FORM NO 15H See Section 197A1C and Rule 29C ICICI Bank

Understanding Form No 15H

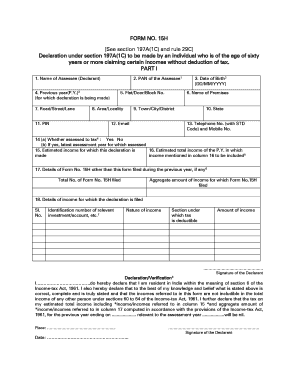

Form No 15H is a declaration form used by individuals to ensure that no tax is deducted at source (TDS) on their interest income. This form is particularly relevant for senior citizens or individuals whose total income is below the taxable limit. According to Section 197A(1C) and Rule 29C, this form allows taxpayers to declare their eligibility for non-deduction of TDS, provided they meet certain criteria. It is essential to understand the legal implications and requirements associated with this form to ensure compliance with tax regulations.

Steps to Complete Form No 15H

Completing Form No 15H involves several steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and PAN (Permanent Account Number). Next, indicate the financial year for which you are submitting the form. You will also need to provide details about the income from which TDS is to be exempted. Finally, ensure that you sign and date the form before submission. It is advisable to review the completed form for any errors before sending it to the relevant financial institution.

Obtaining Form No 15H

Form No 15H can be easily obtained from various sources. It is available at ICICI Bank branches and can also be downloaded in PDF format from the bank's official website. Additionally, many financial institutions provide this form upon request. Ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of Form No 15H

The legal use of Form No 15H is critical for ensuring that taxpayers do not face unnecessary TDS deductions. This form serves as a formal declaration to the financial institution regarding the individual's income status. By submitting Form No 15H, taxpayers affirm that their total income is below the taxable threshold, thus complying with tax laws. It is important to keep a copy of the submitted form for personal records and future reference.

Key Elements of Form No 15H

Form No 15H contains several key elements that must be accurately filled out to ensure its validity. These include the taxpayer's personal details, the financial year in question, and a declaration of the total income. Additionally, the form requires the taxpayer's signature, which confirms the accuracy of the information provided. Understanding these elements is essential for the proper execution of the form.

Eligibility Criteria for Form No 15H

To qualify for submitting Form No 15H, individuals must meet specific eligibility criteria. Typically, this form is intended for senior citizens and individuals whose total income falls below the taxable limit. It is important to assess your income sources and ensure that they align with the requirements set forth in Section 197A(1C) and Rule 29C. Failure to meet these criteria may result in the rejection of the form and subsequent tax deductions.

Quick guide on how to complete form no 15h see section 197a1c and rule 29c icici bank

Prepare FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Manage FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank with ease

- Obtain FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15h see section 197a1c and rule 29c icici bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 15H for ICICI Bank?

The form 15H is a self-declaration form that allows senior citizens in India to ensure that no TDS is deducted on their interest income. It is essential for those who have income below the taxable limit. Downloading the form 15H ICICI Bank can help you manage your taxes more effectively.

-

How can I download the form 15H for ICICI Bank?

To download the form 15H ICICI Bank, visit the official ICICI Bank website or contact their customer service. You can easily find the download link in the tax-related forms section. Ensure that you have the latest version to avoid any issues.

-

Is there a fee for using the form 15H with ICICI Bank?

There is no fee associated with submitting the form 15H ICICI Bank. The process of filling out and submitting the form is free of charge, helping you save on unnecessary costs related to tax deduction at source.

-

What are the benefits of using form 15H with ICICI Bank?

Using the form 15H ICICI Bank allows senior citizens to avoid TDS on their interest income, ensuring that they receive their full earnings. This is particularly advantageous for those with income below the tax threshold, providing financial relief and simplifying tax management.

-

Can I submit the form 15H online for ICICI Bank?

Yes, you can submit the form 15H ICICI Bank online through your net banking account. This option provides convenience and saves time, allowing you to complete the process from the comfort of your home without needing to visit a bank branch.

-

What documents do I need to submit form 15H at ICICI Bank?

When submitting the form 15H ICICI Bank, you typically need to provide proof of identity and age, such as a government-issued ID. This documentation helps ensure that the declaration is valid and processed smoothly by the bank.

-

How often do I need to submit form 15H to ICICI Bank?

The form 15H ICICI Bank needs to be submitted each financial year to ensure that no TDS is deducted on your interest income. If your income status changes, or if there are any alterations in your bank account, you may also need to resubmit the form.

Get more for FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank

- Simplifying expressions with negative exponents worksheet with answers form

- 4th grade reading comprehension pdf form

- Cleveland clinic printable living will form

- Section 504 accommodation plan form

- Blumberg lease agreement form

- Bn59 01199f manual form

- Form k pdf

- 8 ball pool account with legendary cues form

Find out other FORM NO 15H See Section 197A1C And Rule 29C ICICI Bank

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template