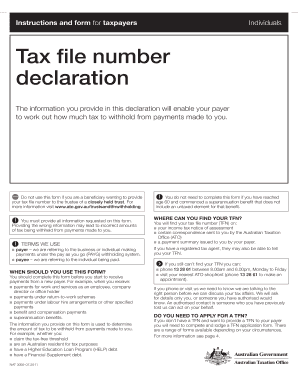

Tax File Number Declaration FM208 Form

What is the Tax File Number Declaration FM208

The Tax File Number Declaration FM208 is a crucial document used in the United States for tax purposes. It serves to inform employers about an employee's tax file number (TFN), ensuring that the correct tax rate is applied to their earnings. This form is particularly important for individuals who may have multiple sources of income or who are new to the workforce. By providing accurate information, the FM208 helps prevent over-taxation and ensures compliance with federal tax regulations.

Steps to Complete the Tax File Number Declaration FM208

Completing the Tax File Number Declaration FM208 involves several straightforward steps. First, download the form in PDF format from a reliable source. Next, fill in your personal details, including your name, address, and TFN. It is essential to double-check the accuracy of the information provided. After completing the form, sign and date it to validate your declaration. Finally, submit the form to your employer, ensuring they have the necessary information to process your tax correctly.

Legal Use of the Tax File Number Declaration FM208

The Tax File Number Declaration FM208 is legally binding when filled out correctly and submitted to the appropriate parties. It complies with the legal frameworks governing eSignatures and digital documentation, such as the ESIGN Act and UETA. This means that when you eSign the form using a trusted platform, it holds the same legal weight as a traditional handwritten signature. Employers are required to keep this form on file to ensure they are withholding the correct amount of tax from your earnings.

Required Documents for the Tax File Number Declaration FM208

When completing the Tax File Number Declaration FM208, certain documents may be needed to support your application. Typically, you will need to provide proof of identity, such as a government-issued ID or Social Security card. Additionally, if you are a new employee, your employer may request other documentation related to your employment status. Having these documents ready can streamline the process and ensure that your declaration is processed without delays.

Form Submission Methods

The Tax File Number Declaration FM208 can be submitted through various methods, depending on your employer's preferences. Common submission methods include:

- Online submission via a secure portal

- Emailing a scanned copy of the completed form

- Mailing a physical copy to the employer's HR department

- Hand-delivering the form during your onboarding process

It is advisable to confirm with your employer the preferred method of submission to ensure timely processing.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Tax File Number Declaration FM208. These guidelines outline the responsibilities of both employees and employers in accurately reporting income and withholding taxes. Employees must ensure that their TFN is correct and up to date, while employers are responsible for using this information to calculate the correct tax deductions. Familiarizing yourself with these guidelines can help prevent issues during tax season.

Quick guide on how to complete tax file number declaration fm208

Complete Tax File Number Declaration FM208 effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It provides an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Tax File Number Declaration FM208 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Tax File Number Declaration FM208 effortlessly

- Find Tax File Number Declaration FM208 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax File Number Declaration FM208 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax file number declaration fm208

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TFN declaration form PDF download?

The TFN declaration form PDF download is a specific document that individuals use to provide their Tax File Number to their employer. By utilizing airSlate SignNow, you can easily download the TFN declaration form in PDF format for filling and signing digitally.

-

How can I access the TFN declaration form PDF download on airSlate SignNow?

To access the TFN declaration form PDF download on airSlate SignNow, simply visit our website and search for the document in our repository. Once located, you can download it in PDF format and begin the signing process in just a few clicks.

-

Is there a cost associated with the TFN declaration form PDF download?

Downloading the TFN declaration form in PDF format on airSlate SignNow is part of our cost-effective solution for document management. While basic downloads may be free, premium features and additional integrations may incur fees, providing exceptional value for businesses.

-

What features does airSlate SignNow offer for managing the TFN declaration form PDF download?

airSlate SignNow offers a range of features for managing your TFN declaration form PDF download, including easy digital signing, secure storage, and automatic alerts for signers. These tools streamline the signing process and enhance document management efficiency.

-

Can I edit the TFN declaration form PDF after downloading it?

Yes, you can easily edit the TFN declaration form PDF after downloading it with airSlate SignNow. Our platform allows you to add fields, text, and make necessary adjustments before sending it for eSignature, ensuring that your document is accurate and complete.

-

How does airSlate SignNow integrate with other platforms for the TFN declaration form PDF download?

airSlate SignNow integrates seamlessly with various platforms to facilitate the TFN declaration form PDF download process. Whether you’re using CRM software or other business tools, our integrations enhance workflows and simplify document management.

-

What are the benefits of using airSlate SignNow for the TFN declaration form PDF download?

Using airSlate SignNow for the TFN declaration form PDF download offers numerous benefits, including time savings through streamlined signing processes and improved accuracy. Additionally, our platform enhances security with encrypted documents, ensuring sensitive information is protected.

Get more for Tax File Number Declaration FM208

- 2021 schedule 1299 c income tax subtractions and credits for individuals 2021 schedule 1299 c income tax subtractions and form

- Il 1040 fill out and sign printable pdf templatesignnow form

- Federal state employment taxes fset ides illinoisgov form

- 2022 i 010 form 1 wisconsin income tax fillable

- Pa 003 statement of personal property form

- 05 158 texas franchise tax 2021 annual report form

- 05 166 2022 texas franchise tax affiliate schedule for final report 05 166 2022 texas franchise tax affiliate schedule for form

- D2l2jhoszs7d12cloudfrontnetstatehawaiiinstruction sheet for form uc 25 notification of changes

Find out other Tax File Number Declaration FM208

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure