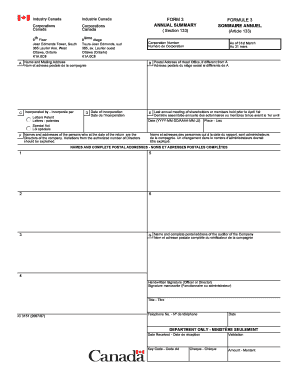

Formulaire 3 Sommaire Annuel

What is the Formulaire 3 Sommaire Annuel

The Formulaire 3 Sommaire Annuel is a crucial document used primarily for tax reporting purposes in the United States. It serves as a summary of income and deductions for individuals and businesses, ensuring compliance with federal tax regulations. This form is often required by the Internal Revenue Service (IRS) and is essential for accurately reporting financial information during the tax filing process.

How to use the Formulaire 3 Sommaire Annuel

Using the Formulaire 3 Sommaire Annuel involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents, including income statements, receipts for deductions, and any other supporting materials. Next, carefully fill out the form, ensuring that each section is completed with precise information. It is important to review the completed form for any errors before submission. Once finalized, the form can be submitted through the appropriate channels as specified by the IRS.

Steps to complete the Formulaire 3 Sommaire Annuel

Completing the Formulaire 3 Sommaire Annuel requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary financial documents, including W-2s and 1099s.

- Fill out personal identification information at the top of the form.

- Report all sources of income in the designated sections.

- Include any eligible deductions and credits to reduce taxable income.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Formulaire 3 Sommaire Annuel

The Formulaire 3 Sommaire Annuel must be completed in accordance with IRS guidelines to ensure its legal validity. This includes using accurate financial data and adhering to deadlines for submission. Failure to comply with these regulations can result in penalties or audits. It is advisable to keep copies of the submitted form and all supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Formulaire 3 Sommaire Annuel are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes in deadlines or filing requirements announced by the IRS.

Who Issues the Form

The Formulaire 3 Sommaire Annuel is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to properly complete and submit the form, along with any updates or revisions to the form itself. It is important to refer to the official IRS website for the most current version of the form and related instructions.

Quick guide on how to complete formulaire 3 sommaire annuel

Manage Formulaire 3 Sommaire Annuel seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Formulaire 3 Sommaire Annuel on any device using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Formulaire 3 Sommaire Annuel effortlessly

- Obtain Formulaire 3 Sommaire Annuel and click on Obtain Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as an ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Formulaire 3 Sommaire Annuel and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulaire 3 sommaire annuel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Formulaire 3 Sommaire Annuel and how does it work?

The Formulaire 3 Sommaire Annuel is a summary form used for reporting purposes, primarily for tax declarations. With airSlate SignNow, you can easily fill, sign, and send this form electronically, saving time and ensuring compliance. Our platform simplifies the process, allowing you to track submissions and maintain organized records.

-

How can airSlate SignNow help with filling out the Formulaire 3 Sommaire Annuel?

AirSlate SignNow provides intuitive tools to help users fill out the Formulaire 3 Sommaire Annuel accurately and efficiently. With features such as template creation and guided workflows, you can ensure that all necessary information is collected and completed. This minimizes errors and accelerates the submission process.

-

Is there a specific pricing plan for using airSlate SignNow to manage the Formulaire 3 Sommaire Annuel?

AirSlate SignNow offers flexible pricing plans suited for businesses of all sizes. Each plan includes access to tools that streamline the completion and submission of the Formulaire 3 Sommaire Annuel. You can select a plan based on your volume needs and features required, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for eSigning the Formulaire 3 Sommaire Annuel?

With airSlate SignNow, eSigning the Formulaire 3 Sommaire Annuel is made seamless and secure. Our platform includes advanced security features that ensure the integrity of your document. Additionally, you can track signatures in real-time, receiving instant notifications when a document is signed.

-

Can I integrate airSlate SignNow with other software for handling the Formulaire 3 Sommaire Annuel?

Yes, airSlate SignNow integrates with a variety of popular software tools, enhancing your workflow when handling the Formulaire 3 Sommaire Annuel. You can connect with CRM systems, cloud storage services, and workflow automation tools to create a cohesive document management process. This integration helps streamline operations and data management.

-

What are the benefits of using airSlate SignNow for the Formulaire 3 Sommaire Annuel?

Using airSlate SignNow for the Formulaire 3 Sommaire Annuel offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The electronic process allows for faster completion and submission, while tracking capabilities help you maintain compliance. You can also enjoy the convenience of access from any device.

-

Is airSlate SignNow user-friendly for completing the Formulaire 3 Sommaire Annuel?

Absolutely! AirSlate SignNow is designed with user experience in mind, ensuring that completing the Formulaire 3 Sommaire Annuel is straightforward. Our platform provides step-by-step guidance and a simple interface, making it accessible even for those with minimal technical skills. You can quickly navigate through the form’s requirements.

Get more for Formulaire 3 Sommaire Annuel

Find out other Formulaire 3 Sommaire Annuel

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed