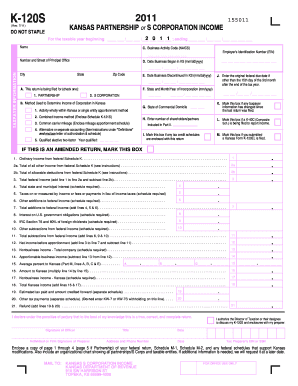

K 120s Form

What is the K 120s?

The K 120s is a tax form used in the state of Kansas for reporting income and calculating tax liabilities. This form is typically utilized by individuals and businesses to ensure compliance with state tax regulations. It captures essential information about income sources, deductions, and credits, allowing taxpayers to accurately determine their tax obligations. Understanding the K 120s is crucial for residents and business owners in Kansas to fulfill their tax responsibilities effectively.

How to Use the K 120s

Using the K 120s involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. It is important to review the form for any errors before submission. Once completed, the K 120s can be filed electronically or mailed to the appropriate state tax office, depending on your preference.

Steps to Complete the K 120s

Completing the K 120s involves a systematic approach:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for accuracy.

- Submit the form electronically or via mail to the Kansas Department of Revenue.

Legal Use of the K 120s

The K 120s must be completed and submitted in accordance with Kansas state tax laws. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal repercussions. Filing the form correctly can help taxpayers avoid penalties and ensure compliance with state regulations. Understanding the legal implications of the K 120s is vital for maintaining good standing with the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the K 120s are crucial for taxpayers to remember. Typically, the form must be submitted by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is advisable to stay informed about any changes to deadlines or additional requirements that may arise, ensuring timely submission to avoid late fees or penalties.

Form Submission Methods

The K 120s can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to file electronically through the Kansas Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the designated tax office.

- In-Person: Taxpayers may also choose to submit the form in person at local tax offices, if available.

Quick guide on how to complete k 120s

Effortlessly Prepare K 120s on Any Device

Digital document management has gained immense popularity among businesses and individuals. It serves as a remarkable eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Manage K 120s on any device using the airSlate SignNow Android or iOS applications and simplify your document-oriented tasks today.

The easiest method to alter and eSign K 120s without hassle

- Locate K 120s and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your preferred method to share your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and eSign K 120s and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the k120s 2018?

The k120s 2018 boasts a user-friendly interface, allowing seamless document signing and management. It includes advanced security features like encryption and audit trails, ensuring that all your eSigned documents are safe. Additionally, the k120s 2018 supports various file formats, making it versatile for different business needs.

-

How does the k120s 2018 improve workflow efficiency?

The k120s 2018 streamlines your workflow by facilitating quick eSigning processes. With its automated reminders and notifications, you can keep track of pending documents efficiently. This helps eliminate delays and ensures that contracts and forms are signed promptly, enhancing overall productivity.

-

What is the pricing structure for the k120s 2018?

The k120s 2018 offers competitive pricing designed to meet the budgets of businesses of all sizes. We provide various subscription plans that cater to different needs, from basic features to advanced functionalities. For more detailed pricing information, you can visit our pricing page for the most current offers.

-

Can the k120s 2018 be integrated with other applications?

Yes, the k120s 2018 supports integrations with a variety of applications such as CRM systems, project management tools, and cloud storage services. This flexibility allows businesses to incorporate the k120s 2018 into their existing workflows seamlessly. By doing so, you can enhance collaboration and streamline processes across your organization.

-

What are the benefits of using the k120s 2018 for small businesses?

The k120s 2018 offers small businesses an affordable solution to manage documents efficiently. With its easy-to-use interface and powerful features, small teams can benefit from quick eSigning and reduced turnaround times. This cost-effective tool helps small businesses maintain professionalism and improve client satisfaction without breaking the bank.

-

Is the k120s 2018 compliant with legal standards?

Absolutely! The k120s 2018 adheres to various industry regulations and standards, ensuring that your eSigned documents hold legal validity. With features like secure storage and compliance with eSign Act and other laws, you can be confident in the legality of your transactions. This compliance enhances trust in your business practices.

-

How can I get support for using the k120s 2018?

Our dedicated support team is available to assist with any questions you have about the k120s 2018. You can signNow out to us via email, phone, or live chat for quick and effective assistance. Additionally, we provide a comprehensive knowledge base with FAQs and tutorials to help you maximize the use of the k120s 2018.

Get more for K 120s

- Cigna international reimbursement form

- Seaview ipa authorization form

- Pshcp out of country form

- Swa rs1 form

- Fairleigh dickinson university letter of recommendation form

- Division of unit fractions and whole numbers independent practice worksheet fractions operations quotients form

- Doh 5153 form

- Gender reassignment surgery aetna student health precert form accessible gender reassignment surgery aetna student health

Find out other K 120s

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy