Bank of Baroda Pension Loan Form

What is the Bank of Baroda Pension Loan Form

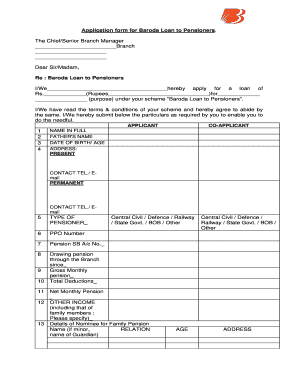

The Bank of Baroda Pension Loan Form is a specific document required for individuals seeking financial assistance through a pension loan. This form facilitates the application process for retirees who wish to leverage their pension benefits for immediate financial needs. It includes essential information about the applicant, such as personal details, pension details, and the amount requested. Understanding this form is crucial for ensuring a smooth application process.

Steps to Complete the Bank of Baroda Pension Loan Form

Completing the Bank of Baroda Pension Loan Form involves several key steps:

- Gather necessary documents, including proof of identity and pension details.

- Fill in personal information accurately, ensuring all fields are completed.

- Provide details regarding the pension scheme and the amount of loan requested.

- Review the form for accuracy and completeness before submission.

Taking these steps carefully can help prevent delays in the loan approval process.

Eligibility Criteria for the Bank of Baroda Pension Loan

To qualify for the Bank of Baroda Pension Loan, applicants must meet specific eligibility criteria. Generally, these include:

- Being a pensioner of the Bank of Baroda or a recognized government entity.

- Having a regular pension income that meets the bank's minimum requirements.

- Providing necessary documentation to verify identity and pension status.

Meeting these criteria is essential for a successful application.

Required Documents for the Bank of Baroda Pension Loan Form

When applying for a pension loan, certain documents must be submitted along with the Bank of Baroda Pension Loan Form. These typically include:

- Proof of identity, such as a government-issued ID.

- Pension payment slip or certificate.

- Bank statements for the last three months.

- Any additional documents as specified by the bank.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods for the Bank of Baroda Pension Loan

The Bank of Baroda Pension Loan Form can be submitted through various methods to accommodate different preferences:

- Online submission through the bank's official website.

- Mailing the completed form to the designated branch.

- In-person submission at the nearest Bank of Baroda branch.

Choosing the right submission method can enhance convenience and efficiency in processing the loan application.

Legal Use of the Bank of Baroda Pension Loan Form

The Bank of Baroda Pension Loan Form is legally binding once completed and submitted. It must adhere to relevant laws and regulations governing financial transactions and lending practices. Ensuring that all information provided is truthful and accurate is vital, as discrepancies can lead to legal complications or denial of the loan application. Understanding the legal implications of this form helps protect both the applicant and the bank.

Quick guide on how to complete bank of baroda pension loan form

Effortlessly Prepare Bank Of Baroda Pension Loan Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow offers all the resources you require to quickly create, modify, and eSign your documents without delays. Handle Bank Of Baroda Pension Loan Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Bank Of Baroda Pension Loan Form with Ease

- Find Bank Of Baroda Pension Loan Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your amendments.

- Select your preferred method for delivering your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, time-consuming form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Bank Of Baroda Pension Loan Form and maintain excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of baroda pension loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bob pension loan?

A bob pension loan is a financial product that allows individuals to borrow against their pension funds. This type of loan provides quick access to cash while leveraging the value of your pension, making it an attractive option for those in need of immediate funds.

-

How can I apply for a bob pension loan?

You can apply for a bob pension loan directly through your pension provider or financial institution. The application process usually involves submitting relevant documentation to assess your pension's value and eligibility, ensuring a smooth experience.

-

What are the repayment terms for a bob pension loan?

Repayment terms for a bob pension loan can vary widely depending on the lender. Typically, borrowers can expect flexible repayment options that align with their financial situation, which could include monthly installments or a lump-sum payment.

-

What are the benefits of a bob pension loan?

The primary benefits of a bob pension loan include quick access to funds, competitive interest rates, and the ability to utilize your pension assets without having to withdraw funds entirely. This flexibility helps you maintain your retirement savings while addressing current financial needs.

-

Are there any fees associated with a bob pension loan?

Yes, there may be fees associated with obtaining a bob pension loan, including application fees, processing fees, or early repayment penalties. It's important to review the terms and conditions from your lender to fully understand any potential costs.

-

Can I consolidate multiple loans into a bob pension loan?

In some cases, you can consolidate multiple loans into a bob pension loan, depending on your lender's policies. By doing so, you may simplify your financial obligations and potentially lower your overall interest rate, but make sure to discuss this option with your financial advisor.

-

Is a bob pension loan a good idea for retirees?

For retirees, a bob pension loan can be a viable option to access cash while preserving their pension for future needs. However, it's essential to carefully consider the implications and ensure it aligns with your overall retirement strategy.

Get more for Bank Of Baroda Pension Loan Form

Find out other Bank Of Baroda Pension Loan Form

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter