From 14039 Form

What is IRS Form 14039?

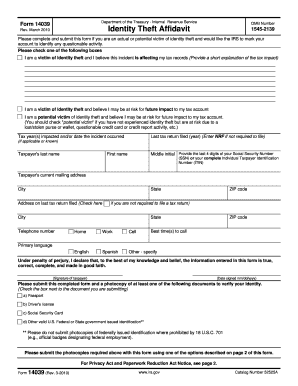

IRS Form 14039, also known as the Identity Theft Affidavit, is a document used by individuals who believe they have been victims of identity theft. This form allows taxpayers to report identity theft to the IRS, enabling them to take necessary steps to protect their tax records and accounts. By submitting Form 14039, individuals can alert the IRS about fraudulent activity linked to their Social Security number, which can help prevent further misuse of their identity.

How to Use IRS Form 14039

Using IRS Form 14039 involves several straightforward steps. First, individuals should gather all relevant information regarding the identity theft incident, including any fraudulent tax returns filed in their name. Next, they must complete the form accurately, providing details such as their personal information and a description of the identity theft. Once completed, the form should be submitted to the IRS, either by mail or electronically, depending on the specific instructions provided on the form.

Steps to Complete IRS Form 14039

Completing IRS Form 14039 requires careful attention to detail. Here are the essential steps:

- Download the form from the IRS website or obtain a printable version.

- Fill out your personal information, including your name, address, and Social Security number.

- Provide a detailed description of the identity theft incident, including any fraudulent activity.

- Sign and date the form to certify the information is accurate.

- Submit the completed form according to IRS instructions, either by mail or electronically.

Legal Use of IRS Form 14039

The legal use of IRS Form 14039 is crucial for individuals affected by identity theft. By reporting identity theft through this form, taxpayers can establish a formal record with the IRS, which is essential for resolving tax-related issues. This form also plays a role in protecting the taxpayer's rights, as it helps the IRS recognize and address fraudulent claims made in their name. Proper use of the form ensures that individuals can take advantage of the protections offered under federal law.

IRS Guidelines for Form 14039 Submission

The IRS provides specific guidelines for submitting Form 14039. Individuals should ensure that they follow the latest instructions outlined on the IRS website. It is important to submit the form as soon as identity theft is suspected to minimize potential tax complications. Additionally, taxpayers should keep a copy of the submitted form for their records, as it may be needed for future reference or follow-up with the IRS.

Required Documents for IRS Form 14039

When submitting IRS Form 14039, certain documents may be required to support the claim of identity theft. These documents can include:

- Copies of any fraudulent tax returns filed in your name.

- Any correspondence received from the IRS regarding the fraudulent activity.

- Proof of identity, such as a government-issued ID or Social Security card.

Providing these documents can help expedite the review process and strengthen your case with the IRS.

Quick guide on how to complete from 14039

Complete From 14039 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to access the appropriate form and securely archive it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage From 14039 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to edit and electronically sign From 14039 with ease

- Obtain From 14039 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure private information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign From 14039 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from 14039

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the irs form 14039 printable and why is it important?

The IRS Form 14039 printable is a crucial document used to report identity theft related to tax returns. By completing this form, individuals can alert the IRS of unauthorized use of their Social Security number, ensuring their tax records are secure and protected.

-

How can airSlate SignNow help with completing the irs form 14039 printable?

AirSlate SignNow simplifies the completion of the irs form 14039 printable by providing an intuitive platform for filling, signing, and sending documents electronically. This ensures that you can efficiently handle sensitive forms while maintaining compliance and security.

-

Is there a cost associated with using airSlate SignNow for the irs form 14039 printable?

AirSlate SignNow offers a range of pricing plans to accommodate different business needs, making it a cost-effective solution for managing the irs form 14039 printable and other documents. You can choose a plan that fits your budget while enjoying a suite of features.

-

What features does airSlate SignNow provide for the irs form 14039 printable?

With airSlate SignNow, you can easily access the irs form 14039 printable, add signatures, and securely store your documents in the cloud. Additional features include real-time tracking, templates, and integration capabilities which enhance your document management efficiency.

-

Can I integrate airSlate SignNow with other applications when working on the irs form 14039 printable?

Yes, airSlate SignNow supports integrations with various applications like Google Drive, Dropbox, and more. This allows you to streamline your workflow and easily access and manage the irs form 14039 printable alongside your other essential documents.

-

How secure is my information when using airSlate SignNow with the irs form 14039 printable?

AirSlate SignNow prioritizes security by using industry-leading encryption protocols to protect your data. When dealing with sensitive documents like the irs form 14039 printable, you can trust that your information remains confidential and secure.

-

Can I save my progress while filling out the irs form 14039 printable on airSlate SignNow?

Absolutely! AirSlate SignNow allows you to save your progress when filling out the irs form 14039 printable. This feature ensures you can complete the form at your convenience without losing any entered information.

Get more for From 14039

Find out other From 14039

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter