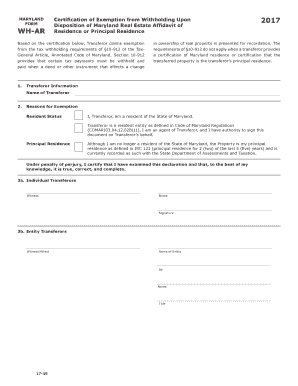

Maryland Form Wh Ar 2017

What is the Maryland Form WH-AR?

The Maryland Form WH-AR is a document used for reporting withholding tax information for employees in the state of Maryland. This form is essential for employers to accurately report the state income tax withheld from employees' wages. It ensures compliance with Maryland tax regulations and helps maintain proper records for both employers and employees. The WH-AR form is typically required to be submitted annually, summarizing the total amounts withheld throughout the year.

How to Use the Maryland Form WH-AR

To effectively use the Maryland Form WH-AR, employers need to gather all relevant payroll information for their employees. This includes total wages paid and the amount of state income tax withheld. Once this information is compiled, employers can fill out the form, ensuring that all sections are completed accurately. It is crucial to double-check the figures to avoid any discrepancies that could lead to penalties or compliance issues. After completing the form, it should be submitted to the appropriate state agency, either electronically or via mail.

Steps to Complete the Maryland Form WH-AR

Completing the Maryland Form WH-AR involves several key steps:

- Gather all payroll records for the year, including total wages and withholding amounts.

- Obtain the latest version of the WH-AR form from the Maryland Comptroller's website.

- Fill out the form, ensuring all employee information and withholding amounts are accurate.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal Use of the Maryland Form WH-AR

The Maryland Form WH-AR is legally required for employers who withhold state income tax from their employees' wages. Proper use of this form ensures compliance with state tax laws and helps avoid potential legal issues. Employers must keep accurate records and submit the form on time to meet legal obligations. Failure to do so may result in penalties, including fines or interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Maryland Form WH-AR. Typically, the form is due by January 31 of the following year for the previous calendar year’s withholdings. It is important for employers to mark this date on their calendars to ensure timely submission. Additionally, any changes in state regulations may affect deadlines, so staying informed through the Maryland Comptroller’s office is advisable.

Form Submission Methods

The Maryland Form WH-AR can be submitted through various methods to accommodate different employer preferences:

- Online Submission: Employers can file electronically through the Maryland Comptroller's online services.

- Mail Submission: Completed forms can be printed and mailed to the appropriate address provided by the Maryland Comptroller.

- In-Person Submission: Employers may also choose to deliver the form in person at designated state offices.

Quick guide on how to complete maryland form wh ar

Effortlessly prepare Maryland Form Wh Ar on any device

Digital document management has become favored by companies and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Maryland Form Wh Ar on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Maryland Form Wh Ar seamlessly

- Locate Maryland Form Wh Ar and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all your information and click on the Done button to finalize your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Maryland Form Wh Ar and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form wh ar

Create this form in 5 minutes!

How to create an eSignature for the maryland form wh ar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland form WH AR and how can airSlate SignNow help with it?

The Maryland form WH AR is a tax form used for employee withholding, and airSlate SignNow simplifies the process of sending and eSigning this document. With our platform, users can easily upload the form, get it signed electronically, and store it securely. This streamlines the workflow for businesses managing employee tax documentation.

-

Is airSlate SignNow suitable for businesses of all sizes in Maryland?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it ideal for companies in Maryland. Whether you're a small business or a large corporation, our platform offers an easy-to-use solution for managing documents like the Maryland form WH AR efficiently. You can scale the service according to your business needs.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs in Maryland. Our plans are designed to be cost-effective while providing all necessary features to manage documents like the Maryland form WH AR. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes with a variety of features including document templates, eSignature capabilities, and secure cloud storage. These features make managing documents like the Maryland form WH AR straightforward and efficient. Additionally, our platform supports collaboration, allowing multiple users to work on documents seamlessly.

-

How does airSlate SignNow ensure the security of the Maryland form WH AR?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Maryland form WH AR. We utilize advanced encryption technologies and secure servers to protect your documents. Furthermore, our platform complies with industry standards to guarantee that your data remains confidential and safe.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers various integrations with popular applications and platforms. This feature enables you to streamline your workflow when managing documents, including the Maryland form WH AR. Whether you need integration with CRMs, cloud storage, or other tools, our platform can adapt to your business ecosystem.

-

What benefits will I gain by using airSlate SignNow for the Maryland form WH AR?

Using airSlate SignNow for the Maryland form WH AR offers multiple benefits, including time savings and increased efficiency. The platform enables electronic signatures, which speed up the approval process signNowly. Additionally, you gain access to a user-friendly interface that simplifies document management for your team.

Get more for Maryland Form Wh Ar

- Mcgill pain questionnaire online form

- Acknowledgement form template

- Waiver template word form

- Affidavit of purchase price kansas form

- Judgment declaratory form

- Learn more by attending the clinic amp early registration form

- Gpdffor1rutha7449rfrj printing armycom form

- Permission to photograph consent form city of oshawa oshawa

Find out other Maryland Form Wh Ar

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself