Personal Loan Form

What is the Personal Loan Form

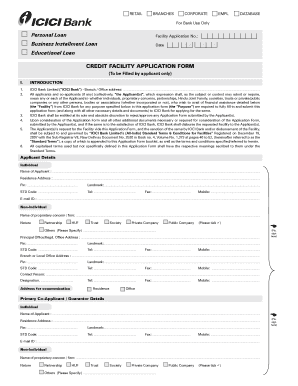

The personal loan form is a document used by individuals seeking to borrow money from a financial institution or lender. This form collects essential information about the applicant, including personal details, employment history, income, and the amount of money requested. It serves as a formal request for a loan and is a critical step in the borrowing process. Understanding the purpose and components of this form is essential for anyone looking to secure a personal loan.

Steps to complete the Personal Loan Form

Completing the personal loan form involves several key steps to ensure accuracy and completeness. Begin by gathering necessary documents, such as proof of income and identification. Next, fill out the form with accurate personal information, including your full name, address, and Social Security number. Be sure to specify the loan amount you are requesting and provide details about your employment. Review the form for any errors before submission to avoid delays in processing.

Legal use of the Personal Loan Form

The legal use of the personal loan form is governed by various regulations that ensure the protection of both the borrower and the lender. For the form to be considered valid, it must include the borrower's signature, which signifies agreement to the loan terms. Additionally, lenders are required to comply with federal and state lending laws, including those related to interest rates and disclosure of terms. Understanding these legal aspects can help borrowers navigate the lending process more effectively.

Key elements of the Personal Loan Form

Several key elements are essential to the personal loan form. These include:

- Personal Information: Full name, address, and contact details.

- Employment Information: Current employer, position, and salary.

- Loan Details: Requested loan amount and purpose of the loan.

- Financial Information: Monthly expenses, debts, and assets.

- Signature: Acknowledgment of the terms and conditions.

Each of these elements plays a crucial role in determining the applicant's eligibility and the lender's ability to assess risk.

How to obtain the Personal Loan Form

The personal loan form can be obtained directly from lenders, either through their websites or in-person at their branches. Many financial institutions offer downloadable PDF versions of the form, making it easy to fill out digitally. Additionally, some lenders may provide the option to complete the form online, streamlining the application process. It is advisable to check with multiple lenders to compare their forms and requirements.

Form Submission Methods

Submitting the personal loan form can be done through various methods, depending on the lender's policies. Common submission methods include:

- Online Submission: Many lenders allow applicants to submit the form electronically via their websites.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Submitting the form directly at a lender's branch is also an option for those who prefer face-to-face interaction.

Choosing the right submission method can depend on personal preference and the lender's processing times.

Quick guide on how to complete personal loan form

Effortlessly Prepare Personal Loan Form on Any Device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely preserve it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your files quickly without delays. Manage Personal Loan Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Most Efficient Way to Alter and eSign Personal Loan Form with Ease

- Obtain Personal Loan Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or cover sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Personal Loan Form and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal loan form and why do I need it?

A personal loan form is a document used to apply for a loan from financial institutions. It typically collects personal information, income details, and the loan amount requested. Completing a personal loan form accurately is essential to ensure a smooth approval process and secure the necessary funds.

-

How does airSlate SignNow simplify the personal loan form process?

airSlate SignNow streamlines the personal loan form process by allowing you to create, send, and eSign documents electronically. This eliminates the need for printing and mailing, saving you both time and resources. With our user-friendly interface, completing the personal loan form is more efficient and accessible.

-

Are there any fees associated with using the personal loan form through airSlate SignNow?

airSlate SignNow offers competitive pricing with no hidden fees for using the personal loan form. Our plans are designed to fit various budgets, ensuring you find a solution that meets your needs without breaking the bank. Check our pricing page for more details on available options.

-

What features does airSlate SignNow provide for personal loan forms?

airSlate SignNow provides a range of features for personal loan forms, including customizable templates, secure eSigning, and real-time tracking. These tools enhance your document workflow, making it easier to send and receive signed personal loan forms quickly. Additionally, our cloud storage feature ensures easy access to your documents at any time.

-

Can I integrate airSlate SignNow with other software for personal loan forms?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance the personal loan form process. Whether using CRM systems, project management tools, or cloud storage solutions, our integrations enhance workflow efficiency. This allows you to work in your preferred environments while managing personal loan forms effortlessly.

-

How secure is the personal loan form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling personal loan forms. We use advanced encryption and authentication measures to protect your sensitive information. You can trust that your personal loan form data is secure and compliant with industry regulations.

-

What benefits can I expect from using airSlate SignNow for my personal loan form?

Using airSlate SignNow for your personal loan form provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced document visibility. The ability to eSign eliminates delays associated with traditional paper forms. Moreover, our platform ensures that your personal loan form is processed swiftly and securely.

Get more for Personal Loan Form

Find out other Personal Loan Form

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe