8582 Worksheets with ease

- Find 8582 Worksheets and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or conceal sensitive information using features specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, frustrating form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign 8582 Worksheets and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8582 worksheets

Create this form in 5 minutes!

How to create an eSignature for the 8582 worksheets

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is passive activity loss in the context of airSlate SignNow?

Passive activity loss refers to losses incurred by a business or investor from rental activities or other passive income sources. In the context of airSlate SignNow, understanding passive activity loss can help users manage documentation related to their financial health and tax implications efficiently.

-

How does airSlate SignNow help manage documents related to passive activity loss?

airSlate SignNow features customizable templates and workflows that help businesses automate their documentation processes. By utilizing our solution, you can easily create, send, and eSign documents related to passive activity loss, ensuring accuracy and compliance with tax regulations.

-

Is airSlate SignNow cost-effective for managing passive activity loss documentation?

Yes, airSlate SignNow offers a cost-effective solution for managing all kinds of documents, including those related to passive activity loss. With our competitive pricing plans, you can streamline your document management without breaking the bank, helping you save both time and money.

-

What key features of airSlate SignNow are beneficial for handling passive activity loss?

Key features of airSlate SignNow include eSigning, document sharing, and secure cloud storage. These features facilitate the quick and compliant handling of documents tied to passive activity loss, making it easier for businesses to keep track of their financial obligations.

-

How can I integrate airSlate SignNow with accounting software to track passive activity loss?

airSlate SignNow offers integrations with popular accounting software, allowing for seamless tracking of financial activities, including passive activity loss. By connecting these tools, you can enhance your document management and ensure all relevant financial data is synchronized and accessible.

-

What benefits does airSlate SignNow provide for businesses dealing with passive activity loss?

Using airSlate SignNow can improve efficiency and accuracy in handling documents related to passive activity loss. The platform's automation capabilities reduce manual errors and ensure that you have easy access to all necessary documentation when needed, ultimately supporting better financial management.

-

Can airSlate SignNow help with compliance regarding passive activity loss documentation?

Absolutely, airSlate SignNow is designed with compliance in mind. Our solution helps users create, store, and send compliant documents related to passive activity loss, making it easier to adhere to legal and financial requirements while minimizing risks.

Get more for 8582 Worksheets

- Bid bond form

- Houston rodeo vendor application form

- Inpatriate health plan enrolmentchange form for employees

- Acknowledgement form california

- Application for waiver form

- New mexico form pit x amended return

- Franklin county area tax bureau fill online printable form

- Pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

Find out other 8582 Worksheets

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document