Otc 901 Form

What is the OTC 901 Form

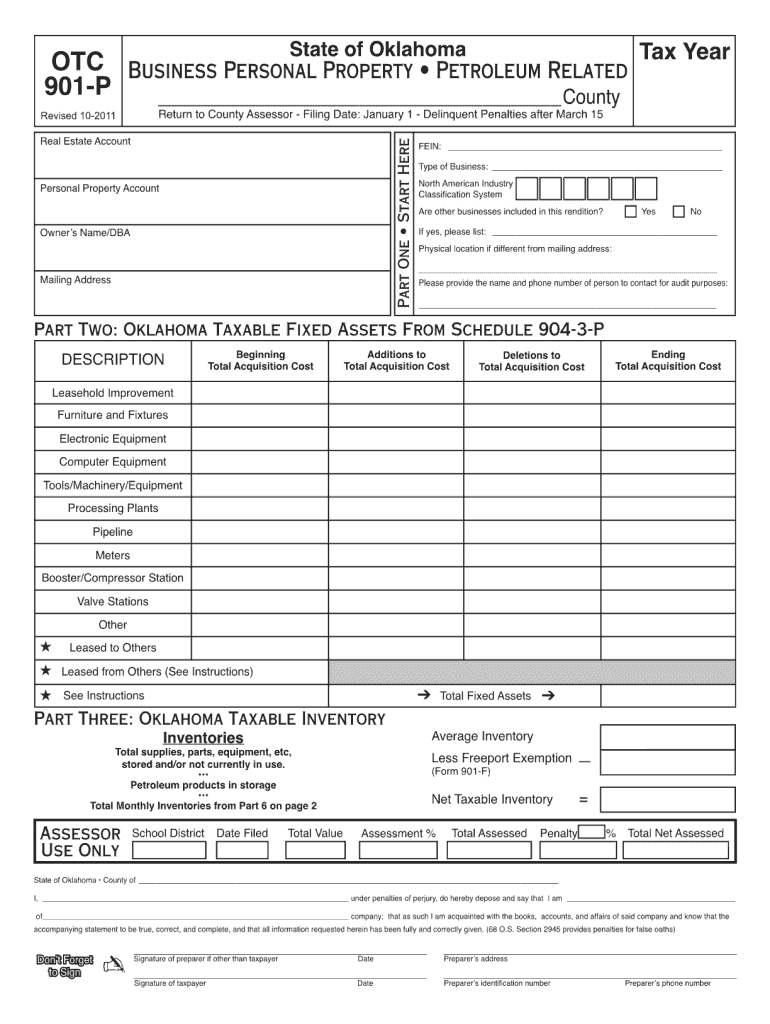

The OTC 901 form is a specific document used in various administrative processes, particularly related to tax and compliance in the United States. This form is essential for individuals and businesses to report certain transactions or claim specific benefits. Understanding the purpose and requirements of the OTC 901 form is crucial for ensuring compliance with relevant regulations.

How to Use the OTC 901 Form

Using the OTC 901 form involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required for the form. This may include personal identification details, financial information, and any supporting documents relevant to the transactions being reported. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submission.

Steps to Complete the OTC 901 Form

Completing the OTC 901 form requires a systematic approach. Follow these steps:

- Gather necessary documents, such as identification and financial records.

- Access the OTC 901 form through official sources.

- Fill in personal information, including name, address, and identification numbers.

- Provide details regarding the specific transactions or claims being reported.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, whether online or via mail.

Legal Use of the OTC 901 Form

The OTC 901 form must be used in accordance with applicable laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. The form serves as a legal document, and improper use or submission of false information can result in penalties or other legal actions.

Key Elements of the OTC 901 Form

Several key elements are essential to the OTC 901 form. These include:

- Personal identification information: Name, address, and identification numbers.

- Details of the transactions or claims being reported.

- Signature and date to validate the information provided.

- Any necessary supporting documentation that substantiates the claims made on the form.

Form Submission Methods

The OTC 901 form can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through designated portals.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Quick guide on how to complete otc 901 form

Effortlessly Create Otc 901 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to produce, modify, and electronically sign your documents swiftly without delays. Manage Otc 901 Form on any device with the airSlate SignNow apps for Android or iOS and enhance your document-centered processes today.

How to Modify and Electronically Sign Otc 901 Form with Ease

- Find Otc 901 Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Otc 901 Form and guarantee excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc 901 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OTC 901 form and why is it important?

The OTC 901 form is a crucial document used for reimbursement of over-the-counter medications through flexible spending accounts (FSAs) and health savings accounts (HSAs). Understanding how to fill and submit the OTC 901 form can signNowly streamline your healthcare expenses. This form ensures that you can access your benefits efficiently without any hassles.

-

How can airSlate SignNow help with the OTC 901 form?

AirSlate SignNow provides a user-friendly platform for electronically signing and managing the OTC 901 form. With easy document sharing and eSigning capabilities, you can complete your OTC 901 form quickly and return it for reimbursement without unnecessary delays. This enhances your experience by making it simple to handle important documents.

-

Is there a cost associated with using the OTC 901 form through airSlate SignNow?

Yes, while using the OTC 901 form itself is free, airSlate SignNow offers subscription plans that allow you to access features like document tracking and unlimited eSignatures. These cost-effective plans cater to individual users as well as businesses handling a large volume of documents. Consider exploring our pricing options to find the best plan for your needs.

-

What features does airSlate SignNow offer for managing the OTC 901 form?

AirSlate SignNow offers several features that make managing the OTC 901 form easier, including templates, eSignature capabilities, and secure cloud storage. You can customize templates for frequently used documents, like the OTC 901 form, to save time. Additionally, all documents are securely stored and can be accessed at any time.

-

Can I integrate airSlate SignNow with other applications for the OTC 901 form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and popular CRMs. This means you can easily upload and access your OTC 901 form from your preferred platform, streamlining your workflow even further and ensuring access to all necessary documents when you need them.

-

What are the benefits of using airSlate SignNow for the OTC 901 form?

Using airSlate SignNow for your OTC 901 form offers multiple benefits, including improved efficiency, security, and convenience. You can eSign documents in just a few clicks, eliminating the need for printing and scanning. Additionally, the platform provides tracking features to monitor the status of your OTC 901 form, ensuring that you don’t miss important deadlines.

-

How do I ensure my OTC 901 form is filled out correctly?

To ensure your OTC 901 form is filled out correctly, it's essential to review the requirements thoroughly before submission. AirSlate SignNow provides intuitive guides and templates that help you accurately complete the form. Additionally, our platform allows you to collaborate with team members for an extra set of eyes before finalizing your submission.

Get more for Otc 901 Form

Find out other Otc 901 Form

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online