Choicelend Discharge 2009-2026

What is the Choicelend Discharge

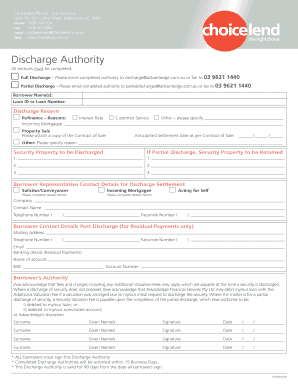

The Choicelend Discharge is a formal document used to release a borrower from the obligations of a loan or mortgage. This discharge is essential for individuals who have fulfilled their repayment terms and wish to clear their financial record. It serves as proof that the loan has been satisfied, ensuring that the borrower is no longer liable for the debt. Understanding this document is crucial for anyone navigating the complexities of loan agreements and financial obligations.

How to use the Choicelend Discharge

Using the Choicelend Discharge involves several steps to ensure that the document is properly filled out and submitted. First, gather all necessary information related to the loan, including account numbers and personal identification. Next, accurately complete the discharge form, ensuring that all details match the original loan documents. Once completed, the form should be submitted to the appropriate authority, typically the lender or a designated agency, to finalize the discharge process.

Steps to complete the Choicelend Discharge

Completing the Choicelend Discharge requires careful attention to detail. Follow these steps:

- Gather relevant documents, including loan agreements and payment records.

- Fill out the Choicelend Discharge form with accurate information.

- Review the form for any errors or omissions.

- Submit the form to the lender or appropriate agency.

- Keep a copy of the submitted form for your records.

Legal use of the Choicelend Discharge

The legal use of the Choicelend Discharge is governed by various regulations that ensure its validity. This document must meet specific criteria to be recognized legally, including proper signatures and adherence to state laws. It is essential for borrowers to understand these legal requirements to avoid complications in the discharge process. Compliance with these regulations safeguards the borrower’s rights and confirms the completion of their financial obligations.

Key elements of the Choicelend Discharge

Several key elements are crucial for the validity of the Choicelend Discharge:

- Borrower Information: Accurate personal details of the borrower must be included.

- Lender Information: The lender's name and contact details should be clearly stated.

- Loan Details: Information about the loan, including account numbers and amounts, is necessary.

- Signatures: Required signatures from both the borrower and lender validate the document.

- Date of Discharge: The date when the discharge is officially recognized should be noted.

Who Issues the Form

The Choicelend Discharge form is typically issued by the lender or financial institution that originally provided the loan. It is essential for borrowers to request this form directly from their lender to ensure they receive the correct version and that all necessary information is included. In some cases, state or federal agencies may also provide guidance on obtaining the discharge form.

Quick guide on how to complete choicelend discharge

Complete Choicelend Discharge effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Choicelend Discharge on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to edit and eSign Choicelend Discharge with ease

- Locate Choicelend Discharge and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Choicelend Discharge while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the choicelend discharge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is choicelend discharge and how does it work?

Choicelend discharge is a straightforward process that allows users to manage their loan release documents electronically. By utilizing airSlate SignNow, users can securely eSign and send these documents, ensuring a quick and efficient experience.

-

What are the benefits of using airSlate SignNow for choicelend discharge?

Using airSlate SignNow for choicelend discharge simplifies document management, making it easier to create, sign, and store essential paperwork. Additionally, it offers enhanced security features, ensuring that all sensitive information is kept safe throughout the process.

-

Is there a cost associated with choosing airSlate SignNow for choicelend discharge?

Yes, airSlate SignNow provides a variety of pricing plans designed to suit different business needs. For those looking for an effective solution for choicelend discharge, there's a plan that balances cost and features, ensuring great value.

-

Can I integrate airSlate SignNow with other software for managing choicelend discharge?

Absolutely! airSlate SignNow offers a wide range of integrations with popular software, facilitating a seamless workflow for choicelend discharge and enhancing productivity. You can easily connect it with your existing tools to streamline the document signing process.

-

How does airSlate SignNow enhance the security of choicelend discharge documents?

AirSlate SignNow employs advanced encryption methods to protect your choicelend discharge documents. With features such as audit trails and secure access controls, users can trust that their documents are safeguarded at all times.

-

What features does airSlate SignNow offer for managing choicelend discharge?

Key features of airSlate SignNow for choicelend discharge include customizable templates, automated workflows, and real-time tracking of document status. These tools are designed to make the process more efficient and user-friendly.

-

Can airSlate SignNow help in reducing the time required for choicelend discharge?

Yes, airSlate SignNow is designed to save time during the choicelend discharge process by allowing users to quickly send, sign, and manage documents electronically. This expedites the overall timeline signNowly compared to traditional methods.

Get more for Choicelend Discharge

Find out other Choicelend Discharge

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later