Property Tax Deduction Claim by Veteran or Surviving Spousecivil Union or Domestic Partner of Veteran or Serviceperson 2020-2026

Understanding the Property Tax Deduction Claim

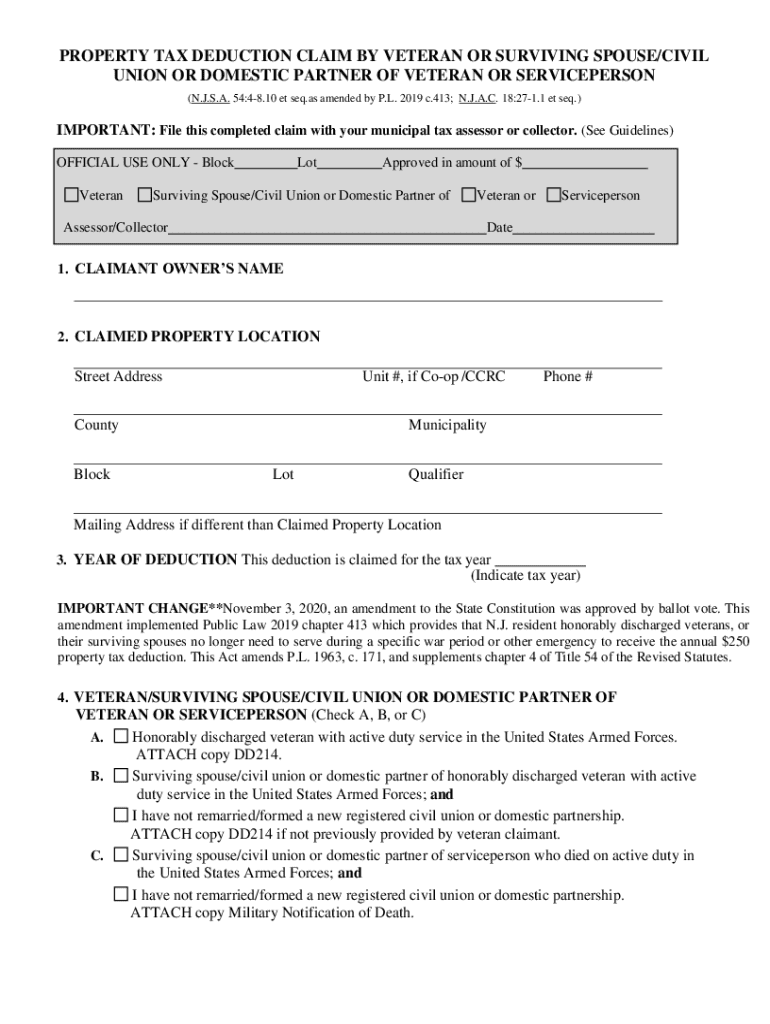

The Property Tax Deduction Claim is a specific form designed for veterans, surviving spouses, civil union partners, or domestic partners of veterans or servicepersons. This claim allows eligible individuals to receive a reduction in property taxes based on their service or relationship to a service member. Each state may have its own regulations and requirements for filing this claim, which can affect the amount of deduction available.

Eligibility Criteria for the Claim

To qualify for the Property Tax Deduction Claim, applicants must meet certain criteria. Generally, the individual must be a veteran or the surviving spouse, civil union, or domestic partner of a veteran or serviceperson. Additionally, the applicant must own the property for which the deduction is being claimed and reside there as their primary residence. States may have additional requirements, so it is essential to review local laws for specific eligibility guidelines.

Required Documents for Filing

Filing the Property Tax Deduction Claim typically requires several documents to verify eligibility. Commonly required documents include:

- Proof of military service, such as a DD-214 form.

- Documentation of relationship, such as marriage certificates or civil union documents.

- Proof of property ownership, like a deed or tax bill.

- Identification, such as a driver's license or state ID.

Gathering these documents in advance can streamline the filing process.

Steps to Complete the Claim

Completing the Property Tax Deduction Claim involves several key steps:

- Gather all required documentation.

- Obtain the Property Tax Deduction Claim form from your local tax authority.

- Fill out the form accurately, providing all necessary information.

- Attach required documents to support your claim.

- Submit the completed claim form to the appropriate local tax office by the specified deadline.

Following these steps can help ensure a successful claim submission.

Filing Deadlines and Important Dates

Each state may have different deadlines for submitting the Property Tax Deduction Claim. It is crucial to be aware of these dates to avoid missing out on potential tax savings. Typically, claims must be filed by a certain date each year, often coinciding with property tax assessment deadlines. Check with your local tax authority for specific filing deadlines relevant to your area.

Form Submission Methods

There are various methods for submitting the Property Tax Deduction Claim. Applicants can usually choose from:

- Online submission through the local tax authority's website.

- Mailing the completed form and documents to the designated tax office.

- In-person submission at the local tax office.

Choosing the most convenient method can help facilitate a smoother filing process.

State-Specific Rules and Variations

Each state has its own rules regarding the Property Tax Deduction Claim, which can impact eligibility, documentation requirements, and the amount of deduction available. Some states may offer additional benefits or have specific forms tailored to their regulations. It is important to consult state-specific resources or local tax offices to understand the nuances of the claim process in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct property tax deduction claim by veteran or surviving spousecivil union or domestic partner of veteran or serviceperson

Create this form in 5 minutes!

How to create an eSignature for the property tax deduction claim by veteran or surviving spousecivil union or domestic partner of veteran or serviceperson

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson?

The Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson allows eligible individuals to reduce their property tax burden. This deduction is designed to support veterans and their families, ensuring they receive financial relief on their property taxes.

-

Who qualifies for the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson?

Eligibility for the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson typically includes veterans, their surviving spouses, and domestic partners. Specific criteria may vary by state, so it's essential to check local regulations to confirm eligibility.

-

How can I file a Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson?

To file a Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson, you need to complete the appropriate forms provided by your local tax authority. airSlate SignNow can help streamline this process by allowing you to eSign and submit documents easily.

-

What documents are required for the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson?

Typically, you will need to provide proof of military service, identification, and any relevant documentation that supports your claim. airSlate SignNow simplifies document management, making it easy to gather and eSign all necessary paperwork for your Property Tax Deduction Claim.

-

Is there a cost associated with filing the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson?

While filing the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson itself may not incur a fee, there could be costs related to document preparation or legal assistance. Using airSlate SignNow can help minimize these costs by providing an affordable eSigning solution.

-

What are the benefits of using airSlate SignNow for my Property Tax Deduction Claim?

Using airSlate SignNow for your Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson offers numerous benefits, including ease of use, cost-effectiveness, and secure document handling. Our platform ensures that your claims are processed quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for my Property Tax Deduction Claim?

Yes, airSlate SignNow offers integrations with various tools and platforms, enhancing your workflow for the Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson. This allows you to manage your documents seamlessly across different applications.

Get more for Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson

- Thirty 30 day notice to quit quotstate law permits aagla form

- Surviving spouse dependent or heir application for hearing dol ks form

- Stage 1 grammar hammer name skill check 1 class date 1 kerrmackie primary school org form

- Vr 50 rev 802 application forcremation permit form

- Spiritual gifts and passion assessment kensington church kensingtonchurch form

- Disabilityform

- Comprehensive pediatric nursing assessment form comprehensive pediatric nursing assessment form eiklh

- Osa ii ilmoitusosa form

Find out other Property Tax Deduction Claim By Veteran Or Surviving Spousecivil Union Or Domestic Partner Of Veteran Or Serviceperson

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now