Loan Guarantor Form 2012-2026

What is the loan guarantor form?

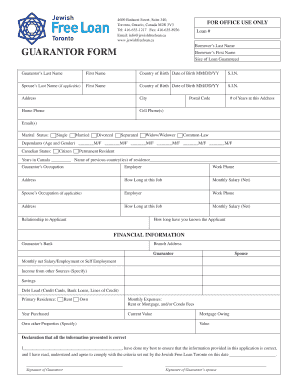

The loan guarantor form is a legal document that outlines the responsibilities of a guarantor in a loan agreement. A guarantor is an individual who agrees to take on the financial obligation of a borrower if they default on their loan. This form typically includes essential details such as the names of the borrower and guarantor, the loan amount, and the terms of the agreement. By signing this form, the guarantor provides assurance to the lender that they will cover the loan payments if necessary, thereby increasing the likelihood of loan approval for the borrower.

How to use the loan guarantor form

To use the loan guarantor form effectively, both the borrower and guarantor should carefully review the document before signing. The borrower must ensure that the terms of the loan are clearly stated, and the guarantor should fully understand their obligations. Once both parties agree to the terms, the guarantor fills out their personal information and signs the form. This document can often be submitted electronically, making the process more convenient. It is important to keep a copy of the signed form for personal records and future reference.

Steps to complete the loan guarantor form

Completing the loan guarantor form involves several straightforward steps:

- Obtain the loan guarantor form from the lender or download it from a trusted source.

- Read through the form carefully to understand the terms and obligations.

- Fill in the required information, including personal details of both the borrower and guarantor.

- Review the completed form for accuracy and completeness.

- Sign the form in the designated area, ensuring that all signatures are dated.

- Submit the form as instructed by the lender, either online or via mail.

Legal use of the loan guarantor form

The loan guarantor form is legally binding when completed and signed according to the relevant laws governing contracts. For the form to be enforceable, it must include all necessary elements such as the identification of the parties involved, the loan amount, and the specific terms of the guarantee. It is essential that both the borrower and guarantor understand the implications of signing the form, as it creates a legal obligation for the guarantor to fulfill the loan payments if the borrower defaults.

Key elements of the loan guarantor form

Several key elements are crucial for the validity of the loan guarantor form. These include:

- Borrower Information: Full name and contact details of the borrower.

- Guarantor Information: Full name, address, and contact details of the guarantor.

- Loan Details: Amount of the loan, interest rate, and repayment terms.

- Signatures: Signatures of both the borrower and guarantor, along with the date of signing.

- Legal Language: Clear statements outlining the obligations of the guarantor.

Form submission methods

The loan guarantor form can typically be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow electronic submission of the form through their secure portals.

- Mail: The form can be printed and mailed to the lender's designated address.

- In-Person: Some borrowers may prefer to deliver the form directly to the lender's office.

Quick guide on how to complete loan guarantor form 28306584

Complete Loan Guarantor Form effortlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the accurate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Loan Guarantor Form on any platform with airSlate SignNow Android or iOS applications and improve any document-related process today.

How to modify and eSign Loan Guarantor Form with ease

- Locate Loan Guarantor Form and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Loan Guarantor Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan guarantor form 28306584

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan guarantor form and why is it important?

A loan guarantor form is a legal document that ensures a third party will be responsible for a loan if the primary borrower defaults. This form is crucial as it provides lenders with an added layer of security, making it easier for borrowers to secure loans, especially if they have limited credit history.

-

How does airSlate SignNow work with loan guarantor forms?

airSlate SignNow simplifies the process of creating, sending, and signing loan guarantor forms electronically. Our platform allows users to efficiently manage these forms, ensuring compliance and reducing turnaround times for approvals.

-

What features does airSlate SignNow offer for loan guarantor forms?

airSlate SignNow provides features such as customizable templates for loan guarantor forms, real-time tracking of document status, and secure cloud storage. This ensures that your forms are organized, accessible, and protected.

-

Is airSlate SignNow cost-effective for managing loan guarantor forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing loan guarantor forms. Our plans ensure that even small businesses can access powerful eSignature capabilities without breaking the bank.

-

Can I integrate airSlate SignNow with other software for loan guarantor forms?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications such as CRM and document management systems. This allows for a streamlined workflow when handling loan guarantor forms, enhancing productivity.

-

What are the benefits of using airSlate SignNow for loan guarantor forms?

Using airSlate SignNow for loan guarantor forms leads to faster processing times, improved accuracy, and enhanced security. Our platform eliminates the need for paper-based processes, making documentation more efficient and easier to manage.

-

How secure are the loan guarantor forms signed via airSlate SignNow?

airSlate SignNow employs advanced security measures, including data encryption and secure cloud storage, to protect your loan guarantor forms. This ensures that all sensitive information is safe from unauthorized access.

Get more for Loan Guarantor Form

- Bre 365 download form

- Transportable building electrical installation certificate form

- Recruitment sla pdf form

- Mini practice set 1 accounting answers pdf form

- Shriver and atkins inorganic chemistry solutions manual pdf download form

- Rental application 275381 form

- Usatestprep answer key form

- Sample request fax form fax to 973 644 2386

Find out other Loan Guarantor Form

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now